Retail Inventory Method

Estimating Inventories

Retail Inventory Method

The retail inventory method is an aggregate method used to estimate the cost assigned to our ending inventory. The method requires maintaining some detailed records. Records are maintained for purchases and inventories at both cost and retail prices. In other words, the cost of the beginning inventories and purchases are maintained as well as the retail value (sales prices) of the beginning inventories and purchases.

In addition a physical inventory is taken and priced at retail.

Let's prepare a simple table to illustrate the cost and retail data maintained.

We obtained the following information from our detailed records.

Beginning Inventory 10,000 15,000

Purchases 100,000 150,000

Sales 120,000

Why don't we have a cost amount in our table for Sales ? Easy answer. We don't know ! That amount along with our Ending Inventory Cost is what we're going to estimate using the Retail Method.

Step (1)

The Goods Available for Sale at Retail is calculated by adding the Beginning Inventory Retail Value and the Purchases Retail Value.

The Goods Available for Sale at Retail is calculated by adding the Beginning Inventory Retail Value and the Purchases Retail Value.

- Goods Available For Sale @ Retail = Beginning Inventory @ Retail + Purchases @ Retail

Calculation of Goods Available For Sale at Retail

Purchases-Retail 150,000

Goods Available For Sale-Retail 165,000

Step (2)

The Ending Inventory amount stated at Retail Dollars is determined by subtracting the Sales for the period from the Goods Available for Sale at Retail.

The Ending Inventory amount stated at Retail Dollars is determined by subtracting the Sales for the period from the Goods Available for Sale at Retail.

- Inventory @ Retail Dollars = Goods Available For Sale @ Retail - Sales

In our illustration, the calculations would be:

Sales obtained from our General Ledger for the period were $120,000.

Purchases-Retail 150,000

Goods Available For Sale-Retail 165,000

Less:

Sales 120,000

Sales 120,000

Ending Inventory-Retail 45,000

Step (3)

The Cost Of The Goods Available For Sale at Cost is calculated by adding The Beginning Inventory at Cost and the Purchases at Cost.

The Cost Of The Goods Available For Sale at Cost is calculated by adding The Beginning Inventory at Cost and the Purchases at Cost.

- Cost Of Goods Available For Sale @ Cost = Beginning Inventory @ Cost + Purchases @ Cost

Calculation of Goods Available For Sale at Cost

Beginning Inventory-Cost 10,000Purchases-Cost 100,000

Goods Available For Sale-Cost 110,000

Step (4)

The cost percentage (cost-to-retail-ratio)is obtained by dividing the Goods Available for Sale at Cost by the Goods Available for Sale at Retail Prices.

The cost percentage (cost-to-retail-ratio)is obtained by dividing the Goods Available for Sale at Cost by the Goods Available for Sale at Retail Prices.

Cost Percentage (Cost-To-Retail-Ratio) Calculation:

Cost Percentage (Cost-To-Retail-Ratio) = Goods Available For Sale @ Cost / Goods Available For Sale @ Retail x 100

Cost Percentage (Cost-To-Retail-Ratio) = 110,000 / 165000 x 100

Cost Percentage (Cost-To-Retail-Ratio) = 66.67 %

Cost Decimal Equivalent = .6667

Cost Percentage (Cost-To-Retail-Ratio) = 110,000 / 165000 x 100

Cost Percentage (Cost-To-Retail-Ratio) = 66.67 %

Cost Decimal Equivalent = .6667

Final Step

Our final step is simply to multiply our Cost Percentage/Cost-To-Retail-Ratio (Decimal Equivalent) by our Ending Inventory- Retail Value

Estimated Cost Of Ending Inventory = $45,000 x .6667

Our final step is simply to multiply our Cost Percentage/Cost-To-Retail-Ratio (Decimal Equivalent) by our Ending Inventory- Retail Value

Estimated Cost Of Ending Inventory = $45,000 x .6667

Estimated Cost Of Ending Inventory = $30,002

What about our Cost Of Goods Sold amount ?

Now that we have an estimate for the cost of our Ending Inventory the calculation of our Cost Of Goods is simple arithmetic.

Purchases- Cost 100,000

Goods Available For Sale- Cost 110,000

Less:

Ending Inventory- Cost 30,002

Ending Inventory- Cost 30,002

Cost Of Goods Sold 79,998

So we had Sales of $120,000 with an estimated Cost of $79,998.

Just testing ya. What's our Gross Profit (Margin) and what estimated percentage Gross Profit did we make ?

- Gross Profit is $40,002 ($120,000 - 79,998)

- Estimated Gross Profit Percentage = 33.33 % ($40,002 / $120,000 x 100)

The steps used in calculating the estimated cost of the ending inventory using the Retail Inventory Method are normally combined into one schedule.

Beginning Inventory 10,000 15,000

Purchases 100,000 150,000

Goods Available For Sale 110,000 165,000

Percentage Of Cost To Retail 110,0000 / 165,000 x 100 =66.67% (.6667)

Less:Sales 120,000

Ending Inventory at Retail 45,000

Estimated Ending Inventory at Cost 30,002 (45,000 x .6667)

Estimated Cost Of Goods Sold 79,998

What major benefit did we receive from using the Retail Inventory Method ? If you recall, in our prior Lesson about Costing Methods, we had to determine the unit costs either from invoices, our perpetual records, or our detailed purchases records in order to assign cost to our ending inventory and cost of goods sold.

Using the Retail Inventory Method eliminated the need for determining unit costs and maintaining detailed product cost records. Before you start jumping up and down too much though, we have to maintain detailed sales and price (retail) records.

