Self Employed

SECA Tax

New business owners are sometimes caught off guard ( with their pants down ) when preparing their first income tax return. In addition to paying income tax, they find out that they are also required to pay SECA taxes. What the heck are SECA taxes ? The abbreviation SECA stands for the Self-Employment Contributions Act.

The SECA tax is basically the business owner's version of the Social Security and Medicare tax that employers and employees pay. The Self-Employed Contributions Act (SECA) tax is a levy from the U.S. government on those who work for themselves, rather than for an outside company. It requires self-employed workers to contribute tax equivalent to both the employer and employee of the FICA tax, which funds Social Security and Medicare.

If you recall from our discussion about deductions, employees that work for you have social security and medicare deducted from their wages. In addition, you as their employer are also required to match their deduction.

- Who is considered to be Self-Employed ?

Basically, anyone that has an ownership interest in what is called a "flow thru" type of business organization. The one exception is a Subchapter S corporation where working owners are considered employees.

- What's the Tax Rate ?

The basic tax rate for the self-employed under SECA is 15.30 percent for 2020 made up of 12.4% (6.2% for employer plus for 6.2 % for employee) Social Security Tax and 2.9% (1.45% for employer plus 1.45% for employees) Medicare Tax. If you noticed, the rate is twice the 7.65 percent rate that employees must pay. This is because you as an owner (self-employed) are paying the employee's share and the owner's share on your own earnings.

- Are there any limits on SECA Taxes ?

There are limits, however, on how much income is subject to this percentage. The Social Security Tax is only applied to the first $137,700 of net income, for a maximum tax of $17,075 in tax year 2020. (In 2021, the tax will be applied to the first $142,800 of net income, for a maximum tax of $17,707.) Any income above that level is not subject to Social Security tax. This upper limit usually increases each year.

The Medicare tax rate is 2.9% (1.45% for employer plus 1.45% for employees), and there is no exemption above a certain income.

High-income earners face an additional SECA levy. As a result of the Affordable Care Act, individuals with net income above $200,000 ($250,000 for married couples filing jointly) will be subject to an additional 0.9% Medicare tax.

- What if you work as an employee for someone else and also have a business ?

In that case, the amounts deducted from your wages while working as an employee for someone else will count towards meeting the Social Security maximum limit.

- What earnings are included in the calculation ?

Earnings included in the calculation are your business income that you earned from your sole proprietorship, partnership, or LLC treated as a "flow thru" entity. If these earnings are less than $400 you are not required to pay any SECA Tax.

- Are there any Special Provisions ?Employers get to deduct their contributions when figuring their income tax, do the self-employed get to deduct a portion of their self employment tax ?

There are two provisions in the tax law used when calculating the tax that attempt to place self-employed individuals on the same level as employees.- First, your net earnings from self-employment are reduced by an amount equal to half of your total self-employment tax rate for the year. For 2005, this amounts to a reduction of 7.65 percent of your net earnings from self-employment.

- Second, you are allowed to deduct half of your self-employment tax from your gross income on your Form 1040 (Personal Income Tax Return).

Estimated Tax Payments

Another area where many new business owners get caught with their pants down is estimated payments. Many have been used to working for someone else and having the required deductions for social security, medicare, and income tax taken out of their earnings each pay period. Since the self-employed individual does not receive an "actual payroll check" (they get what are called draws), the IRS requires the self-employed to make estimated tax payments so that the individual does not end up at the end of a year owing income tax and self-employment tax and not having the cash available to pay them.

Another area where many new business owners get caught with their pants down is estimated payments. Many have been used to working for someone else and having the required deductions for social security, medicare, and income tax taken out of their earnings each pay period. Since the self-employed individual does not receive an "actual payroll check" (they get what are called draws), the IRS requires the self-employed to make estimated tax payments so that the individual does not end up at the end of a year owing income tax and self-employment tax and not having the cash available to pay them.

Self- Employed Earnings

Employees receive a W-2 that reports their earnings and amount subject to social security and medicare. How do the self-employed determine their earnings subject to self-employment tax and also their earnings subject to income tax ?

