Sales & Collections

Cash Forecasts > Developing Your Forecast

Where do you start ?

Sales is the "engine" that runs our car (Cash Forecast).

In preparing the Cash Flow Projection start with your Estimated Sales for the period(s). Why ? The reason is that most of the other estimated amounts are related directly or indirectly to sales.

Your Sales Estimate(s) is the most important estimate that you have to make. Why ? I just got thru telling ya, but I guess you're going to make me repeat myself, but it's definitely something that can stand repeating.

Most of the other estimated amounts for expenses and other payments depend on the amount of sales that you estimate. If an increase in sales of, for example 10 percent is anticipated various other expenditures must also be adjusted. One that should come to light immediately is Purchases. Quite simply, in order to sell more, you have to buy more. You might, but not necessarily, also need to hire some additional sales people to handle the increased amount of sales. Another expenditure that might need to be increased is advertising.

Hopefully, you now see how the level of sales also affects the amount of other related expenditures. Therefore, in order to prepare realistic forecasts, you need to understand the relationships of your costs and expenses to your sales forecast.

You should now know that your sales forecast is the first estimate that is prepared and it sets the expected level of business that you plan to conduct during your forecast period. In addition, the amounts estimated for many other types of expenditures and payments depend on the amounts that you estimate for sales.

If you do a poor job of estimating your sales, you're well on your way to preparing a useless Cash Forecast.

How Do you Go About Developing Your Sales Estimate / Budget ?

As we mentioned earlier, the foundation upon which you will build your cash forecast is your sales forecast. So you need to round up your historical information such as your Prior Years Income Statements and Sales Analysis Reports.

Tasks You Need To Perform

- Organize your sales into groups or categories such as product lines that have similar characteristics and gross margin percentages. If you don't already know, a gross margin percentage is your gross profit (sales less cost of goods sold) divided by sales.

- If you don't already have one, prepare a monthly sales analysis by category for at least three years.If you haven't been in business for three years, or don't feel that your prior years are indicative of the future, you should at least use your business's previous year's sales amounts as a starting point for your estimated sales forecast. By using last year's sales amounts at least you'll be considering such factors as seasonal fluctuations and trends when preparing your sales forecast.

- Research and find current information and trends applicable to your particular type of business.

- Research and check out what your competition is doing.

- Think about and analyze variables that affect your level of sales (sales volume).

- Analyze Prices that you charge and what prices your competition is charging and determine whether you need to increase or decrease your prices.

- The current capacity of your business and any plans for increasing or decreasing your capacity. A store with 5000 square feet only has room to stock so many products.

- Product availability and the status and financial condition of your suppliers.

- The magnitude of your sales area (local or national)

- Current and future marketing plans.

You can also get fancy and use software and spreadsheets to aid you in developing sales estimates that include trend and probability analysis.

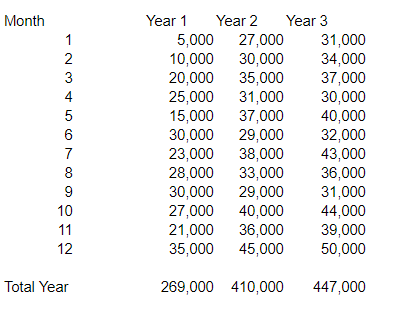

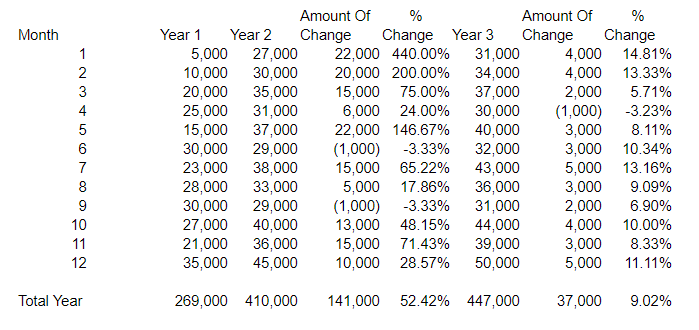

The Tables Below provide an example of a simple sales analysis.

Sales History By Year and Month

Sales Comparison & Analysis

Comments:

Year 1 was the first year of operations

Year 2 was a growth year and had a 52% increase in sales amounting to $141,000

Year 3 leveled off and had a slight increase of 9% in sales amounting to $37,000

After Estimating Sales Where Do I Go To From There ?

Analyze Sales Credit Terms and Collection Patterns

Estimating your Cash Receipts for your Cash Forecast involves using the Estimated Sales Amounts determined in your Sales Budget to determine when the Cash will probably be received (collected) from these sales.

If your business only has cash sales, the sales estimated in your Sales Forecast / Budget also represent when the estimated payments for these "cash" sales are received.

If your business sells a significant portion of its products or services on credit, you should do a historical analysis of your accounts receivable credit terms and collections. In other words, you need to perform an analysis to determine how long it is after you bill your customer for the goods and/or services sold until you actually receive the payment.

Applying your sales and accounts receivable collection patterns based on your historical analysis from the past to your sales forecast is the best way to predict your cash receipts from the collection of your estimated sales.

