Costing Methods

Costing Methods

Just like our cartoon fellow with the ice cream cone with many different flavors, there are different costing methods that you may choose to value your inventory.

Costing Methods

Both the Perpetual and Periodic Inventory Methods require you to calculate and assign (attach) cost to the Ending Inventory. Knowing the quantities on hand is only half the battle. If the purchases of items were always made at the same cost (which is not the real world case) our job would be simple. Use this cost and multiply by the quantity on hand and you'd have the cost assigned to the item.

Since this is not normally the case, purchases are more often made at various prices, we have to determine what costs are assigned to our units (quantity) on hand (ending inventory), and what cost are assigned to our units (quantity) of items sold. So our problem becomes what cost do I use to value my inventory when my business has made purchases of the same item at different costs.

Let's revisit an earlier example.

Example

Product: Super Widget

Purchases:

Quantity Unit CostProduct: Super Widget

Purchases:

100 $10.00

300 $9.00

200 $11.00

Do I use $10.00, $9.00, $11.00 ,an average or what to assign cost to my cost of goods sold and/or ending inventory ? I told you we would revisit this question.

I know, you're probably wondering what the heck is a widget. I did too when I was taking my introductory accounting courses in college. A widget is just a term used to mean any type of product imaginable. So many times, instead of using a specific product such as toy dolls, lawn mowers, etc. in examples, we just refer to our product as widgets.

Costing Products In A Nutshell

Calculating and determining costs assigned to Ending Inventory and Cost Of Units Sold is really just a matter of applying some good ole logic and common sense.

It's basically just involves three steps.

- Select a Method(s) Of Accounting for Inventory.

- Periodic

- Perpetual

- Determine the Total Product Costs and Total Units To Account For.

- Assign Costs To Ending Inventory and Cost Of Goods Sold based on a consistent method of valuing inventory (Costing Method).

- Specific Identification

- FIFO -First-in First-out

- LIFO -Last-in First-out

- Average Cost

If the Periodic Method is used a Physical Count of the Items is Required.

Class dismissed ! Just kidding, although that's all that really needs to be done, but I realize that we still need to learn how to do it. We discussed the Periodic and Perpetual Inventory Methods earlier. This Lesson will concentrate on the methods of costing and hopefully enlighten you as to what the methods are and how to use them.

We'll first discuss the different methods and their calculations and later provide some examples that will illustrate how to actually perform the calculations necessary for using the different Inventory Costing Methods.

Costing Methods Described (Cost Flows)

Specific Identification

If we could, the best matching of our revenue and costs would be accomplished by determining the specific cost of the item that was sold or that we still had on hand. For some high dollar and uniquely identifiable items this can easily be accomplished. Can you think of a few product examples. How about automobiles, boats, and custom jewelry to name a few. These item usually have a unique product ID (identification number) assigned to them. In the case of automobiles, all vehicles have a unique serial number.

If we could, the best matching of our revenue and costs would be accomplished by determining the specific cost of the item that was sold or that we still had on hand. For some high dollar and uniquely identifiable items this can easily be accomplished. Can you think of a few product examples. How about automobiles, boats, and custom jewelry to name a few. These item usually have a unique product ID (identification number) assigned to them. In the case of automobiles, all vehicles have a unique serial number.

What about items that are exactly the same ? This makes identifying which items were sold and which are still on hand difficult. If we bought them at different times and at different prices how can we easily determine which units were sold or on hand ? Not by looking at them - they all look exactly the same.

Due the fact that in most cases its hard to determine what specific item was sold, we rely on some assumptions, when it's not feasible to use Specific Identification, for determining which items were sold and which are still on hand. These assumptions are referred to as Cost Flows or Costing Methods.

The following Cost Flows or Methods , FIFO, LIFO, and Average Cost are used in practice to assign costs to ending inventories and cost of items sold. What do we mean by flow ? The flow refers to the flow of the cost of inventory items into the business when items are purchased and the flow of the cost of inventory items out of the business when items are sold. What the heck do those strange abbreviations mean ?

