Final Review

Final Review

Glad to see you made it to the final lesson ! Hope your journey hasn't caused you any nightmares or hair pulling. As in all my tutorials, this last lesson will attempt to summarize and provide a quick review of what we've discussed and hopefully now know about inventories.

What Did We Cover ?

The Introduction provided an overview of inventories and their importance, and the special journals and records used to record and control this key asset.

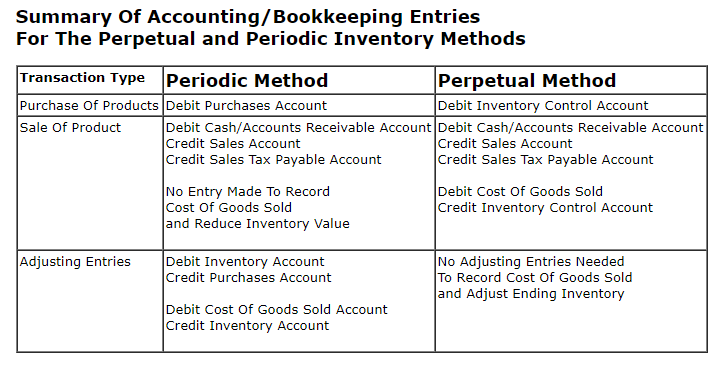

Lesson 1 Inventory Methods discussed the periodic and perpetual methods for accounting for merchandise inventory and how inventory transactions are recorded using each method.

Lesson 2 Costing Methods explained the different methods that are used to determine and assign costs to inventory quantities on hand and sold.

Lesson 3 Estimating Inventories discussed the methods used to estimate the value (cost) of merchandise inventory when no physical count has been taken or few detailed records are available.

Lesson 4 Lower Of Cost Or Market explained why this special rule is used for valuing inventory and how to apply it.

Lesson 5 Accounting for Inventory discussed and reviewed the accounts, subsidiary ledgers, records, and special journals used to record inventory transactions using the perpetual and periodic inventory methods.

What You Should Know

Businesses that have Inventories are faced with two basic decisions concerning Inventories:

(1) Choice Of Inventory Method

- Perpetual Inventory System-Method for keeping up with products and calculating the cost of products that were sold in a period. Up-to-date inventory records are continually maintained at all times. A detailed record (subsidiary ledger record) is maintained for each product that keeps up with the quantities and cost of each purchase and the quantities and cost associated with each sale. An actual count is usually done at the end of the year in order to check the accuracy and correct any errors in the detailed records.

The perpetual inventory method records the effect on inventory and cost of goods sold of each purchase and sale at the time the goods are bought or sold. There is no need for any closing or adjusting entries at the end of the period except to account for goods that are stolen, damaged, or not available due to other reasons.

- Periodic Inventory System-Simple method for keeping up with products and calculating the cost of products that were sold in a period. An actual count is periodically performed in order to determine the value of the inventory.

The periodic method does not maintain a running total of the current actual balances for Inventory and Cost Of Goods Sold. The effects of purchases and sales on Inventory and on Cost of Goods sold are determined at the end of each period when a physical inventory is taken. Adjusting and closing entries are required to adjust the Inventory and Cost Of Goods Sold amounts.

- Retail Inventory Method-Aggregate method used to estimate the cost assigned to our ending inventory. The method requires maintaining some detailed records. Records are maintained for purchases and inventories at both cost and retail prices. In other words, the cost of the beginning inventories and purchases are maintained as well as the retail value (sales prices) of the beginning inventories and purchases.

- Gross Profit Method-Aggregate method used to estimate the cost assigned to our ending inventory.

The main difference between the Gross Profit Method and the Retail Inventory Method is the data that is used to calculate the cost percentage used to convert sales at selling prices to sales at cost. The retail inventory method uses a cost percentage, called the cost-to-retail ratio , which is based on a current relationship between cost and selling price. The gross profit method relies on past data to estimate the current cost-to-retail-ratio (percentage).

- Combination of Methods-Perpetual for high dollar items and the Periodic or another method for lower dollar items.

Considerations in Choosing an Inventory Method

Perpetual

- More overall control.

- Cost of sales and inventory amounts are readily available for preparing interim (monthly) financial statements.

- Used more frequently now due to computers, software, and scanning equipment.

- More record keeping required.

