Recording Cash

The first step in managing and controlling cash is to accurately record the transactions that affect your Cash Balance. The records that you use depend on whether you have a simple or elaborate bookkeeping system. The following section lists and describes some of the special journals a business might use and then since this tutorial is about cash later isolates only the journals and records related to recording Cash.

Some of the following information was borrowed from my So, you want to learn Bookkeeping! - Special Journals tutorial. I discussed the various types of special journals to at least provide those of you that have not taken my Special Journals Tutorial with a basic background and familiarity with special journals.

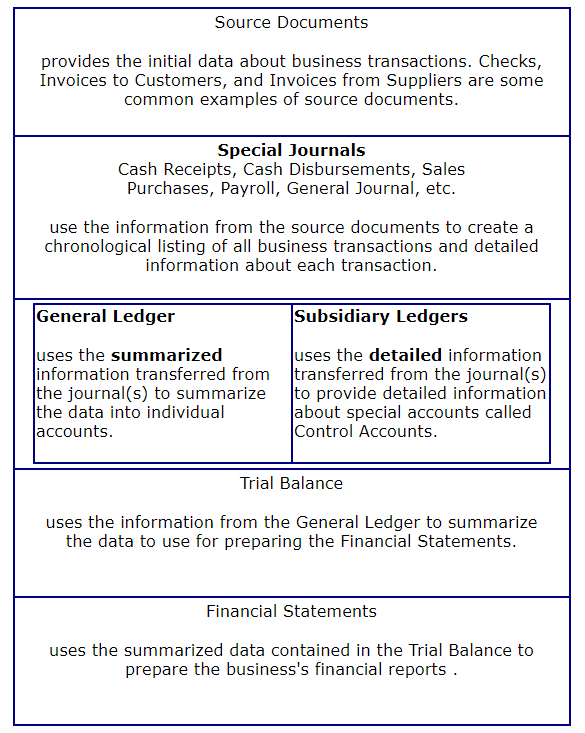

Flow Of Information into and thru your Accounting and Bookkeeping Records

The chart illustrates that your recording begins with a financial transaction. A source document such as a check, supplier invoice, or customer bill that provides verification that the transaction occurred and the amounts needed to properly record the transaction.

The original entry for the transaction is made in your Special Journals depending on the type of transaction.

The other records are used to summarize entries recorded in your various journals and prepare summarized Financial Records such as your Balance Sheet and Income Statement.

Journal Definition

A Journal is an accounting record that is used to record the different types of transactions using various source documents. Source Documents are the original sources of information that provide documentation (proof) that a transaction has occurred such as sales invoices (tickets), invoices from suppliers, contracts, checks written and checks received , promissory notes, and various other types of business documents. These documents provide us with the information needed to record our financial transactions in our bookkeeping records. If you recall a transaction is any event or condition that must be recorded in the books of a business because of its effect on the financial condition of the business, such as buying and selling. A business deal or agreement.

A Journal is an accounting record that is used to record the different types of transactions using various source documents. Source Documents are the original sources of information that provide documentation (proof) that a transaction has occurred such as sales invoices (tickets), invoices from suppliers, contracts, checks written and checks received , promissory notes, and various other types of business documents. These documents provide us with the information needed to record our financial transactions in our bookkeeping records. If you recall a transaction is any event or condition that must be recorded in the books of a business because of its effect on the financial condition of the business, such as buying and selling. A business deal or agreement.

Journals are often called or referred to as the books of original entry. The reason is that this is the first place that business transactions are formally recorded. Specialized Journals are journals used to initially record special types of transactions such as sales, cash disbursements, and cash receipts in their own journal. All these journals are designed to record special types of business transactions and post the totals accumulated in these journals to the General Ledger periodically (usually once a month).

You can think of a Journal as a Financial Diary.

The General Journal is the record used to record unusual or infrequent types of transactions. Type of entries normally made in the general journal are depreciation entries, correcting entries, and adjusting and closing entries.

The Cash Payments Journal is a special journal that is used to record all cash that is paid out by a business except for payroll. Columns are set up for types of transactions that occur frequently enough to warrant a separate column. Some examples are Accounts Payable (Payments on Purchases and Services Charged) and Cash Purchases.

The Cash Receipts Journal is a special journal that is used to record all receipts of cash. Columns are set up that indicate the sources of the cash. Two of the major sources of cash for a business are Cash Sales and Collections of Customer Charge Sales. These and other categories that have a lot of activity (transactions) have their own column.

The Sales Journal is a special journal where sales of services and merchandise made on account (business's customer is allowed to charge purchases) are recorded.

The Purchases Journal is a special journal that is used to record all purchases and various expenses and other charges from suppliers that a business has an open account with (supplier allows the business to charge purchases).

The Payroll Journal is a special journal that is used to record and summarize salaries and wages paid to employees and the deductions for taxes and other authorized employee withholding amounts. Note: Many small businesses use the Cash Disbursement Journal to record their payroll which is also acceptable.

The Sales Return & Allowances Journal is a special journal that is used to record the returns and allowances of merchandise sold on account.

