Purchases & Payments

Cash Forecasts > Developing Your Forecast

Analyze Purchases Credit Terms and Payment Patterns

If your business buys a significant portion of its products or services on credit, you should do a historical analysis of your accounts payable credit terms and payments.

Estimating your Cash Payments for Purchases and Inventory for your Cash Forecast involves using the Estimated Purchases based on the sales in your sales forecast and your analysis of payment patterns to determine when the Cash will probably be paid out for these purchases. In other words, you need to perform an analysis to determine how long it is after you buy the goods and/or services until you actually have to pay for them.

This analysis is similar to the analysis that you perform for your collections of your sales. Instead of calculating your collections history you now calculate your payments history.

Using your purchases and accounts payable collection patterns based on your historical analysis from the past to your purchases estimate is the best way to predict your cash payments needed for your purchases.

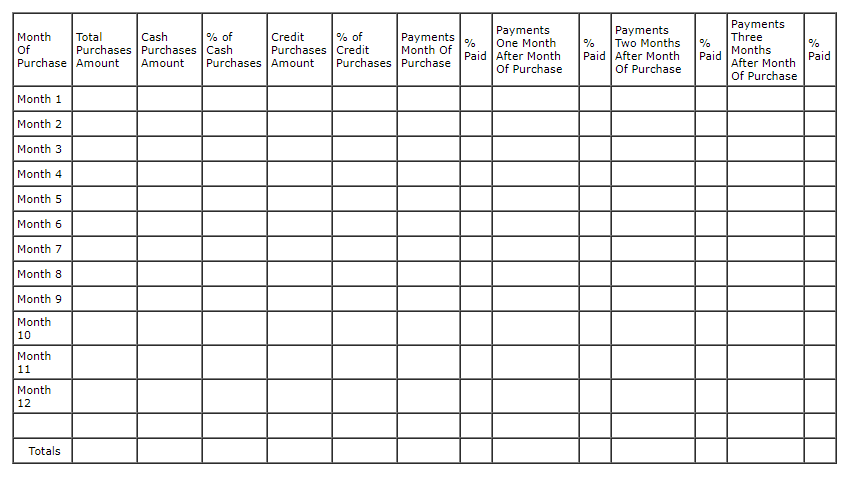

Blank Sample Purchases Payment Analysis Worksheet

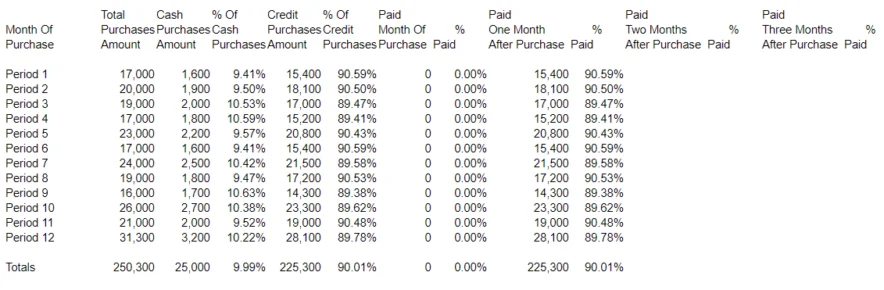

Let's use an illustration to help us understand exactly what this analysis is telling us.

Suppose your business made 10,000 of purchase in a month. After reviewing your detail records, $2,000 of these were "cash" purchases (paid for at the time of purchase) and $8,000 were made on credit (suppliers allowed you to pay later). In addition our analysis found that of the $8,000 of purchases on credit that $6,000 of these credit purchases were paid in the following month and $2,000 was paid two months after the purchase.

For this particular purchases period, we now know that 20% ( $2,000 / $10,000) of our purchases were "cash" purchases and paid in the month of purchase, 60% ( $6,000 / $10,000 ) were paid in the following month ( one month after the purchase), and 20 % ( $2,000 / $10,000) were paid two months after the purchase. When you apply this method to 12 months of actual purchases activity, you will have an excellent indicator of when you have to pay (cash outflow) for the products that you purchase from your suppliers.

If the results are roughly the same for each of the 12 periods that you analyzed and calculated, you can use an average percentage calculated for the entire years worth of purchases. If your payment patterns vary with the time of year, you may want to use monthly data rather than averages.

Sample Filled In Purchases Payment Analysis Worksheet

What major factor do you think might affect the time that it takes to pay for your purchases ? Similar to sales, the credit terms that your suppliers grant to your business affect when you'll have to pay for your purchases. Again, common sense tells you that the longer the period of time that your supplier allows you to pay, the longer you will be able to hold on to your cash without having to part with it.

