Lease Buy Decision

Example 1

Burgers Deluxe is considering opening an additional restaurant and wants to buy the building and land instead of leasing. They have discussed and eliminated the option of leasing. By building a new building Burgers Deluxe projects that the new property could have an estimated annual income of $200,000 for first year, $225,000 for the second year, $250,000 for the third year, and $275,000 for the fourth thru the tenth year. Burgers Deluxe owners require an annual rate of return of 10% from the investment. The new building and land will cost $1,000,000. The new building will be useful only for 10 years after which Burgers Deluxe will sell the building and land for $100,000.

Is the investment worth it?

Yes, the Net Present Value is $600,023 and the Internal Rate Of Return is 21.54 %

Example 2

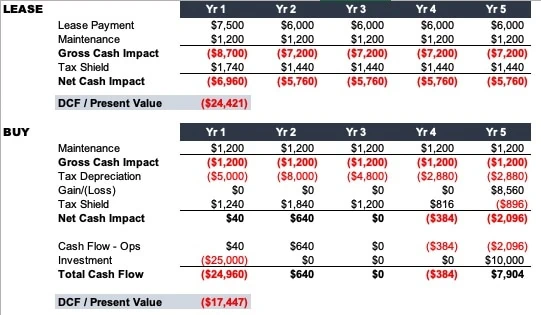

Decision Information:

Equipment Cost $25,000Salvage Value 10,000

Depreciation

Year1 $5,000

Year 2 $8,000

Year 3 $4,800

Year 4 $2,880

Year 5 $2,880

Gain on Sale $8,560

Service Life 5 years

Discount Rate 7.5%

Tax Rate 20%

Lease Payment $6,000 year

Down Payment Lease $1,500

Lease Term 5 years

Maintenance $1,200 year for lease and purchase option

In this example, the NPV for leasing is ($24K) while the NPV for Purchasing is ($17K). Purchasing is the clear winner. That said, always ensure that the cash is available to purchase. Otherwise, you must find a loan or lease regardless of the NPV.