Final Review

Final Review

Final Review

Of course businesses have many more than the ten simple transactions that I used in my example of ABC Mowing. Probably 80% of a bookkeeper's time is spent recording and summarizing a business's financial transactions. I intentionally limited the transactions used in my prior lessons in order to focus on the broad concepts. My purpose (which I hope I accomplished) was to prepare you with a strong foundation that you can continue to build on.

What We Covered

Let's Review the path that got us here.

The Introduction discussed the types of business organizations, types of business activities, users of financial information, bookkeeping systems, accounting rules, and the cash and accrual basis of accounting.

Highlights:

Bookkeeping

The process of recording and classifying business financial transactions (activities). In simple language-maintaining the records of the financial activities of a business or an individual. Bookkeeping's objective is simply to record and summarize financial transactions into a usable form that provides financial information about a business or an individual.

Types Of Business Organization

One of the first decisions that a person(s) needs to make is how the company should be structured. The four basic legal forms of ownership for small businesses are a Sole Proprietorship, Partnership, Corporation, and Limited Liability Company. There are advantages and disadvantages as well as income tax ramifications associated with each type of organization. We aren't going to delve in to this area but a brief description of the different types of organization and what they are is needed.

Sole Proprietorship

Most small business start out as sole proprietorships. These firms are owned by one person who is normally active in running and managing the business.

Partnership

A partnership is two or more people who share the ownership of a single business. In order to avoid misunderstandings about how profits/losses are shared , who's responsible for what, and other management, ownership, and operating decisions the partners normally have a formal legal partnership agreement.

Corporation

A corporation is an organization that is made up of many owners who normally are not active in the decision making and operations of the business. These owners are called shareholders. Their ownership interest is represented by certificates of ownership (stock) issued by the corporation.

Limited Liability Company (LLC)

The LLC is a relatively new type of business structure that combines the benefits of a partnership and corporation.

Types Of Bookkeeping Systems

Single Entry

With the single-entry system, you record a daily and a monthly summary of business income, and a monthly summary of business expenses. Single-entry is not a complete accounting system, but it shows income and expenses in sufficient detail for tax purposes. This system focuses on the business' profit and loss statement and not on its balance sheet. The single entry system is an "informal" record keeping system. While the single entry system may be acceptable for tax purposes, it does not provide a business with all the financial information needed to adequately report the financial affairs of a business.

Double Entry System

The double-entry system has built-in checks and balances and is more accurate than single-entry system. The double-entry system is self-balancing. Since all business transactions consist of an exchange of one thing for another, double-entry bookkeeping is used to show this two-fold effect. This system is a complete accounting system and focuses on the income statement and balance sheet.

Cash Basis/Accrual Basis of Accounting

Another decision faced by a new business is what accounting/bookkeeping method they are going to use to track their revenue and expenses. If inventories are a major part of the business, the decision is made for the business owner by the Internal Revenue Service (IRS) and the business is required to use the accrual method of accounting.

The Cash Basis recognizes revenues (earnings) in the period the cash is received and expenses in the period when the cash payments are made. The Accrual Basis records income in the period earned and all expenses in the period incurred.

Rules

Just like we have rules in sports to tell us how to play the game, we also have rules for accounting and bookkeeping.

The following are some of the Rules used to "play" the Accounting "Game":

Accrual Concept

Revenue Realization Concept

Matching Concept

Accounting Period Concept

Money Measurement Concept

Business Entity Concept

Going Concern Concept

Cost Concept

Conservatism Concept

Consistency Concept

Comparable

Materiality Concept

Cost-Benefit Convention

Industry Practices Convention

Lesson 1 The Bookkeeping Language introduced you to some of the terminology and definitions used in the accounting and bookkeeping language.