In conjunction with your analysis of the future expenditures you should use an Accounts Payable Aging Report to schedule these prior year amounts that need to be paid in your future periods.

An accounts payable aging schedule is a report that lists all of the amounts that you owe to your suppliers and groups the unpaid invoices that make up the total into categories to indicate if any are late.

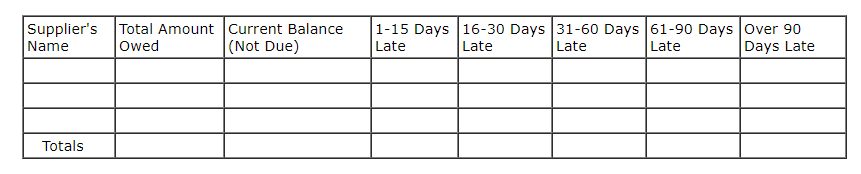

Blank Sample Accounts Payable Aging Report

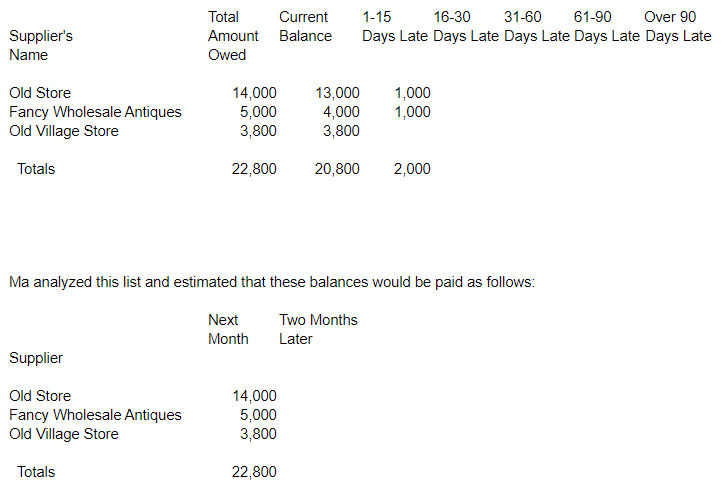

Sample Accounts Payable Aging Report

You use this Aging Report as a tool for estimating when you expect to pay these accounts.

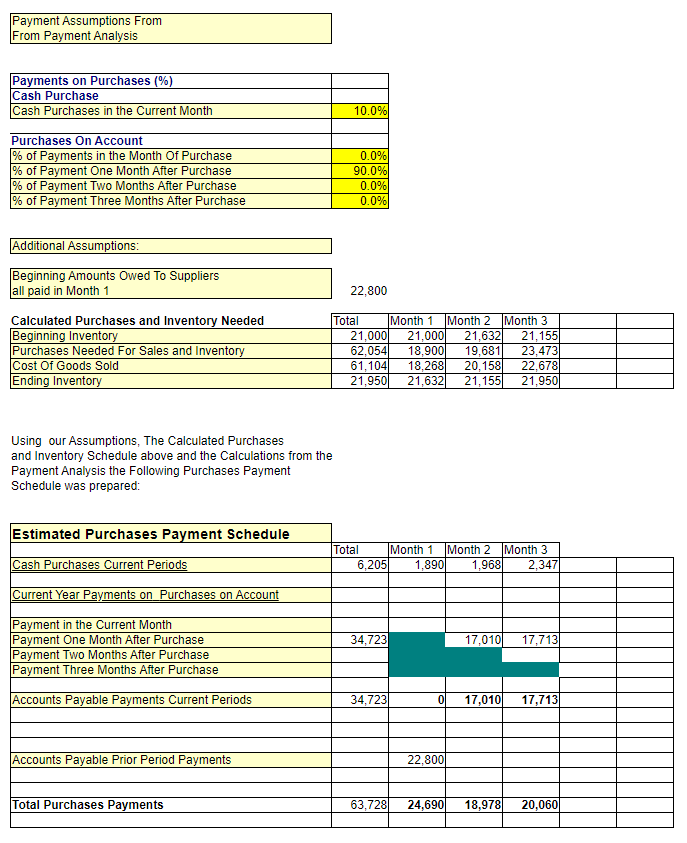

Prepare Estimated Accounts Payable and Purchases Payments Schedule

After completing your Purchases Credit Terms and Payment Patterns Analysis and reviewing your Accounts Payable Aging Report you should now have the information needed to prepare your Estimated Accounts Payable and Purchases Payments By Period Schedule.

All your doing here is using your Estimated Purchases along with your collection analysis to estimate in what periods you'll actually have to spend your cash resulting from these purchases.

What do you think an Estimated Accounts Payable and Purchases Payments Schedule might look like ?

Sample Accounts Payable and Purchases Payments Schedule

What's next ?

Costs and Expenses