FIFO is an abbreviation for the first-in, first-out method of assigning costs to ending inventory and the cost of items sold. The FIFO inventory method assumes that costs are matched with revenue in the order in which they are incurred. In others words, the first goods purchased are the first goods sold. The effect of this method is that the most recent costs incurred remain in the Ending Inventory while the first (oldest) costs are used to assign costs to the goods that are sold. Costs assigned to our beginning of the year inventory (earliest purchases) are assigned to goods sold first and then cost associated with the first (oldest) purchases during the year (period) are use to assign costs to the goods sold. Using this method with either the Perpetual or Periodic System will produce the same results.

The FIFO cost flow assumption actually closely matches the actual cost flow in and out of many types of businesses. Many businesses try to sell their oldest goods first. Grocery stores (if the oldest goods are not sold first many of their products will perish) and clothing goods stores are just a couple of examples. Selling the oldest products first also helps reduce the loss from products losing value due to obsolescence.

LIFO is an abbreviation for the last-in, first-out method of assigning costs to ending inventory and the cost of items sold. The LIFO method assumes that the last items purchased are the first items sold. The effect of this method is that the oldest goods purchased (earliest) and their assigned costs make up the Ending Inventory while the most recent goods purchased and their unit costs are used to assign costs to the cost of units sold.

In reality, there are not many instances where the actual flow of goods into and out of a business adhere to the last-in first-out cost flow assumption. The use of the LIFO costing method is influenced by the tax savings resulting during periods of rising prices. Due to using the newest unit costs, which when prices are rising, are higher the costs assigned to the costs of the units sold (Cost Of Goods Sold) are higher which results in a lower reported profit. Since income taxes are calculated based on profits, a lower profit results in less taxes being paid.

IRS Rules Relating to the LIFO Method

Any taxpayer may elect the LIFO method for assigning cost to any or all of his inventory items.

Once elected, the LIFO method must continue to be used in future periods unless a change of method is applied for and granted by the IRS.

Form 970, Application To Use LIFO Inventory Method must be submitted with your timely filed tax return for the year that you adopt LIFO as your inventory method.

A taxpayer must adhere to two restrictions for the portions of its inventory valued using the LIFO method.

Any taxpayer may elect the LIFO method for assigning cost to any or all of his inventory items.

Once elected, the LIFO method must continue to be used in future periods unless a change of method is applied for and granted by the IRS.

Form 970, Application To Use LIFO Inventory Method must be submitted with your timely filed tax return for the year that you adopt LIFO as your inventory method.

A taxpayer must adhere to two restrictions for the portions of its inventory valued using the LIFO method.

- The inventory is to be valued at cost regardless of market value.

- The general rule is that the taxpayer may not use a different method in determining financial results for external reports. If LIFO is used for tax purposes, it must also be used for financial reporting purposes. Specific exceptions to this general rule exist to allow for reporting additional financial information using assumptions other than strictly LIFO.

Average Cost (no strange abbreviation here) makes no effort to identify the actual flow of cost in and out of the business. Instead costs and quantities are "pooled" and an average is calculated that is used to determine the amount assigned to inventory and the cost of the items sold. All items in Merchandise Inventory at any time are assumed to have the same unit average cost. This method assumes that the same cost per unit (average cost) is assigned to items on hand and remaining in inventory as to items that were sold. IRS approval may be necessary.

Quick Overview of Cost Methods (Flow Assumptions) and Calculations

This section provides a quick overview and explanations of the costing methods and how they're used with the different inventory methods. In order to introduce the calculations, only the FIFO and LIFO costing methods used with the Periodic Inventory Method are illustrated with examples. Don't get excited, later sections provide ample examples of using all the costing methods with the Perpetual and Periodic Inventory Methods.