It actually depends on the type of business organization. As we briefly mentioned earlier, owners of the "flow thru" types of business organizations are required to pay self employment taxes (except Sub- S Corporations). "Flow Thru" types of organizations are business organizations where all the earnings are allocated to the individual owners and the organization itself is not subject to federal income taxes- the owner's are.

Flow-Thru Types of Organizations

- Sole Proprietorship

A sole proprietor prepares a Schedule C or Schedule C-EZ that is used to calculate the earnings and amounts subject to income and self employment taxes. - Partnership

A partnership prepares a Form 1065 and distributes a Form K-1 to each partner that is used to report individual partner earnings and the amounts subject to self-employment tax. The individual partner transfers the information from the K-1 to his Schedule E. - Limited Liability Company ( LLC )

LLC's when formed make an election with the IRS on how their type of organization will be treated for tax purposes. If the LLC elects to be treated as a single entity (sole proprietorship) or a partnership the owner's earnings will be subject to self employment taxes and similar forms used by a sole proprietorship and partnership are used to calculate and report earnings. - Corporations

Owners (stockholders) who also work as employees are not considered to be self-employed and receive regular pay checks and thus are not subject to self-employment taxes. This is the case whether the corporation is a "regular" corporation referred to as a C-Corporation or the corporation is a special type of corporation know as a Subchapter-S or S-Corporation. These owner employees receive W-2's.

How does this tax benefit the self employed owner ? By making these "contributions", like an individual who worked for someone all their life, you too will be eligible to receive social security and medicare benefits when you retire.

Computing Your SECA Tax

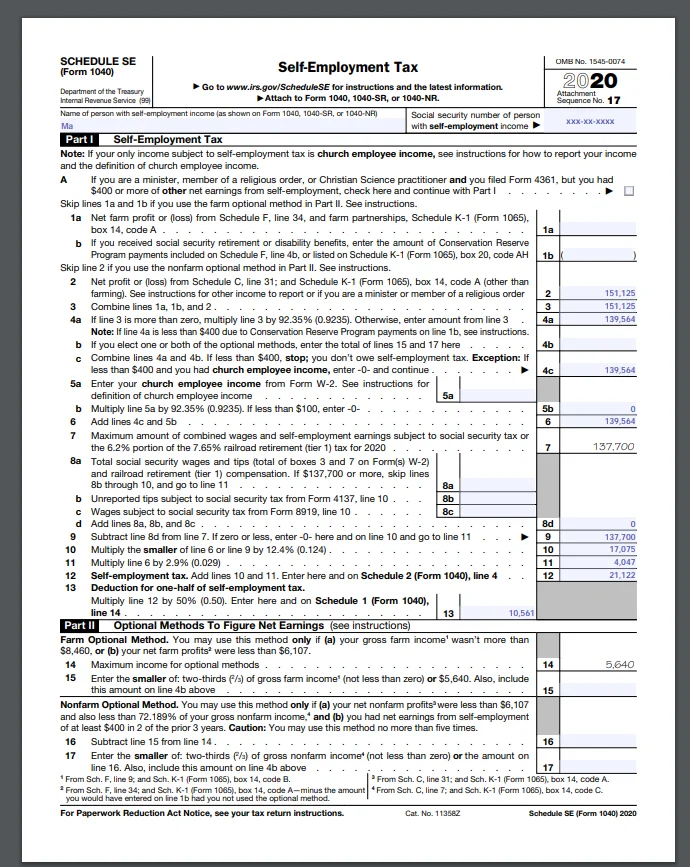

IRS Form SE is used to calculate the amount of this tax. The Form for 2020 is illustrated below.

What About Ma ?

In an earlier lesson, Ma (the owner) was left out of the payroll calculations because she is considered to be self employed. So, in this lesson we'll use Ma to illustrate how to calculate her earnings for income and self employment taxes.

In order to illustrate the calculations we'll use the following assumptions regarding Ma doing business as - Mom's Secret Recipes. Ma called in her bright and handsome accountant, Dave Marshall (that's me) , from Bean Counter and together they assembled the following figures for the year.