Highlights:

Major Type of Accounts:

ALOE-RED

A | L | OE | |||

| | Assets | | Liabilities | | Owner's Equity | |||

| | _____ | R | E | D | ||

| Revenue | Expense | Draws | |||

The above diagram is made up of two terms ALOE and RED. These are the basis for the acronym

ALOE-RED which helps us remember the major types of accounts. ALOE-represents Assets, Liabilities, and Owner's Equity. RED-represents Revenues, Expenses, and Draws/Dividends.

Associate these terms with a day at the beach when you get a RED sunburn and use ALOE (the ointment) to ease the pain.

Assets

Formal Definition:The properties used in the operation or investment activities of a business.

Informal Definition:All the good stuff a business has (anything with value). The goodies.

Additional Explanation: The good stuff includes tangible and intangible stuff. Tangible stuff you can physical see and touch such as vehicles, equipment and buildings. Intangible stuff is like pieces of paper (sales invoices) representing loans to your customers where they promise to pay you later for your services or product. Examples of assets that many individuals have are cars, houses, boats, furniture, TV's, and appliances. Some examples of business type assets are cash, accounts receivable, notes receivable, inventory, land, and equipment.

Liabilities

Formal Definition:Claims by creditors to the property (assets) of a business until they are paid.

Informal Definition:Other's claims to the business's good stuff. Amounts the business owes to others.

Additional Explanation: Usually one of a business's biggest liabilities (hopefully they are not past due) is to suppliers where a business has bought goods and services and charged them. This is similar to us going out and buying a TV and charging it on our credit card. Our credit card bill is a liability. Another good personal example is a home mortgage. Very few people actually own their own home. The bank has a claim against the home which is called a mortgage. This mortgage is another example of a personal liability. Some examples of business liabilities are accounts payable, notes payable, and mortgages payable.

Owner's Equity also called Owner's Capital

Comment:Both terms may be used interchangeably. In my tutorial lessons, I may refer to both terms or just use one or the other.

Formal Definition:The owner's rights to the property (assets) of the business; also called proprietorship and net worth.

Informal Definition:What the business owes the owner. The good stuff left for the owner assuming all liabilities (amounts owed) have been paid.

Additional Explanation:Owner's Equity (Capital) represents the owner's claim to the good stuff (assets). Most people are familiar with the term equity because it is so often used with lenders wanting to loan individuals money based on their home equity. Home equity can be thought of as the amount of money an owner would receive if he/she sold their house and paid off any mortgage (loan) on the property.

Revenue (Income), Expenses, Investment, and Draws

Revenues, expenses, investment, and draws are sub categories of owner's equity (capital). Think of owner's equity as a mom named Capital with four children to keep up with.

The kids are named Revenue, Expense, Investment, and Draws and each kid has one job that they are responsible for in order to earn their allowance.

Kid Revenue is responsible for keeping track of increases in owner's equity (Ma Capital) resulting from business operations.

Kid Expense is responsible for keeping track of decreases in owner's equity (Ma Capital) resulting from business operations.

Kid Draws has the job of keeping up with decreases in owner's equity (Ma Capital) resulting from owner withdrawals for living expenses and other personal expenses.

Kid Investment has the job of keeping up with increases in owner's equity (Ma Capital) resulting from additional amounts invested in the business.

Revenue also called Income

Formal Definition:The gross increase in owner's equity (capital) resulting from the operations and other activities of the business.

Informal Definition:Amounts a business earns by selling services and products. Amounts billed to customers for services and/or products.

Additional Explanation:Individuals can best relate by thinking of revenue as their earnings/wages they receive from their job. Most business revenue results from selling their products and/or services.

Expense also called Cost

Formal Definition:Decrease in owner's equity (capital) resulting from the cost of goods, fixed assets, and services and supplies consumed in the operations of a business.

Informal Definition:The costs of doing business. The stuff we used and had to pay for or charge to run our business.

Additional Explanation:Some examples of personal expenses that most individuals are familiar with are utilities, phone, clothing, food, gasoline, and repairs. Some examples of business expenses are office supplies, salaries & wages, advertising, building rental, and utilities.

