|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash Conversion Cycle |

|

| https://www.dwmbeancounter.com |

|

|

|

| Input Cells are colored |

|

|

|

|

| Enter Period |

365 |

|

|

| |

|

|

| Days - 30, 90, 180, or 365 |

|

| |

|

| 30 Days= 12 Periods |

|

| 90 Days= 4 Periods |

|

| 180 Days= 2 Periods |

|

| 365 Days= 1 Period |

|

|

| Financial Information |

|

Period 1 |

Period 2 |

Period 3 |

Period 4 |

Period 5 |

Period 6 |

Period 7 |

Period 8 |

Period 9 |

Period 10 |

Period 11 |

Period 12 |

|

| Beginning

Inventory |

|

90,000 |

120,000 |

100,000 |

|

|

|

|

|

|

|

|

|

|

| Ending

Inventory |

|

110,000 |

100,000 |

140,000 |

|

|

|

|

|

|

|

|

|

|

| Cost of Goods

Sold |

|

600,000 |

700,000 |

900,000 |

|

|

|

|

|

|

|

|

|

|

| Beginning

Account Receivable |

|

85,000 |

75,000 |

125,000 |

|

|

|

|

|

|

|

|

|

|

| Ending Account

Receivable |

|

75,000 |

115,000 |

95,000 |

|

|

|

|

|

|

|

|

|

|

| Net Credit

Sales |

|

1,000,000 |

1,200,000 |

1,500,000 |

|

|

|

|

|

|

|

|

|

|

| Beginning

Account Payable |

|

45,000 |

55,000 |

65,000 |

|

|

|

|

|

|

|

|

|

|

| Ending Account

Payable |

|

55,000 |

65,000 |

85,000 |

|

|

|

|

|

|

|

|

|

|

| Net Credit

Purchases |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash Convesion Cycle

Calculations |

|

Period 1 |

Period 2 |

Period 3 |

Period 4 |

Period 5 |

Period 6 |

Period 7 |

Period 8 |

Period 9 |

Period 10 |

Period 11 |

Period 12 |

|

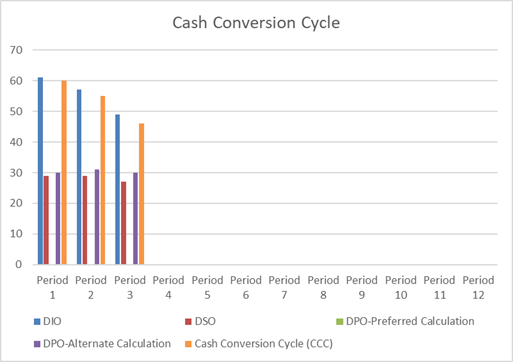

| DIO |

|

61 |

57 |

49 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

| DSO |

|

29 |

29 |

27 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

| DPO-Preferred

Calculation |

|

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

| DPO-Alternate

Calculation |

|

30 |

31 |

30 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

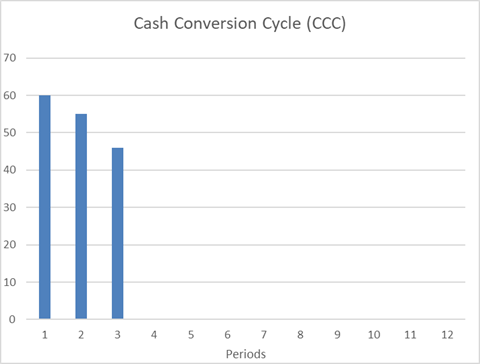

| Cash

Conversion Cycle (CCC) |

|

60 |

55 |

46 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

|

|

|

| DIO (Days

Inventory Outstanding) is calculated using the formula given below |

|

| DIO

= (Average Inventory / Cost of Goods Sold) * No of Days |

|

| A lower DIO

suggests that a company is efficiently managing its inventory and converting

it into sales quickly. |

|

|

| DSO (Days

Sales Outstanding) is calculated using

the formula given below |

|

| DSO

= (Average Account Receivable / Total Credit Sales) * No of Days |

|

| A lower DSO

indicates that the company collects cash from customers more quickly,

improving cash flow. |

|

|

| DPO (Days

Payable Outstanding) is calculated using the formula given below |

|

| DPO

= (Average Account Payable /Net Credit Purchases) * No of Days |

|

| If

the total Net Credit Purchase Amount is not available, Cost Of Goods

Sold |

|

|

|

|

| is

often used as a substitute although Net Credit Purchases is preferred for

accuracy |

|

|

| A higher DPO can be beneficial as it allows

the company to retain cash longer before settling its obligations. |

|

|

|

| Cash

Conversion Cycle (CCC) is calculated using the formula given below |

|

| Cash

Conversion Cycle (CCC) = DIO + DSO -

DPO |

|

| A shorter

cash conversion cycle indicates that a company can quickly convert |

|

| its

investments back into cash, which is generally seen as a sign of good

financial health and operational efficiency. |

| Conversely,

a longer cash conversion cycle may suggest inefficiencies in inventory

management |

|

| or

collections processes, potentially leading to liquidity issues. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|