- Provides up to date detailed information about what was sold, to whom, at what price and cost, what was purchased at what cost and from whom, and quantities and costs currently on hand.

- At least an annual physical count is still necessary.

- Requires a choice of Costing Method(s).

Note: All the methods (periodic, perpetual, or retail) methods require a decision regarding the Costing Method(s) to use. - Entry is made to reduce the Merchandise Inventory and record the cost of the items sold at the time of sale.

Purchases are recorded directly to the Merchandise Inventory Account.

Periodic

- Less overall control.

- Less record keeping required.

- No detail records are continually available for determining what was purchased , at what cost, and from whom or what was sold, to whom, at what price and cost or quantities and costs currently on hand.

- Cost of sales and inventory amounts are not readily available for preparing interim (monthly) financial statements-amounts are only available after counting and pricing the inventory.

- Requires a choice of a Costing Method(s).

- No entry is made to record the decrease in inventory or the cost of the items sold at the time of the sale.

Purchase are recorded in a special Purchases Account at the time of purchase. - At least an annual physical count is necessary.

Retail Inventory Method

- Less overall control.

- Less record keeping required.

- Detailed sales (price) records that allow a comparison of cost and retail amounts must be maintained.

- No detail records are continually available for determining what was purchased , at what cost, and from whom or what was sold, to whom, at what price and cost or quantities and costs currently on hand.

- Cost of sales and inventory amounts are not immediately available for preparing interim financial statements-amounts are only available after performing an analysis and preparing computations of the relationship between cost and selling prices in order to estimate the ending inventory value.

- Requires a choice of a Costing Method(s).

- No entry is made to record the decrease in inventory or the cost of the items sold at the time of the sale.

Purchases are recorded in a Special Purchases Account at the time of purchase. . - An annual physical count is required.

Don't be fooled - the periodic method is often presented as a simple method for small businesses to use for maintaining their inventory. Performing the actual physical count presents no problem. Determining the cost to assign to the individual items due to the fact that no detail records are maintained during the year is where a significant amount of time has to be spent analyzing supplier invoices in order to arrive at the proper unit costs used to assign costs to the inventory. Using the Retail Method does alleviate some, but not all, of the requirements for keeping detail inventory records.

The choices are up to you. I stated in an earlier lesson that with the cost of computers and bookkeeping software so reasonable, I lean toward using the Perpetual Inventory Method. Why ? The main reasons are control, information is readily available for prompt preparation of interim (monthly) financial statements, and additional valuable and useful business information about customers and products is easily accessible.

(2) Choice Of Costing Method (Flow)

