Debit or Credit Usage

Debits Credits

Debit or Credit -When ?

What to Debit or Credit or as William Shakespeare might have said

"To Debit or Credit that is the question"

All the stuff that you've told me is great; but, how do I determine what to debit or credit when recording transactions ? And here I am thinking you won't ask.

Let's revisit some terms and concepts from prior lessons.

Account Definition

An Account is a separate record for each type of asset, liability, equity, revenue, and expense used to show the beginning balance and to record the increases and decreases for a period and the resulting ending balance at the end of a period.

You should be aware that All Accounts :

- Can Be Debited and Credited

- Have an Increase Side (Column) and a Decrease Side (Column)

- Have a Debit Side (Column) and a Credit Side (Column)

- Debit Side is the Left Side (Left Column)

- Credit Side is the Right Side (Right Column)

- Have a Type and are classified as an Asset, Liability, Equity, Revenue, Expense, or Draw

- Are Either a Balance Sheet or Income Statement Account

- Have a Normal Balance Amount that is normally a Debit Balance or a Credit Balance

Formal Definitions of Debit and Credit

Debit

An entry (amount) entered on the left side (column) of a journal or general ledger account that increases an asset, draw or an expense or an entry that decreases a liability, owner’s equity (capital) or revenue.

Credit

An entry (amount) entered on the right side (column) of a journal or general ledger account that increases a liability, owner’s equity (capital) or revenue, or an entry that decreases an asset, draw, or an expense.

Fully Expanded Accounting Equation and Debit Credit Equation

Assets = Liabilities + Beginning Equity + Revenues - Expenses - Draws

In the Expanded Version of the Accounting Equation, “Ma Capital’s (Equity) Kids” are hiding behind her skirt. They’re there; you just don’t see them. The fully expanded version unhides them Revenue, Expense, and Draws and shows you their affects on Owner’s Equity (“Ma Capital”).

Rearranging the Fully Expanded Version (Simple Algebra) it becomes the Debit Credit Equation

Assets + Expenses + Draws = Liabilities + Beginning Equity + Revenue

From our formal definition you can see that:

The term Debit refers to the Left and the term Credit refers to the Right.

Using this knowledge, the type of accounts on the Left Side of our Debit and Credit Equation have normal Debit Balances.

All the types of accounts on the Right Side of our Debit and Credit Equation have normal Credit Balances.

The Left Side Normal Debit Balance Accounts = Right Side Normal Credit Balance Accounts

Again, a picture is worth a thousand words.

Debit and Credit Equation | |||||

Left Side | = Right Side | ||||

| Assets + | Draws + | Expenses | = Liabilities + | Owner's Equity + | Revenue |

| Normal Debit Balances | = Normal Credit Balances | ||||

| Debit Balance Accounts | = Credit Balance Accounts | ||||

With this information in hand, knowing when to debit or credit just requires knowing three things. The Type of Account, whether the account Increases or Decreases, and the Account's Normal Balance.

How To Use and Apply The Debit and Credit Rules:

(1) Determine the types of accounts the transactions affect-asset, liability, revenue, expense or draw account.

(2) Determine the account's normal balance.

(3) Determine if the transaction increases or decreases the account's balance.

(4) Apply the debit and credit rules based on the type of account , its normal balance, and whether the balance of the account will increase or decrease.

What's an Easy Way To Remember the Type Of Accounts ? Let's revisit the acronym ALOE-RED.

A | L | OE | |||

| | Assets | | Liabilities | | Owner's Equity | |||

| | _____ | R | E | D | ||

| Revenue | Expense | Draws | |||

The above diagram is made up of two terms ALOE and RED. These are the basis for the acronym

ALOE-RED which helps us remember the major types of accounts. ALOE-represents Assets, Liabilities, and Owner's Equity. RED-represents Revenues, Expenses, and Draws/Dividends.

Associate these terms with a day at the beach when you get a RED sunburn and use ALOE (the ointment) to ease the pain.

Now, we have our Major Types Of Accounts:

Assets , Liabilities, Owner's Equity, Revenue, Expense, and Draws.

