Specific Identification

Costing Methods

Specific Identification costs are calculated from the actual cost of the item obtained from your inventory or purchasing records.

I saved the discussion and example calculations for the specific identification method to last because the logic behind the method is obvious. The actual cost of the item sold or on hand is the cost used to assign cost to Cost Of Goods Sold and Ending Inventory.

In order to be able to use this method we have to be able to identify the actual unit sold or on hand and the actual cost of the unit. In our example, even though the mowers look alike, we are going to use serial numbers to identify each unit.

Periodic Inventory Method uses the actual cost to assign costs to the ending inventory value when a physical inventory is taken.

Perpetual Inventory Method uses the actual cost to assign cost to the Cost Of Goods Sold ( cost of the units sold) and for updating the remaining balance of the inventory still on hand at the time the product is sold.

Our example assumes that we are in the Home and Garden Business. We use the Specific Identification Method for costing our high dollar Super Grasser Lawn Mowers.

Inventory, Sales, and Purchasing Information For The Year

- We had no units of Super Grasser Mowers on hand at the beginning of our year. In other words, we had no Beginning Inventory.

- Sales and Purchases of Super Grasser Mowers made during the year are as follows:

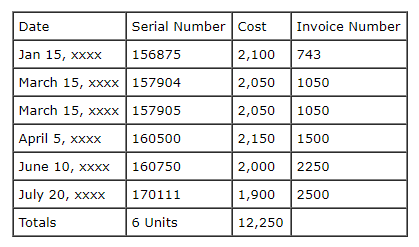

Purchases made during the year from our supplier Big Time Mowers are as follows:

Note:Purchase unit costs varied during the year due to various incentives offered by our suppler.

Note:Purchase unit costs varied during the year due to various incentives offered by our suppler.

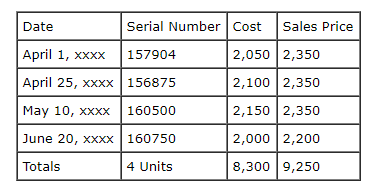

Sales made during the year (suggested List Price $2,350) to our customers are as follows:

Specific Identification with the Perpetual Inventory Method

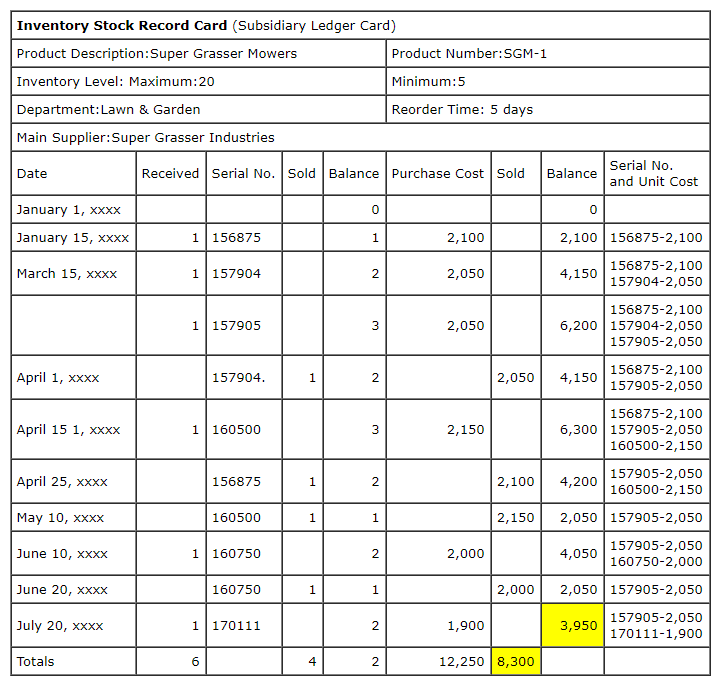

Our Stock Record Card (Subsidiary Ledger Card) for Super Widgets assuming the Specific Identification Cost Flow appears below:

Notice that we used serial numbers in order to be able to identify each mower and treat it as unique. Each new purchase was assigned a serial number(s) and each mower sold was identified by it's serial number. The cost assigned to the goods sold is the actual cost of the specific mower sold and the mowers remaining on hand are each valued at their actual cost.

Of course the yellow highlighted balances represent our Cost Of Goods Sold and Ending Inventory amounts at the end of our period.

Specific Identification with the Periodic Inventory Method

Beginning Inventory $00 0

Purchases $12,2506 6

Total Cost and Units To Account For $12,2506 6

Costs Assigned to Ending Inventory

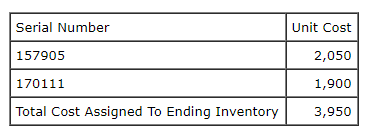

Per physical count of our remaining mowers we determine that we have two (2) unsold mowers at the end of year as follows:

Costs Assigned to Cost Of Goods Sold

Cost Of Goods Sold Calculation:

Less: Costs Assigned To Ending Inventory 3,950

Costs Assigned To Cost Of Goods Sold $8,300

Did you notice that the cost assigned to Cost Of Goods Sold and Ending Inventory are the same whether a Periodic or Perpetual Method was used for calculating the costs ?

Observation: In our example, we purchased the same mower at different unit costs during the year. Since all the units are the same, we could have "manipulated" are profit somewhat based on what mower (serial number) we selected to sell from those we had on hand at the time of the sale. Normally, dealers would choose the oldest model to sell because of floor plan (credit granted dealers by supplier) interest requirements. Interest is normally charged by the supplier to the dealer after they have had the item for a certain period of time.

What's Next ?

Costing Methods Comparison