Costs & Expenses

Cash Forecasts > Developing Your Forecast

Analyze Relationships of Your Costs and Expenses To Sales

We need to prepare estimates of our cash outlays for the following categories:

- Cost Of Sales (Cost Of Goods Sold) / Purchases / Inventory Levels

- Payroll (including payroll tax deposits)

- Operating Expenses

If you recall, we learned earlier that your sales forecast is the first estimate that is prepared and it sets the expected level of business that you plan to conduct during your forecast period. In addition, the amounts estimated for many other types of expenditures and payments depend on the amounts that you estimate for sales.

You use your sales forecast along with your analyses to calculate your estimated amounts for costs and expenses that are related to the level of sales (variable costs and expenses). Your estimates for fixed cost and expenses should consider your estimated anticipated future sales volume along with prior year(s) historical information and future plans.

You now need to prepare analyses of your prior year(s) cost of sales, purchases, inventory levels, payroll, and operating expenses. You'll find the prior year(s) information you need for these analyses in your prior year(s) income statement or general ledger.

In addition, in order to properly estimate your costs and operating expenses, you need a basic understanding of cost behavior.

Fixed and Variable Costs / Expenses

Variable costs are costs that change as the amounts of products and/or services sold increase or decrease. On the other hand, fixed costs do not change (remain the same) regardless of how many products and/or services are sold or not sold.

Variable costs are costs that change as the amounts of products and/or services sold increase or decrease. On the other hand, fixed costs do not change (remain the same) regardless of how many products and/or services are sold or not sold.

Our Formal Definitions

- Variable Costs (Expenses) are costs that change directly in proportion to changes in activity (volume).

- Fixed Costs (Expenses) are costs that remain constant (fixed) for a given time period despite wide fluctuations in activity (volume).

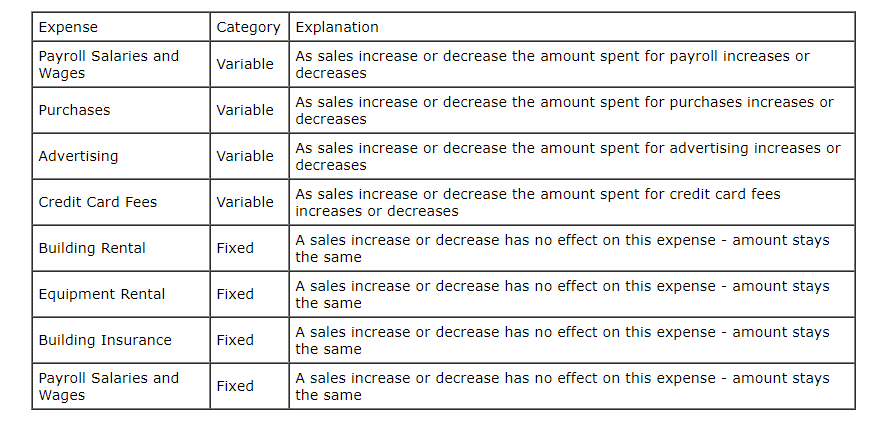

A few examples of types of expenses that fit into the each of these categories:

Did you catch me ? I listed payroll expenses in both the variable and fixed categories.

Salaries & Wages are classified as variable or fixed based on your employee's type of job.

Salaries, wages, and commissions paid to salespeople would be an example of payroll expenses that are normally classified as variable expenses because they are related to changes in sales. If you planned on increasing your sales, you'd probably need to hire more salespeople.

In a manufacturing business, an example of a variable type of payroll expense would be production jobs where the employees actually make your product. If you planned on increasing your sales, more than likely you would need to produce more products which in turn would require you to hire more employees.

What about salaries and wages that are classified as fixed ? Examples of these type of jobs would be your bookkeeper, managers, and supervisors. A reasonable increase in your sales would normally not require you to have to hire any additional bookkeepers or managers.

Purchases / Cost Of Sales / Inventory

For those businesses that buy and sell goods and products, Purchases for Inventory is one, if not the biggest, cash outlays that you need to prepare an estimate for.

The three terms purchases, cost of sales, and inventory are all interrelated.

The following simple formula illustrates this relationship.

Ending Inventory = Beginning Inventory + Purchases - Cost Of Sales

This simply means that what you have on hand plus what you buy less what you sell determines what you have left. Nothing complicated about this - right ?