Step 1 is to Identify the Major Type Of Accounts affected by the transaction.

Assets , Liabilities, Owner's Equity, Revenue, Expense, or Draws.

Step 2 is to determine the accounts Normal Balance.

What is a Normal Balance ?

The Normal Balance is the debit or credit balance that an account is expected to have. The normal balance is also the side of the account that increases the balance of the account.

What's an Easy Way to Remember an Account's Normal Balance ?

(1) Using our six Major Types of Accounts alphabetize and organize them into two equal Groups

We determined that we have (6) six Major Account Types - Assets , Liabilities, Owner's Equity, Revenue, Expense, and Draws.

Assuming that we wanted to group these 6 (six) account types into 2 (two) equal groups, how many account types would be included in each group ? If my math is correct 6/2 (six divided by two) is equal to 3 (three).

(2) Also assuming that we wanted to Alphabetize our account groups, our listing would appear as Assets, Draws, Expenses, Liabilities, Owner’s Equity, and Revenue.

(3) Now, dividing this listing into our 2 (two) groups with three Account Types in each we have:

Group 1

Assets, Draws, and Expenses

This group is the types of accounts that normally have a Debit Balance and Use The Left Side of an Account to increase the Account's Balance.

Assets, Draws, and Expenses

This group is the types of accounts that normally have a Debit Balance and Use The Left Side of an Account to increase the Account's Balance.

Group 2

Liabilities, Owner’s Equity, and Revenue

This group is the types of accounts that normally have a Credit Balance and use the Right Side of an Account to increase the Account's Balance.

Liabilities, Owner’s Equity, and Revenue

This group is the types of accounts that normally have a Credit Balance and use the Right Side of an Account to increase the Account's Balance.

Organizing these types of accounts into the two equal groups, we end up with our Debit Credit Equation that we discussed earlier.

| Assets | + Draws | + Expenses | = Liabilities | + Owner's Equity | + Revenue |

| Group 1 | Group 2 | ||||

Left Side | = Right Side | ||||

| Normal Balance - Debit | = Normal Balance - Credit | ||||

| Debit - Increases | Credit - Increases | ||||

Step 3 is to determine whether the balances of the accounts affected by the transaction increase or decrease.

All you have to remember is that:

1. Group 1 types of accounts Assets, Draws, and Expenses all normally have a Debit Balance (Left Side) and their balances are increased by using a Debit and entering the amount on the Left Side of an account.

2. Group 2 types of accounts Liabilities, Owner's Equity, and Revenue all normally have a Credit Balance (Right Side)and their balances are increased by using a Credit and entering the amount on the Right Side of an account.

3. Just use the other term (reverse) to record the decrease for each group. In other words, if a debit (left side) increases the balance of a type of account in the group, then a credit (right side) is going to decrease the balance of the type of account in the group. Likewise, if a credit (right side) increases the balance of a type of account in the group, then a debit (left side) is going to decrease the balance of the type of account in the group.

Step 4 you apply the debit and credit rules based on the type of account , its normal balance, and whether the balance of the account will increase or decrease.

The Normal Balance Of An Account determines whether a Debit or Credit Increases an Account's Balance.

Debit and Credit Rule

If the Normal Balance Side of an Account is the Left Side - Debit Side a Debit increases the balance of the Account. If the Normal Balance Side of an Account is the Right Side - Credit Side a Credit increases the balance of the Account.

Additional Explanation

In other words,

If the Normal Balance of an Account is a Debit (Left Side), enter the amount on the Left Side as a Debit to Increase the Account's Balance.

- Assets

- Draws

- Expenses

What does a Credit Do ? The opposite of course, enter the amount on the Right Side as a Credit to Decrease the Account's Balance.

If the Normal Balance of an Account is a Credit (Right Side), enter the amount on the Right Side as a Credit to Increase the Account's Balance.

- Liability

- Owner's Equity

- Revenue

What does a Debit Do ? The opposite of course, enter the amount on the Left Side as a Debit to Decrease the Account's Balance.

