Average-Decreasing

Costing Methods

Average Calculations Using the Perpetual and Periodic Inventory System

Decreasing Prices

We're now going to see the effect of decreasing prices using the Perpetual and Periodic Inventory Methods with Average Costing.

Average Costing

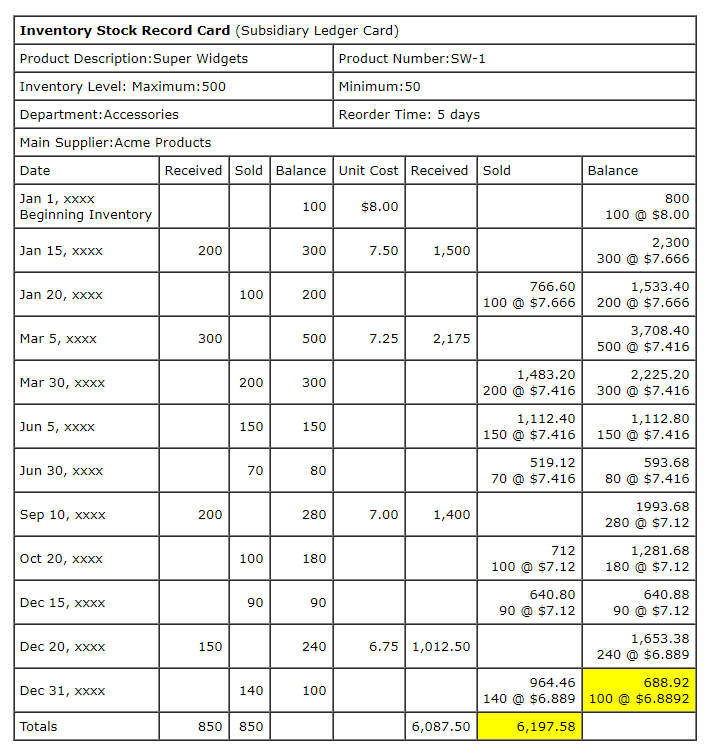

Moving Average with the Perpetual Inventory Method

Our Schedule of Purchases and Beginning Inventory

- Beginning Inventory is made up of 100 units with a cost per unit of $8.00 for a total cost assigned of $800.00.

- Purchases of Super Widget made during the year are as follows:

January 15, xxxx 200 $7.50 1,500 A-976123 Acme Products

March 5, xxxx 300 $7.25 2,175 7898000 Alternate Products

September 10, xxxx 200 $7.00 1,400 A-999999 Acme Products

December 20, xxxx 150 $6.75 1,012.50 B-789012 Acme Products

Total Purchases 850 6,087.50

Our Stock Record Card (Subsidiary Ledger Card) for Super Widgets assuming an Average Cost Flow appears below:

Weighted Average with the Periodic System

Our Schedule of Purchases and Beginning Inventory

- Beginning Inventory is made up of 100 units with a cost per unit of $8.00 for a total cost assigned of $800.00.

- Purchases of Super Widget made during the year are as follows:

January 15, xxxx 200 $7.50 1,500 A-976123 Acme Products

March 5, xxxx 300 $7.25 2,175 7898000 Alternate Products

September 10, xxxx 200 $7.00 1,400 A-999999 Acme Products

December 20, xxxx 150 $6.75 1,012.50 B-789012 Acme Products

Total Purchases 850 6,087.50

Purchased Dollars Purchased Units

Using the data from our Schedule, the calculation of the cost used to assign cost to our Ending Inventory and our Cost of Goods Sold is straight forward.

Beginning Inventory $800.00 100

Purchases $6,087.50 850

Total Cost and Units To Account For $6,887.50 950

Calculation of weighted Average Cost:

Weighted Average Cost Per Unit = Total Costs To Account For / Total Units To Account For

Weighted Average Cost Per Unit = $6,887.50 / 950

Weighted Average Cost Per Unit = $7.25

Weighted Average Cost Per Unit = Total Costs To Account For / Total Units To Account For

Weighted Average Cost Per Unit = $6,887.50 / 950

Weighted Average Cost Per Unit = $7.25

Cost Assigned To Ending Inventory:

Cost Assigned To Ending Inventory = Units On Hand x Weighted Average Cost Per Unit

Cost Assigned To Ending Inventory = 100 x $7.25

Cost Assigned To Ending Inventory = $725.00

Cost Assigned To Ending Inventory = Units On Hand x Weighted Average Cost Per Unit

Cost Assigned To Ending Inventory = 100 x $7.25

Cost Assigned To Ending Inventory = $725.00

What about the cost assigned to Cost Of Goods Sold ?

Cost Of Goods Sold Calculation:

Total Dollars To Account For $6,887.50Less: Costs Assigned To Ending Inventory 725.00

Costs Assigned To Cost Of Goods Sold $6,162.50

What's Next ?

Specific Identification Costing Method