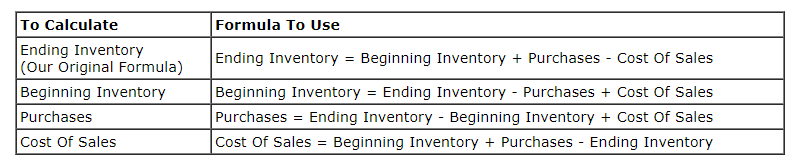

This simple formula allows us to calculate the value for any of our four variables beginning inventory, purchases, cost of goods sold, or ending inventory if we know the values of any three of the four variables.

We'll illustrate what I mean.

Since the amount of your Purchases, Cost Of Sales, and Inventory Levels are related to your Sales (depend on how much you sell), you need to analyze your prior year(s) historical data and calculate some percentage and other relationships.

Before we continue, what do you think the major factor is that determines how much a business has to spend on buying the products that they sell to their customers ? You should know me by now, I don't usually ask you difficult questions.

Sales !!!

Remember, as we learned earlier, many of your costs and expenses depend on (are related to) sales and that's why the very first thing you prepare when preparing a Cash Forecast is your Estimated Sales or Sales Budget.

The more sales that you plan on having, the more you'll need to plan for and estimate to cover your purchases requirements and their resulting cash outflow (payment).

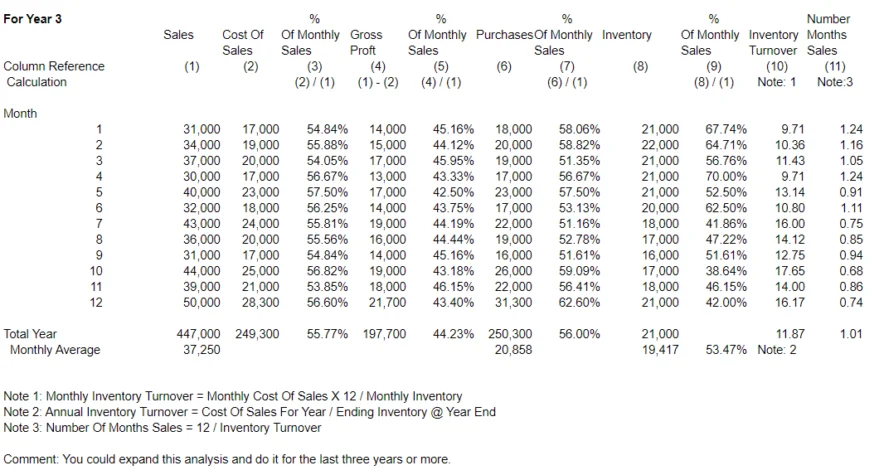

Earlier I said that you needed to analyze historical financial information and prepare some calculations to use as a guide to use to calculate your purchases, cost of sales, and ending inventory amounts for our Cash Forecast. Now we're going to do it.

Let's first review a sample worksheet that provides some of the information and calculations you need in order to prepare your Estimated Purchase and Inventory Amounts Schedule by Period.

- Key Calculations Include:

- Cost Of Sales Percentage Calculation using your actual historical Cost Of Sales and Sales amounts.

- Inventory Calculations using your historical Inventory Levels (How Much Inventory You Normally Keep On Hand)