Debit and Credit Rules Table

| Debit and Credit Table | |||

| Type Of Account | Normal Balance | Increases | Decreases |

| Assets | Debit-Left Side | Debit-Left Side | Credit-Right Side |

| Liabilities | Credit-Right Side | Credit-Right Side | Debit-Left Side |

| Owner's Equity | Credit-Right Side | Credit-Right Side | Debit-Left Side |

| Revenue | Credit-Right Side | Credit-Right Side | Debit-Left Side |

| Expense | Debit-Left Side | Debit-Left Side | Credit-Right Side |

| Draws | Debit-Left Side | Debit-Left Side | Credit-Right Side |

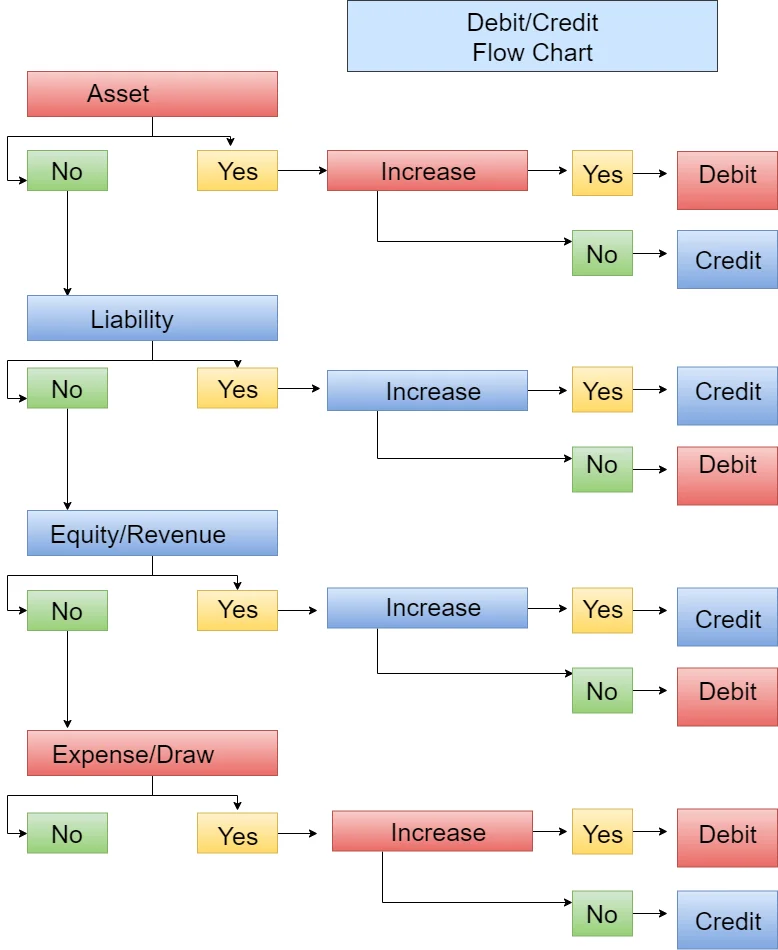

Debit Credit Flow Chart

Don't worry if you are initially having trouble remembering when to use a debit or credit. When all else fails !

You can Download

and/or

Eventually, the light bulb turns on and you don't even have to think about when to use a debit or credit. It becomes second nature.

So you know !

There are various symbols that are used to indicate Debits and Credits and whether an account’s balance is a Debit or a Credit. Ways and symbols you might run across are:

There are various symbols that are used to indicate Debits and Credits and whether an account’s balance is a Debit or a Credit. Ways and symbols you might run across are:

Dr for Debit and Cr for Credit

+ (Plus Sign) for Debit and – (Minus Sign) for Credit

No Bracket for Debit and < > (Brackets) for Credit

No Parentheses for Debit and ( ) (Parentheses) for Credit

Note : The plus (+) and minus (sign) are often used by accounting and bookkeeping programs to indicate debits and credits. Don’t get confused and think that the plus sign means an increase or that the minus sign means a decrease. They do not . In this case, they are simply symbols that mean either a debit or a credit.

about Debits and Credits.