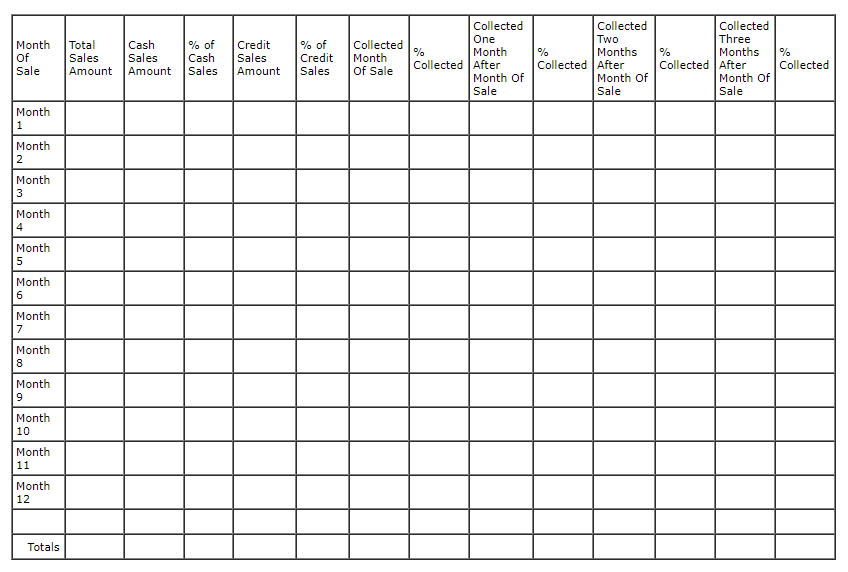

Blank Sample Sales Collection Analysis Worksheet

Let's use an illustration to help us understand exactly what this analysis is telling us.

Suppose your business had 10,000 sales in a month. After reviewing your detail records, $2,000 of these were "cash" sales (paid for at the time of sale) and $8,000 were made on credit (allowed your customers to pay you later). In addition our analysis found that of the $8,000 of credit sales that $6,000 of these credit sales were collected in the following month, $1,000 two months after the sale, and $1,000 was collected three months after the sale.

For this particular sales period, we now know that 20% ( $2,000 / $10,000) of our sales were "cash" sales and collected in the month of sale, 60% ( $6,000 / $10,000 ) were collected in the following month ( one month after the sale), 10 % ( $1,000 / $10,000) were collected two months after the sales, and 10% ( $1,000 / $10,000) were collected three months after the sale.

When you apply this method to 12 months of actual sales activity, you will have an excellent indicator of the time that it takes for your business to convert its sales into cash (collect its money).

If the results are roughly the same for each of the 12 periods that you analyzed and calculated, you can use an average percentage calculated for the entire years worth of sales. If your collection patterns vary with the time of year, you may want to use monthly data rather than averages.

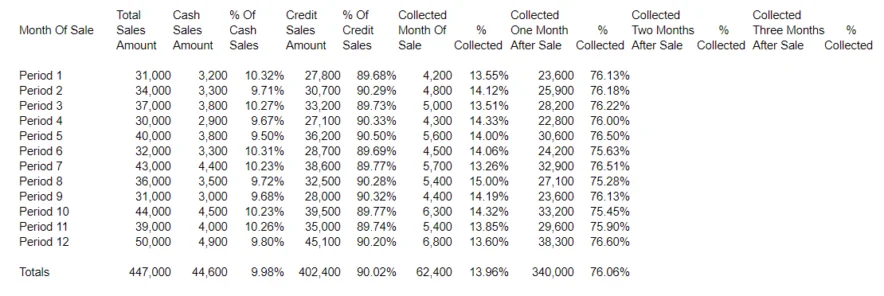

Sample Filled In Sales Collection Analysis Worksheet

What major factor do you think might affect the time that it takes to collect your sales ? This is not a difficult question. The credit terms that you grant your customers affect when your sales will be converted into cash (collected). Common sense tells you that the longer the period of time that you allow your customers to pay you, the longer it will take to get your cash. On the flip side of the coin, if all your sales were "cash" sales you would have your cash at the time of the sale.

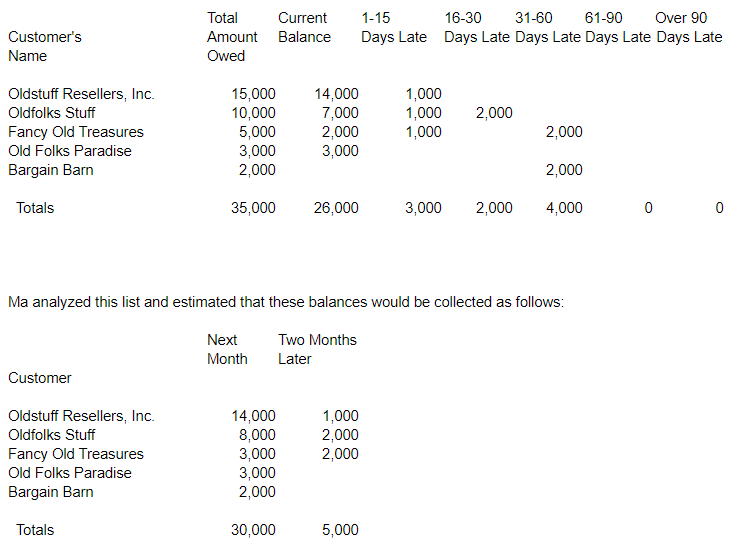

In conjunction with your analysis of the your future collections, you should use an Accounts Receivable Aging Report to schedule your prior period amounts that will be collected in your future periods.