The Purchase Returns & Allowances Journal is a special journal that is used to record the returns and allowances of merchandise purchased on account.

Why Use Special Journals

- Groups and records transactions of a like nature. A familiar example is recording all cash received by a business in one place.

- Saves time with summary and less frequent postings to the General Ledger.

- Allows a business to have different individuals responsible for different journals thereby increasing internal controls and allocating the record keeping workload.

Let's make a simple chart for five of the major Special Journals that tells us what type of transactions are recorded in these special journals.

- Sales/Revenue Journal

- Type of Transaction Recorded:

- Product Sales/Fees billed to customers who we have granted credit (charge sales)

- Cash Receipts Journal

- Types of Transactions Recorded:

- Cash product sales / fees

- Cash collected on customer accounts

- Any other receipt (source) of cash

- Purchases Journal

- Type of Transactions Recorded:

- Purchase of any expense on account

- Purchase of supplies on account

- Purchase of equipment on account

- Purchase of any other asset on account

- Cash Payments Journal

- Types of Transactions Recorded:

- Cash paid for expenses

- Cash payments to our suppliers on account or cash purchases

- Cash purchase of supplies

- Any other cash payment

- Payroll Journal

- Type of Transaction Recorded:

- Cash payments to employees for salary & wages

See, it's really quite easy to determine what journal to use to record business transactions. A little common sense goes a long way.

Remember it's your business and you could if you had a special need design your own special journal. If you wanted to know how much cash you received from customers in different states without doing a special analysis you could set up special cash receipts journals for all 50 states. But in this day and age a computer with good bookkeeping software would provide you with this and many more types of customer analyses.

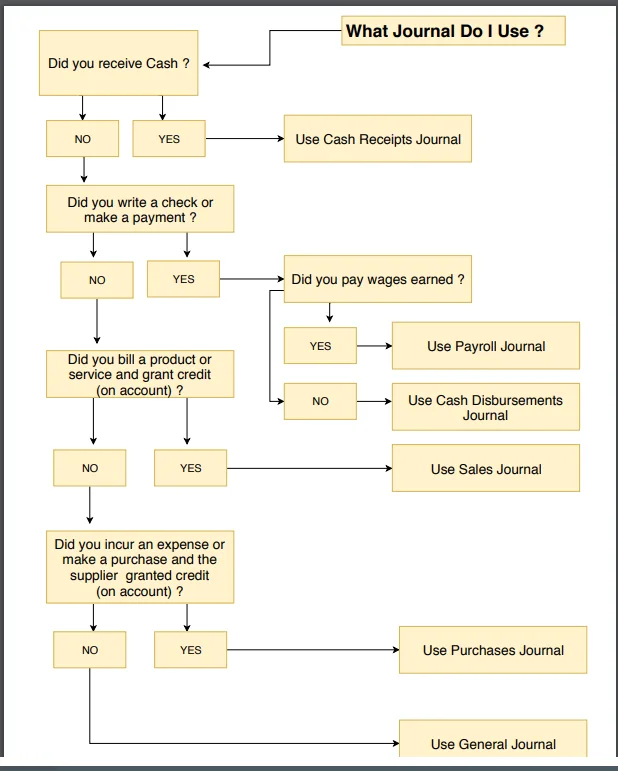

What Journal Do I Use ?

Want to make determining what journal to use even easier ? I knew you'd say yes and make me work harder. The following chart is set up to guide you to the proper journal by answering some simple questions.

All the Special Journals summarize the daily business transactions and feed their summarized information to the appropriate accounts in the General Ledger.

Cash Journals and Records

Since this Tutorial is all about Cash, let's isolate and discuss the records that are used to monitor and control a business's Cash.

Cash Disbursements/Payments Journal

Definition & Purpose

The Cash Payments Journal is a special journal that is used to record all cash that is paid out by a business except for payroll. Businesses with just a few employees could also use this journal to record their payroll checks; however, I recommend that you use a special payroll journal in order to have all your payroll information in one place.

The entries recorded in this journal are a debit to expense accounts, the purchases account, or the accounts payable control account (a debit is also posted to the supplier's Accounts Payable Subsidiary Account) and a credit to the cash account.

The Cash Disbursements Journal lists all checks, in check number order, paid during the month. It posts total checks written as a credit entry to the Cash Account. All payments to suppliers that have an Accounts Payable Subsidiary Ledger Account are Debited to the Accounts Payable Control Account and Credited to our Cash Account.

Payroll Journal

Definition & Purpose

The Payroll Journal is a special journal that summarizes the payroll information and records the payroll checks issued by pay period and is used to post the summary totals to the General Ledger.

The Payroll Journal records the expense accounts where salary and wage gross amounts are charged. In addition, all the deductions taken from salary and wages are charged to the appropriate liability or expense offset account.

Although the Payroll Journal is normally used as the record (special journal) to record payroll, small businesses could also use their Cash Disbursement Journal.

I recommend that you use a special journal for recording your payroll transactions since this provides you with all the information about payroll in one convenient place (your payroll journal).