Owner's Investments

Formal Definition: Increase in owner's equity (capital) resulting from additional investments of cash and/or other property made by the owner.

Informal definition: Additional amounts, either cash or other property, that the owner puts in his business.

Additional Explanation:Although these amounts can be kept up with as a separate item, they are usually recorded directly in the Owner's Capital Account. In other words, immediately put into Ma Equity's purse.

Owner's Drawing

Formal Definition: Decrease in owner's equity (capital) resulting from withdrawals made by the owner.

Informal definition: Amounts the owner withdraws from his business for living and personal expenses.

Additional Explanation:The owner of a sole proprietorship does not normally receive a "formal" pay check from the business, but just like most of the rest of us needs money to pay for his house, car, utilities, and groceries. An owner's draw is used in order for the owner to receive money or other "goodies" from his business to take care of his personal bills.

Lesson 2 the Accounting Equation

Abbreviated version

PROPERTY=PROPERTY RIGHTS

or the Expanded version

ASSETS=LIABILITIES + OWNER'S EQUITY

and lastly the Fully expanded version

ASSETS = LIABILITIES + BEGINNING OWNER'S EQUITY + ADDITIONAL OWNER INVESTMENTS + REVENUE - EXPENSES - DRAWS

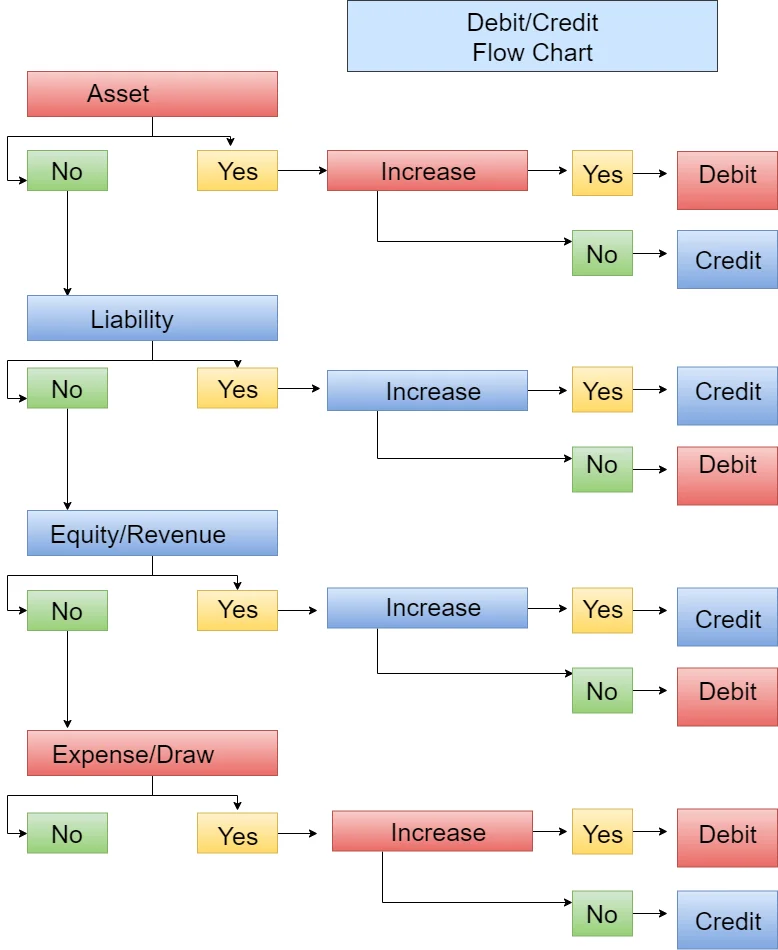

Lesson 3 Debits and Credits introduced and explained Debits and Credits and how they affect the Accounting Equation(s) and are used to record business transactions.