An accounts receivable aging schedule is a report that lists all of the amounts that your customers owe to you and groups the unpaid invoices that make up the total into categories to indicate if any are late.

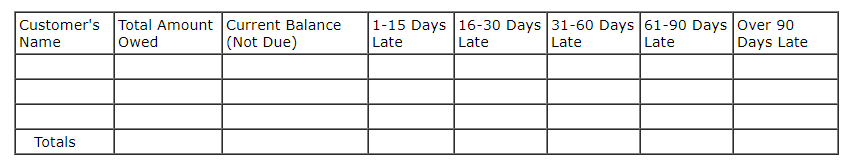

Blank Sample Accounts Receivable Aging Report

Sample Filled In Accounts Receivable Aging Report

You use this Aging Report as a tool for estimating when you can expect to actually collect these accounts.

Prepare Estimated Accounts Receivable and Sales Collection Schedule

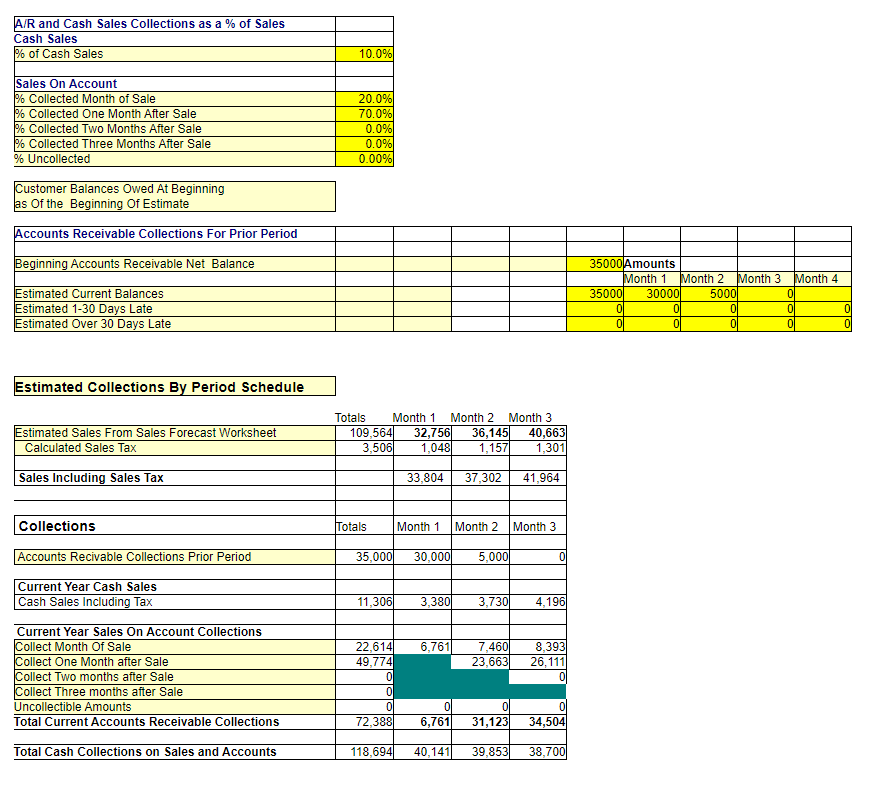

After completing your Sales Credit Terms and Collection Patterns Analysis and reviewing your Accounts Receivable Aging Report you should now have the information needed to prepare your Estimated Accounts Receivable and Sales Collection By Period Schedule.

All your doing here is using your Estimated Sales along with your collection analysis to estimate in what periods you'll actually receive the cash from these sales.

What do you think an Estimated Accounts Receivable and Sales Collection Schedule might look like ?

Sample Accounts Receivable and Collection Schedule

Other Sources Of Receipts

Determine and Estimate any other receipts that you anticipate will occur during your forecast period.

- Additional Loan Requirements

If you are planning on a significant increase in sales, you will need to consider whether you will need to borrow any money. Likewise, if you will need additional equipment you need to include an estimate for any additional loan needs. These borrowings are included as an additional Cash Receipt in your Cash Forecast. - Sale Of Equipment or Obsolete Inventories

If you plan on disposing of any old equipment or obsolete inventory you need to include the proceeds from their sale as a Cash Receipt in your forecast. - Additional Owner Contributions or Sale of Stock

Include amounts for any planned additional capital contributions. - Any Other Miscellaneous Type of Cash Receipt.

Include amounts for any other sources of cash receipts.

What's next ?

Purchases and Payments