Cash Receipts Journal

Definition & Purpose

The Cash Receipts Journal is a special journal that is used to record all receipts of cash.

The entries recorded in this journal are a debit to cash and a credit to the accounts receivable control account (a credit is also posted to the customer's Accounts Receivable Subsidiary Account), sales, or other accounts (normally miscellaneous revenue accounts or loans).

This journal is used to record all the cash that we receive. The biggest sources of cash for businesses result from cash sales and collections from customer's who we have set up on open account (allowed them credit).

Checkbook, Register, or Cash Summary Report

Since most of us have a personal checking account, the checkbook is a record that we already are somewhat familiar with. The same basic practices that apply to maintaining an accurate personal checkbook also apply to a business checkbook.

Other documents used to support and verify your checkbook entries and balance include:

- Actual checks

- Deposit Slips

- Deposit Book

- Daily Cash Report

- Bank Statement

- Bank Reconciliation

- Bank Notices

- Customer Credit Card Slips

Subsidiary Ledgers

Two records that are critical, whether using a manual or computerized bookkeeping system, to Cash Management are the Accounts Receivable and Accounts Payable Subsidiary Ledgers.

Why ? They provide information as to amounts due and when from customers and amounts owed and when to suppliers. In addition, Accounts Receivable and Accounts Payable Aging reports are prepared from the information in these records.

Accounts Receivable Subsidiary Ledger

The Accounts Receivable Subsidiary Ledger's purpose is to provide detail information about transactions that are summarized in the Accounts Receivable Control Account. Both the Sales and the Cash Receipts Journals provide information needed for maintaining our Accounts Receivable Subsidiary Ledger.

Here's that "special book" that we use in order to keep up with how much each of our individual customer's owes us.

This "book" contains a detailed record for each of your customers. What information do you think you might want to keep up with about each of your customers ? Let's make a list of some information that you would include.

- General Information

- Customer's Name and/or Account Number

- Phone Number

- Billing Address

- Shipping Address

- Contact Person

- Credit Limit

- Credit Terms

- Customer Financial Information

- Each Invoice Billed to The Customer

- Each Payment Received From The Customer

- Total Balance Owed By Customer

- Posting Reference-what journal the information was posted from

Normally all the information posted will come from the Sales and Cash Receipts Journals.

Accounts Receivable Aging Report

Since we grant payment terms to our customers, we need a way of tracking whether our customers are paying on time based on the credit terms we granted them. Our Accounts Receivable Subsidiary Ledger provides the information we need for preparing our Accounts Receivable Aging Report. An Accounts Receivable Aging Report, also known simply as an A/R report or aging A/R report, is used by many business owners who invoice their clients to keep track of what payments are due them from their customers. The main information an accounts receivable aging report shows is:

- What payments are owed to us

- When those payments are due, and

- From which customer

An A/R aging report will typically list customers on one side (either alphabetically or by size of debt, depending on how it’s filtered) with invoice amounts in 30-day columns going across to 90 days plus.

Note: When using a manual bookkeeping system, preparing an Aging Report becomes a tedious and time consuming process.

Accounts Payable Subsidiary Ledger

The Accounts Payable Subsidiary Ledger's purpose is to provide detail information about transactions that are summarized in the Accounts Payable Control Account. Both the Purchases and the Cash Disbursements Journals provide information needed for maintaining our Accounts Payable Subsidiary Ledger.

This "book" contains a detailed record for each of your suppliers. What information do you think you might want to keep up with about each of your suppliers ? Let's make a list of some information that you would include.

- General Information

- Supplier's Name and/or Account Number

- Phone Number

- Address

- Contact Person

- Credit Limit

- Credit Terms

- Supplier Financial Information

- Each Invoice Billed By The Supplier

- Each Payment (Check) Sent To The Supplier

- Total Balance Owed To Supplier

- Posting Reference-what journal the information was posted from

Normally all the information posted will come from the Purchases and Cash Disbursements Journals.

Accounts Payable Aging Report

Since our suppliers grant us payment terms, we need a way of tracking to determine if we are paying our suppliers when their invoices are due. Our Accounts Payable Subsidiary Ledger provides the information we need for preparing our Accounts Payable Aging Report. An Accounts Payable Aging Report, also known simply as an A/P report or aging A/P report, is used by many business owners to keep track of what payments are due to their suppliers. The main information an accounts payable aging report shows is:

- What payments are owed

- When those payments are due, and

- Owed to what supplier

An A/P aging report will typically list suppliers on one side (either alphabetically or by size of debt, depending on how it’s filtered) with invoice amounts in 30-day columns going across to 90 days plus.

Note: When using a manual bookkeeping system, preparing an Aging Report becomes a tedious and time consuming process.

The main purpose of this lesson was to illustrate that the starting point of monitoring and controlling Cash begins with good record keeping. Also to introduce those not familiar with Special Journals to what they are and what they look like. For those of you that have taken my So, you want to learn Bookkeeping - Special Journals Tutorial, it served as a quick review.

What's next ?

Petty Cash