Highlights:

For Every Debit There Is A Credit

Debit- an entry (amount) entered on the left side (column) of a journal or general ledger account that increases an asset, draw or an expense or an entry that decreases a liability, owner's equity (capital) or revenue.

Credit - an entry (amount) entered on the right side (column) of a journal or general ledger account that increases a liability, owner's equity (capital) or revenue, or an entry that decreases an asset, draw, or an expense.

Debit and Credit Equation

Assets + Draws + Expenses = Liabilities + Owner's Equity + Revenue

Normal Debit Balance Accounts = Normal Credit Balance Accounts

Debit and Credit Rules Table

| Debit and Credit Table | |||

| Type Of Account | Normal Balance | Increases | Decreases |

| Assets | Debit-Left Side | Debit-Left Side | Credit-Right Side |

| Liabilities | Credit-Right Side | Credit-Right Side | Debit-Left Side |

| Owner's Equity | Credit-Right Side | Credit-Right Side | Debit-Left Side |

| Revenue | Credit-Right Side | Credit-Right Side | Debit-Left Side |

| Expense | Debit-Left Side | Debit-Left Side | Credit-Right Side |

| Draws | Debit-Left Side | Debit-Left Side | Credit-Right Side |

Debit & Credit Flow Chart

Lesson 4 Recording Business Transactions

explained and used examples to illustrate how business transactions are properly analyzed, recorded, and summarized.

Highlights:

We analyzed transactions and identified the Source Document, Type Of Transaction, Accounts Affected, and determined and explained the Debits and Credits needed to properly record and post to our General Ledger Accounts.

The Source Documents that provide documentation (proof) that a transaction has occurred are sales invoices (tickets), invoices from suppliers, contracts, checks written and checks received , promissory notes, and various other types of business documents. These documents provide us with the information needed to record our financial transactions in our bookkeeping records.

Our Chart Of Accounts was used to determine what accounts to use for recording the transactions. If you recall, a Chart Of Accounts is simply a coded listing of all the accounts in the General Ledger.

An Account, if you recall is a separate record for each type of asset, liability, equity, revenue, and expense used to show the beginning balance and record the increases and decreases for a period and the resulting ending balance at the end of a period.

All transactions have at least one debit and one credit.

Lesson 5 The General Ledger and Journals

explained what General Ledger and Journals are, how they're used, and what bookkeeping purposes they serve.

Highlights:

A General Ledger is just a book containing the summarized financial transactions and balances of the accounts for all of a business's assets, liabilities, equity, revenue, and expense accounts.

Journals are preliminary records where business transactions are first entered into the accounting system. The journal is commonly referred to as the book of original entry. Specialized Journals-are journals used to initially record special types of transactions such as sales, cash disbursements, and cash receipts in their own journal.

Lesson 6 Financial Statements explained what financial statements are, how they're created, and how they're used.

Highlights:

Financial Statements are summary accounting reports prepared periodically to inform the owner, creditors, and other interested parties as to the financial condition and operating results of the business. The four basic financial statements are:

Balance Sheet-The financial statement which shows the amount and nature of business assets, liabilities, and owner's equity as of a specific point in time. It is also known as a Statement Of Financial Position or a Statement Of Financial Condition.

Income Statement-The financial statement that summarizes revenues and expenses for a specific period of time, usually a month or a year. This statement is also called a Profit and Loss Statement or an Operating Statement.

Capital Statement-The financial report that summarizes all the changes in owner's equity that occurred during a specific period.

Statement of Changes in Cash-The financial statement that reports the sources and uses of cash for a specific period of time, normally a year.

Believe It Or Not

I know you probably got tired of ABC Mowing; but, using only our 10 sample transactions, we've covered the Basics Of Bookkeeping. Of course, in the real world, a business will have many more transactions that need to be analyzed and recorded; but, you apply the same methods and concepts that we learned and used in this Tutorial.

Congratulations

Cartoons in this tutorial provided by Ron Leishman. If you enjoyed them, get some of your own