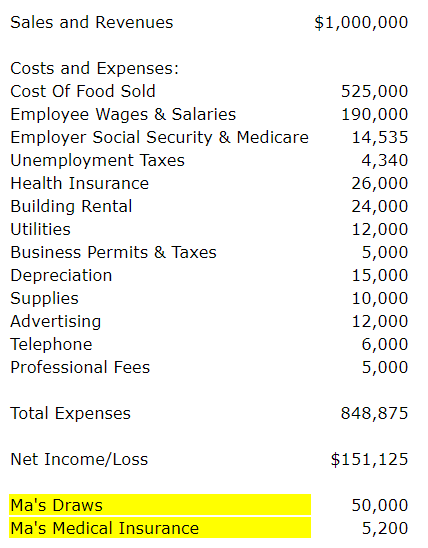

Ma's Schedule C Information

If you noticed, two of the amounts listed in our schedule above are not included in our computation of Ma's profit or loss on Schedule C. Can you tell me which two items ? I'll give you a hint. They are the items highlighted in yellow.

- Draws are not business expenses. They are just advances made to the owner in order to provide cash for paying personal bills and living expenses.

- Medical Insurance for employees is deductible; however, medical insurance for self employed individuals (Ma) has special rules on how this type of expenditure is handled.

Since Ma is a sole proprietorship our next steps are to prepare IRS Form Schedule C and IRS Form SE to determine Ma's earnings subject to income and self employment tax. Our Schedule C Net Income (Profit) amount is $151,125. Looks like Ma's restaurant had a pretty good year.

Your SECA tax is computed by filling out Schedule SE.

Ma's Schedule SE

Ma ended up owing a total of $21,122 for Payroll Taxes.

Social Security - $17,075

Medicare - $4,047

Don't forget to give yourself an income tax deduction for one-half of your SECA tax and transfer this amount to your Form 1040. This allows you to avoid paying income tax on one-half of your SECA tax amount. Since employees don't have to pay income tax for contributions made by their employers, the IRS provided this provision to provide a similar benefit to the self employed.

Ma's Income Tax Deduction was $10,561.

There are also two optional methods of computing SECA tax which are basically used by farmers and low-income non-farmers. The optional methods of computing net earnings from self-employment allow you to pay SECA tax as if your net earnings were higher than they actually are. Why would anyone want to pay more than they have to ?In order to qualify for social security and medicare benefits when they retire.

Did you notice that we used the two special provisions that we mentioned earlier that attempt to place the self employed individual on the same level as employees in our calculation of Ma's self employment tax ?

First, the net earnings from self-employment were reduced by an amount equal to half of the total self-employment tax rate for the year. For 2020, this amounts to a reduction of 7.65 percent of your net earnings from self-employment. This was accomplished by multiplying the Ma's earnings by 92.35 %.

Secondly, we calculated and deducted half of Ma's self-employment tax from her gross income on her Form 1040 (Personal Income Tax Return).

What about that medical insurance premium that Ma paid for her own coverage but was not allowed to deduct on her Schedule C ? In the past, the self employed individual's benefit was somewhat limited. Currently, the rules and laws have been improved.

Although Ma does not take the deduction on her Schedule C, she is allowed to deduct the expense on her 1040 (Personal Tax Return) and receive the benefit of using this deduction to reduce her taxable income and thus the amount of income tax she must pay.

The same applies to other "pass thru" types of business organizations. The adjustment is available to sole proprietors, LLC's, general partners and shareholder-employees of S Corporations. The adjustment is taken on the first page of the Form 1040.