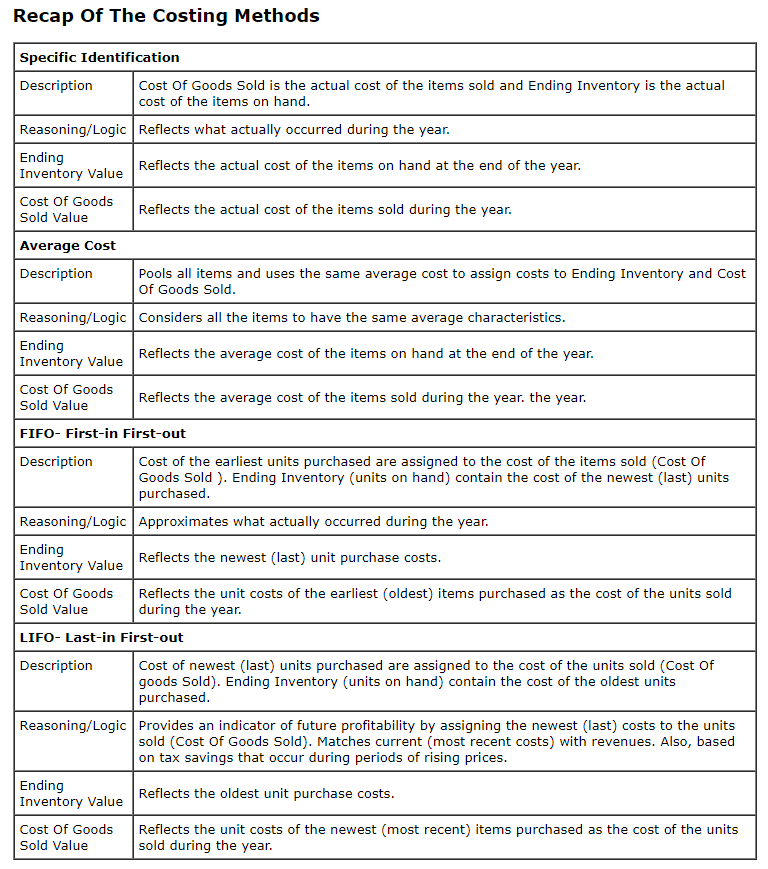

- Specific Identification

If we could, the best matching of our revenue and costs would be accomplished by determining the specific cost of the item that was sold or that we still had on hand. For some high dollar and uniquely identifiable items this can easily be accomplished. Can you think of a few product examples. How about automobiles, boats, and custom jewelry to name a few. These item usually have a unique product ID (identification number) assigned to them. In the case of automobiles, all vehicles have a unique serial number.

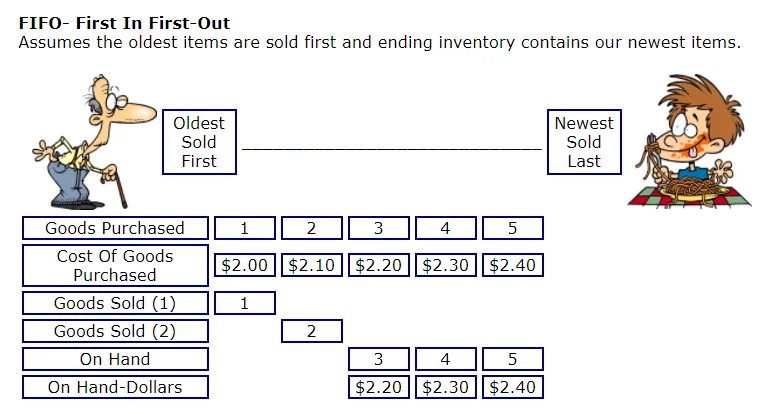

- FIFO is an abbreviation for the first-in, first-out method of assigning costs to ending inventory and the cost of items sold. The FIFO inventory method assumes that costs are matched with revenue in the order in which they are incurred. In others words, the first goods purchased (oldest) are the first goods sold. The effect of this method is that the most recent costs incurred remain in the Ending Inventory while the first (oldest) costs are used to assign costs to the goods that are sold. Costs assigned to our beginning of the year inventory (earliest purchases) are assigned to goods sold first and then cost associated with the first (oldest) purchases during the year (period) are use to assign costs to the goods sold. Using this method with either the Perpetual or Periodic System will produce the same results.

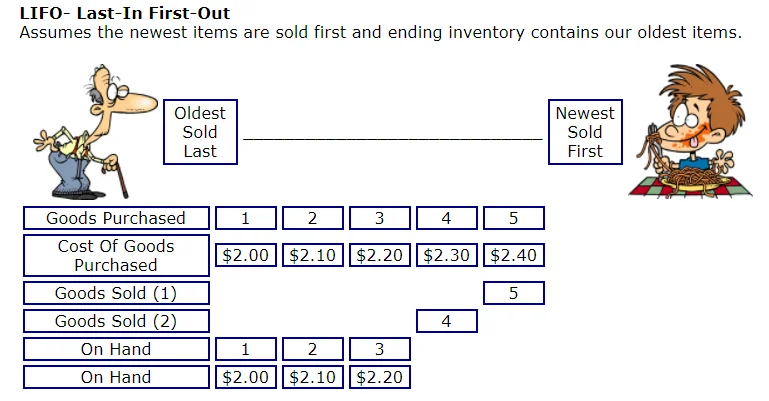

- LIFO is an abbreviation for the last-in, first-out method of assigning costs to ending inventory and the cost of items sold. The LIFO method assumes that the last items purchased (newest) are the first items sold. The effect of this method is that the oldest goods purchased (earliest) and their assigned costs make up the Ending Inventory while the most recent goods purchased and their unit costs are used to assign costs to the cost of units sold.

- Average Cost (no strange abbreviation here) makes no effort to identify the actual flow of cost in and out of the business. Instead costs and quantities are "pooled" and an average is calculated that is used to determine the amount assigned to inventory and the cost of the items sold. All items in Merchandise Inventory at any time are assumed to have the same unit average cost. This method assumes that the same cost per unit (average cost) is assigned to items on hand and remaining in inventory as to items that were sold.