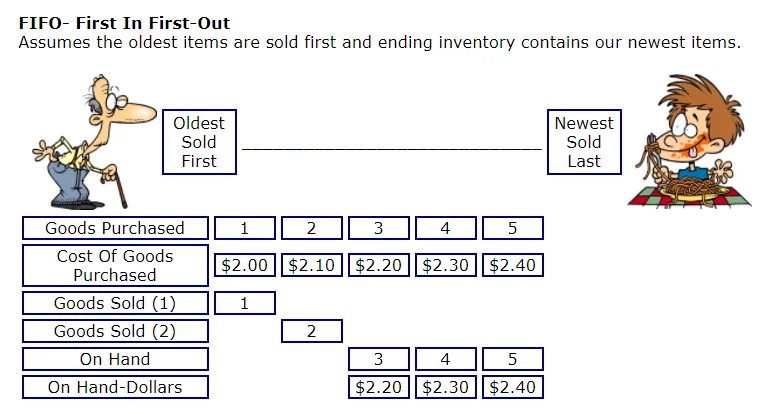

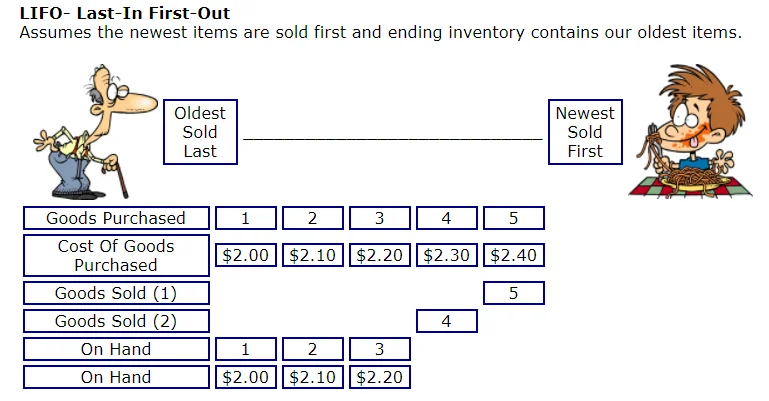

Often a picture or diagram helps to illustrate a principle or concept. Below is a diagram that illustrates the difference between the FIFO and LIFO Cost Flow Assumptions.

Our Assumptions:

- Each Purchase and Sale represents One (1) Unit. In other words, we purchased a total of 5 units of our product and sold two which if my math is correct leaves us with 3 units On Hand.

- The blocks numbered 1-5 represent our first, second, third, fourth, and fifth purchase respectively.

- The First Row Goods Purchased represents five purchases made the oldest (first) represented by the number 1 and the newest (last) being represented by the number 5.

- The Second Row, Cost Of Goods Purchased, represents the unit cost of each Purchase.

- The Third and Fourth Rows, Goods Sold, represent the first sale, Sale Number 1 -Goods Sold (1), and the second sale, Sale Number 2 -Goods Sold (2).

- The Fifth Row represents the Purchases that are still assumed to be On Hand and in our Ending Inventory.

- The Last Row represents the Cost of Purchases that are still assumed to be On Hand and in our Ending Inventory.

Let's calculate the cost assigned to our Ending Inventory of 3 Units using the FIFO Cost Flow Assumption.

Using the FIFO Cost Flow Assumption, the earliest (oldest or first) purchases are sold first and the newest (last) remain on hand and in our Ending Inventory.

Then our first sale is Purchase- 1 and our second sale is Purchase- 2.

Since we now have 3 Units On Hand (Ending Inventory), we need to work backward from our newest (last) purchases in order to calculate our Ending Inventory Value.

Our Ending Inventory is Calculated as follows:

Purchase 5 $2.40Purchase 4 $2.30

Purchase 3 $2.20

Total $6.90

We started with our most recent purchase (newest), Purchase 5, and worked backward to Purchase 4 and then to Purchase 3 in order to arrive at our Ending Inventory Value.

Now let's calculate the cost assigned to our Ending Inventory of 3 Units using the LIFO Cost Flow Assumption.

Using the LIFO Cost Flow Assumption, the newest (last) purchases are sold first and the earliest (oldest or first) remain on hand and in our Ending Inventory.

Then our first sale is Purchase- 5 and our second sale is Purchase- 4.

Since we have 3 Units On Hand (Ending Inventory), we need to work forward from our earliest (oldest or first) purchases in order to calculate our Ending Inventory Value.

Our Ending Inventory is Calculated as follows:

Purchase 1 $2.00Purchase 2 $2.10

Purchase 3 $2.20

Total $6.30

We started with our oldest purchase, Purchase 1, and worked forward to Purchase 2 and then to Purchase 3 in order to arrive at our Ending Inventory Value.

What's Next ?

FIFO- Periodic