- Inventory Turnover and Number of Months/Days Sales On Hand

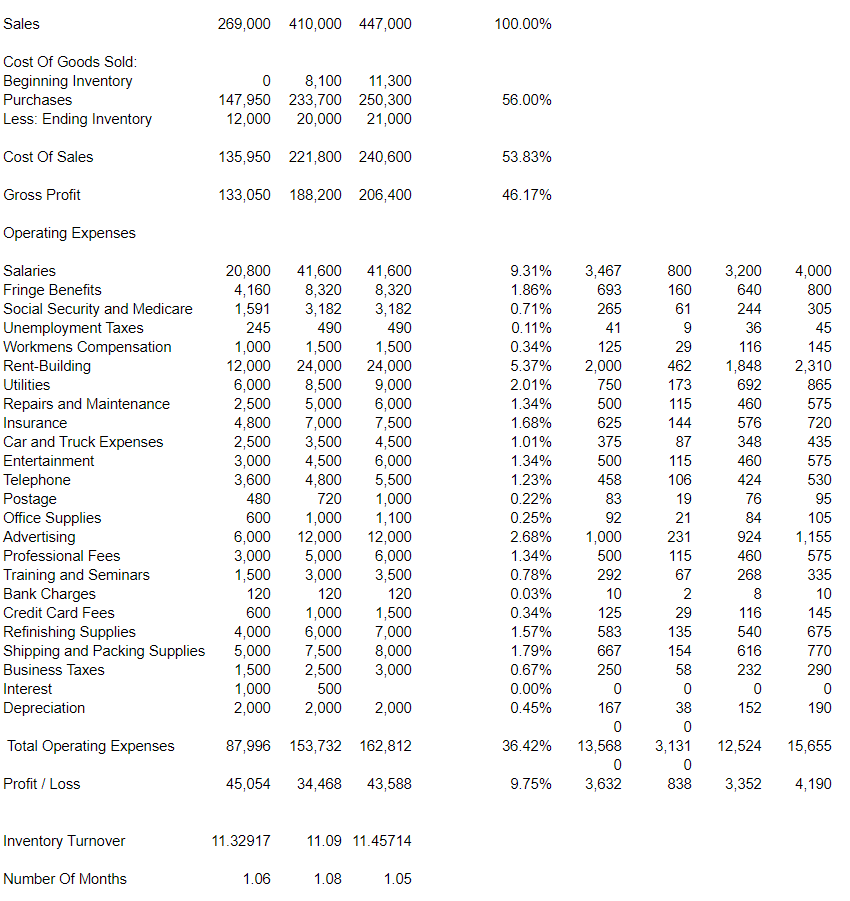

Illustration of Purchases, Cost Of Sales, and Inventory Historical Analysis and Calculations

Where do you get the information for these calculations ? Normally, your monthly and/or annual Income Statements and Balance Sheets.

Gosh, we're rolling right along. You now need to prepare a Worksheet To Calculate your Estimated Purchases and Inventories By Period.

There are many acceptable ways to skin this cat that vary from simple to a little complex. A simple method would be to use purchases as a percentage of sales to calculate the amount of your purchases and cost of sales as a percentage of sales to calculate your monthly cost of sales estimates. You could then use these calculated amounts to calculate your ending inventories.

What should be clear is that our Cost Of Sales, Purchases Needed, and Ending Inventory Calculations all depended on or were related to our Estimated Sales Amounts (sales volume). A little experience will aid you in determining what calculations will more closely approximate your future actual amounts.

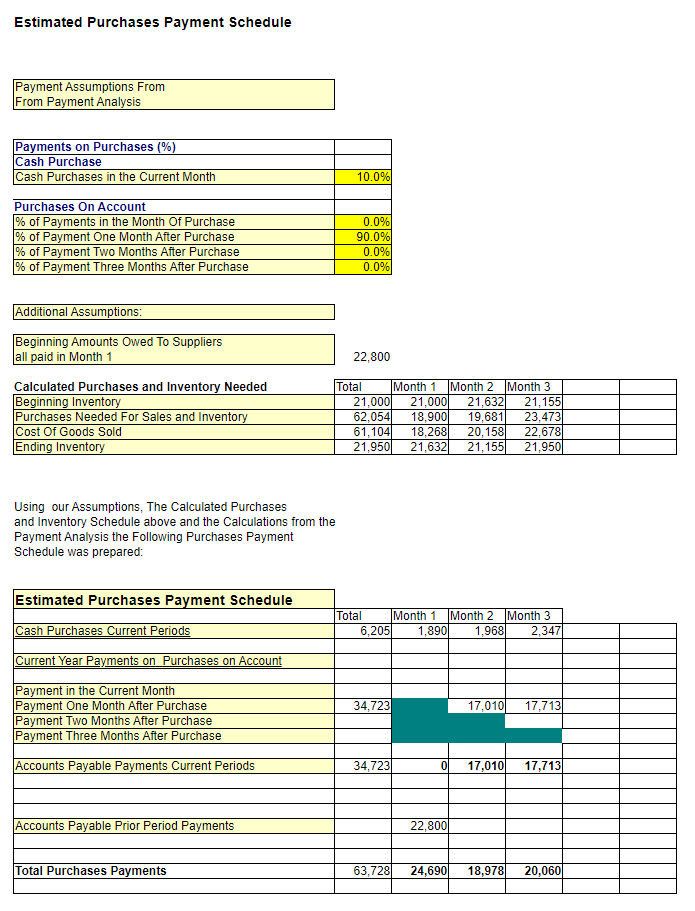

Prepare Estimated Purchases Payment Schedule

What else do we need to do regarding our Estimated Purchases ? Not much. We now know when and how much we need to buy, now we need to determine when we have to pay for these Purchases. You now need to prepare your Estimated Purchases Payment Schedule.

You'll use your Estimated Purchases Amounts Schedule By Period along with your Purchases Credit Terms and Payment Patterns Analysis that was prepared earlier to prepare your Estimated Purchases Payment Schedule and to determine in what future periods these estimated purchases have to be paid for (the period of the actual cash payment for these purchases).