The IRS sometimes questions the use of the average method.

- Combination of Methods-Specific Identification for high dollar items and another method for lower dollar items.

Considerations in Choosing a Costing Method (FIFO, LIFO, Average, Specific Identification)

- Type of business

- Actual flow of goods

- Tax considerations

- Methods used in the industry

Comparison Of Costing Methods

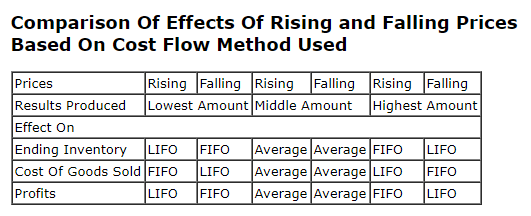

During periods of rising prices, the LIFO Costing Method produces the lowest Ending Inventory Value thus resulting in the lowest reported profits. Since income taxes are based on profits, this is one of the reasons why the method is often used because the amount a business has to pay for income taxes will be less.

During periods of falling or declining prices, the FIFO Costing Method produces the lowest Ending Inventory Value thus resulting in the lowest reported profits.

The average costing method always produces results in the middle whether prices are increasing or declining.

Costing Products In A Nutshell

Calculating and determining costs assigned to Ending Inventory and Cost Of Units Sold is really just a matter of applying some good ole logic and common sense.

It's basically just involves four steps. I know, in an earlier lesson I said three steps, but that was prior to our discussion of the lower of cost or market rule.

1. Select a Method(s) Of Accounting for Inventory.

- Periodic

- Perpetual

- Retail

2. Determine the Total Product Costs and Total Units To Account For.

3. Assign Costs To Ending Inventory and Cost Of Goods Sold based on a consistent method of valuing inventory (Costing Method).

3. Assign Costs To Ending Inventory and Cost Of Goods Sold based on a consistent method of valuing inventory (Costing Method).

- Specific Identification

- FIFO -First-in First-out

- LIFO -Last-in First-out

- Average Cost

4. Apply the Lower Of Cost Or Market Rule.

Observations and Comments:

- Different inventory costing methods produce different results-care should be exercised when making comparisons with other similar companies or industry ratios in order to be sure you're not making the proverbial comparison of "apples to oranges".

- Inventory policies and methods are an integral part of your financial statements and adequate disclosures must be made. Why ? They help us to determine if we might be comparing "apples to oranges" and allow us to adjust and compensate for the differences.

- More than one Inventory and Costing Method can be used to value different segments or products making up your inventory. Once chosen, it must normally be applied (used) on a consistent basis (not changed) in all future periods.

- The methods and records used for recording your daily inventory related transactions such as purchases and sales vary depending on the Inventory Method chosen.

- In a nutshell, all we need to do is select and properly use our inventory and costing method(s), and apply the lower of cost or market rule to properly value our ending inventories.

- Our inventory examples and discussions should alert you to the fact that all aspects of accounting/bookkeeping are not 100% precise. In other words, we have a range of acceptable amounts as demonstrated by our use of different costing methods that produce acceptable but differing amounts.

- Use of the LIFO Costing Method requires IRS approval. In addition, special calculations and index computations are often necessary.

- The Average Cost Method used with the Retail Method and the Lower Of Cost or Market Rule is a common method and is often referred to as the Conventional Retail Method. The method produces results that approximate the lower of average cost or market.

- We've all heard the saying "we can't see the forest because of the trees". Getting out from under the trees (detail) and viewing the forest (overall picture), when applied to inventory, only involves determining how much you had available to sell during a given period (beginning inventory + purchases) and dividing this total amount between how much you have left (on hand) and how much went "out the door" (was sold).

Bookkeeping Entries

These entries are recorded in the Purchases and Sales Special Journals and posted to the General Ledger Accounts. The General Journal records the adjusting entry needed when using the Periodic Inventory System.

Congratulations, we're done ! Hopefully your introduction into the world of Merchandise Inventory has provided you with a good foundation for you to build on. At the very least, you should now be familiar with some terminology and the decisions that businesses face regarding inventory. Some areas are somewhat complex, but most are actually quite simple once you're familiar with the rules.

What's Next ?

Final Review Video