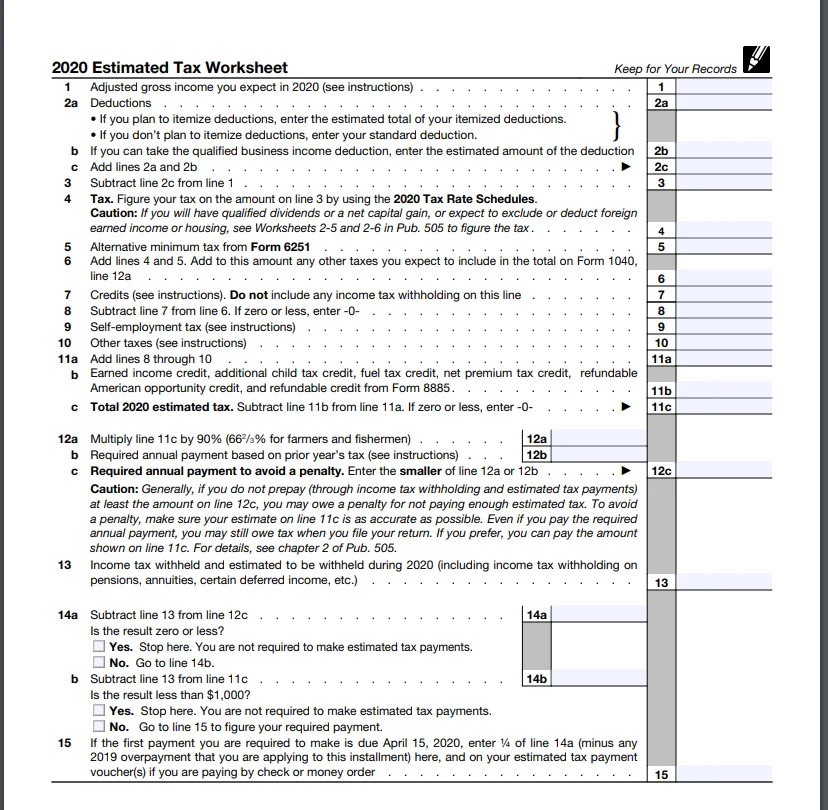

Federal income tax is a pay-as-you-go tax. The estimated tax system is the self employed owner's version of the taxes that are withheld by employers from employee wages each pay period.

Self-employed workers that meet the IRS guidelines are required to pay estimated income and self employment tax as the income is earned and the self employment tax is accrued during the year. This is accomplished by making estimated payments directly to the IRS each quarter using the Electronic Federal Tax Payment System (EFTPS) or by submitting your payments along with Form 1040-ES payment voucher.

General Rule In most cases, you must pay estimated tax for 2020 if both of the following apply.

1. You expect to owe at least $1,000 in tax for 2020, after subtracting your withholding and refundable credits.

2. You expect your withholding and refundable credits to be less than the smaller of: a. 90% of the tax to be shown on your 2020 tax return, or b. 100% of the tax shown on your 2019 tax return.

Your 2019 tax return must cover all 12 months.

When To Pay Estimated Taxes

For estimated tax purposes, the year is divided into four payment periods

You can pay all of your estimated tax by April 15, 2020, or in four equal amounts by the dates shown below.

1st payment ................. April 15, 2020

2nd payment ................ June 15, 2020

3rd payment ................. Sept. 15, 2020

4th payment ................. Jan. 15, 2021

* * You don’t have to make the payment due January 15, 2021, if you file your 2020 tax return by February 1, 2021, and pay the entire balance due with your return.

You may send estimated tax payments with Form 1040-ES by mail, or you can pay online, by phone, or from your mobile device.

For additional information, refer to Publication 505, Tax Withholding and Estimated Tax.

Using the Electronic Federal Tax Payment System (EFTPS) is the easiest way for individuals as well as businesses to pay federal taxes. Make ALL of your federal tax payments including federal tax deposits (FTDs), installment agreement and estimated tax payments using EFTPS. If it’s easier to pay your estimated taxes weekly, bi-weekly, monthly, etc. you can, as long as you’ve paid enough in by the end of the quarter. Using EFTPS, you can access a history of your payments, so you know how much and when you made your estimated tax payments.

Corporations must deposit the payment using the Electronic Federal Tax Payment System. For additional information, refer to Publication 542, Corporations.

In order to determine if you need to pay these installments and how to determine the amounts the IRS has provided a worksheet and detailed instructions. See the worksheet below.

Estimated Tax Worksheet

In this lesson, we learned that the Self Employment Tax (SECA) is basically the business owner's version of the Social Security and Medicare tax that employers and employees pay. If you recall from our discussion about deductions, employees that work for you have social security and medicare deducted from their wages. In addition, you as their employer are also required to match their deduction.

You should also have picked up that basically, anyone that has an ownership interest in what is called a "flow thru" type of business organization is subject to this tax. The one exception is a Subchapter S corporation where working owners are considered employees.

What's Next ?

Government Regulations