Take a look at a sample of an Estimated Purchases Payment Schedule for a three month period.

Payroll, Payroll Taxes, and Fringe Benefits

This is typically another expenditure that represents a significant amount of cash that is spent by a businesses. In order to develop estimates for your future salaries and wages to use in your Cash Projection, again as a starting point, you need to analyze what has happened in the past.

As we learned earlier, some salaries and wages will change as the level of sales increases or decreases (variable expenses) while others are not affected by increases and decreases in sales (fixed expenses). In other words some salaries and wages are related to the level of sales while others are not. An analysis of your salaries and wages that groups your salaries by jobs into fixed and variable expenses is an excellent starting point.

In preparing your estimates for payroll, not only must you consider your wages and salaries; but, also any local, federal, and state payroll taxes and any applicable law or rate changes, and any fringe benefits that you currently provide and any plans for providing any additional fringe benefits.

Methods use to estimate future payroll expenses vary from simple to complex. For larger businesses a detailed Manpower Requirements Budget by Department is often prepared. For smaller outfits, labor (wages, salaries, etc.) as a percentage of sales may serve the purpose.

Operating Expenses

You need to list and analyze each operating expense that appears on your income statement or in your General Ledger in order to develop a reasonable method for estimating the future amounts for these expenses.

Examples of operating expenses your business might have include:

- Rent - Building

- Rent - Equipment

- Utilities

- Repairs and Maintenance

- Insurance

- Car and Truck Expenses

- Travel

- Entertainment

- Postage

- Office Supplies

- Advertising

- Marketing / Promotion

- Professional Fees

- Training and Development

- Bank Charges

- Credit Card Fees

Once again, you should be aware that some of these expenses will vary with sales (variable expenses) while others will not be affected (fixed expenses) by increases and decreases in your sales.

If your anything like me, it's helpful when people discuss and explain things to me, but an example of what their talking about "unmuddies" the water for me. That being said, let's take a look at a sample analysis of payroll and operating expenses based on a sample Income Statement.

Income Statement Analysis

Income Statements Year 1 Year 2 Year 3 Year 3 Monthly Weekly 4-Week 5-Week

Sales Period Period

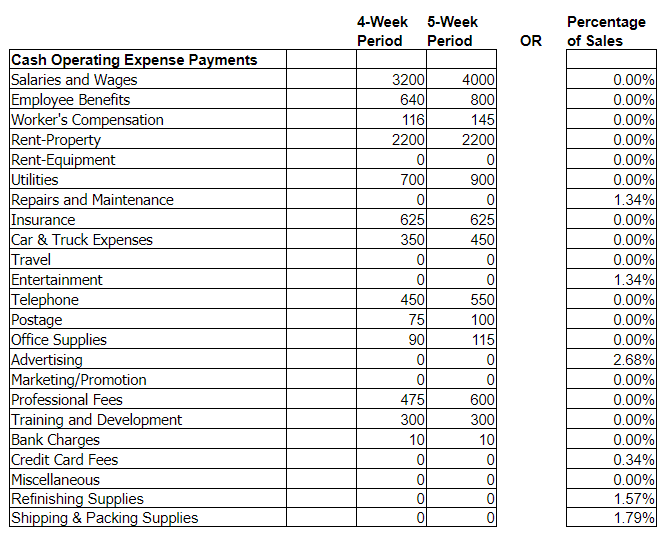

Using the information obtained from analyzing this Income Statement, we prepared the following estimates of operating expenses.

Operating Expense Analysis

Where did these amounts come from ?

See above Income Statement Analysis

Note: Some figures were rounded up.

Other Payments

Determine and Estimate any other payments that you anticipate will occur during your forecast period.

- Owner's Draws / Dividends

Include estimated amounts for any anticipated owner draws or payments of dividends to stockholders. - Current Debt Payments

If you currently have any notes such as borrowings for equipment purchases you also need to include these payments (both principal and interest) as a Cash Payment in your Cash Forecast. - Additional Equipment Needs

Speaking of equipment, if you do need additional equipment, whether you plan on borrowing or paying cash, you need to include the Cost of the Equipment as a Cash Payment in your Cash Forecast. - Income, State, and other Business Taxes

Shucks, you wouldn't want to forget your friendly governments would ya ? You need to prepare estimates for any future income taxes, state business taxes such as franchise and excise taxes, and other business taxes that your specific type of business may be subject to. - Any Other Miscellaneous Type of Cash Payment.

Include amounts for any other cash payments.

What's next ?

Reviewing Cash Forecast Steps