The reasoning behind the calculation is quite simple and is based on the following simple equation and the relationship between cost and retail values expressed by our Cost To Retail Ratio (percentage calculation).

The calculation assumes that the cost-to-retail-ratio computed from the goods available for sale is a representative average of the goods contained in the ending inventory. In reality, it's very unlikely that all the products in the ending inventory would have the same cost percentage. Actual goods in the ending inventory might have 70%, 65%, 75, etc. cost percentage. In other words, we're assuming that the mix of products contained in the ending inventory is the same as the mix calculated and represented by our cost-to-retail-ratio calculated from our goods available or sale.

(1) Retail Value of Beginning Inventory + (2) Retail Value of Purchases

= (Equals)

(3) Retail Value of Goods Sold (Sales) + (4) Retail Value of Ending Inventory

= (Equals)

(3) Retail Value of Goods Sold (Sales) + (4) Retail Value of Ending Inventory

In other words, the total of the goods we had On Hand during the year are either Sold or in our Ending Inventory.

Simple algebra allows us to calculate any of the values if we know three of the values.

Since our records provide us with the values for (1) Retail Value of Beginning Inventory, (2) Retail Value Of Purchases, and the (3) Retail Value Of Goods Sold (Sales), we can calculate our (4) Retail Value Of Our Ending Inventory by rearranging our equation as follows:

Retail Value Of Ending Inventory = Retail Value Of Beginning Inventory + Retail Value Of Purchases - Retail Value Of Goods Sold (Sales)

Since we use Cost to value our Ending Inventory all we need to do to convert the Ending Inventory Amount at Retail to Cost is to calculate our Cost-To-Retail Ratio and multiply it by the Ending Inventory Retail Value.

Ending Inventory At Cost = Ending Inventory At Retail x Cost-To-Retail Ratio

Since I like to keep things simple, the basics that are involved in using the Retail Inventory Method are summarized in the following three steps:

- Step 1 Calculate the Value Of The Ending Inventory At Retail

- Step 2 Calculate Cost-To-Retail Ratio (Percentage)

- Convert Ending Inventory At Retail To Cost by multiplying by the Cost-To-Retail Ratio (Percentage).

The main difference between the Gross Profit Method and the Retail Inventory Method is the data that is used to calculate the cost percentage used to convert sales at selling prices to sales at cost. The retail inventory method uses a cost percentage, called the cost-to-retail ratio , which is based on a current relationship between cost and selling price. The gross profit method relies on past data to estimate the current cost-to-retail-ratio (percentage).

What about those Cost Flow Assumptions we discussed earlier ,Average, FIFO, and LIFO ? Whether you were aware or not, we used the Average Cost Flow Assumption with the Retail Inventory Method in our prior example calculations.

The key to using the Retail Method is the calculation of the Cost-To-Sales-Ratio. The calculation is slightly different based on the cost flow assumption that is used with the Retail Inventory Method.

The FIFO Cost Flow assumes that the ending inventory is made up of the latest purchases. Due to this fact, our calculation of our Cost-To-Sales-Ratio normally excludes our Beginning Inventory Cost and Retail Amounts. Our calculation becomes Net Purchase Cost divided by Net Purchase Sales Value.

The LIFO Cost Flow assumes that the ending inventory is made up of the oldest purchases. We normally would calculate two (2) Cost-To-Sales-Ratios. One for the Beginning Inventory Amounts and the other for the Current Purchase Amounts.

I've made the examples up to now very basic in order to illustrate the basic calculations used with the Retail Inventory Method. The real life applications are just slightly more complex. In order to understand, the following examples we need to become familiar with some new terminology.

- Original or Normal Selling Price - price at which goods are normally sold.

- Markups are increases in price which raise our price above our original selling price.

- Markup Cancellations are decreases in price downward from our current selling price which is currently greater than our normal selling price back toward our original normal selling price but not below it.

- Net Markups are simply the difference between Markups and Markup Cancellations (Markups - Markup Cancellations).

- Markdowns are decreases in price which lower our current selling price below our original selling price.

- Markdown Cancellations are increases in price upward from our current selling price which is currently below our normal selling price back up toward our original selling price but not above it.

- Net Markdowns are simply the difference between Markdowns and Markdown Cancellations (Markdowns - Markdown Calculations).

Examples of usage of the terms:

- Original Selling Price of our Super Widgets is $15.00, normal price our customers pay.

- Increased Selling Price to $17.00 which represents a $2.00 markup ($17.00 - $15.00).

- Decreased Selling Price from $17.00 to $16.00 represents a $1.00 markup cancellation ($17.00 -$16.00).

- Decreased Selling Price from $16.00 to $14.50 represents a $1.00 markup cancellation and a $.50 markdown of our original $15.00 selling price.

Markup cancellation is $1.00 ($16.00 - $15.00).

The amount of the markup cancellation does not go below our original selling price of $15.00.

The amount of the markup cancellation does not go below our original selling price of $15.00.

Price decreases below our original selling price are mark downs.

Markdown is .$50 ($15.00 - $14.50). We decreased our current selling price below our normal $15.00 selling price.

Markdown is .$50 ($15.00 - $14.50). We decreased our current selling price below our normal $15.00 selling price.

- Increased Selling Price from $14.50 to $14.75 represents a markdown cancellation of $.25 ($14.75 - $14.50). Markdown cancellations do not go above our normal selling price.

Observation:

Note that you can't have a markup cancellation without first having a markup and that you can't have a markdown cancellation without first having a markdown.

Note that you can't have a markup cancellation without first having a markup and that you can't have a markdown cancellation without first having a markdown.

Detailed Example Of Retail Method Calculations assuming FIFO, LIFO, and Average Cost Flows.

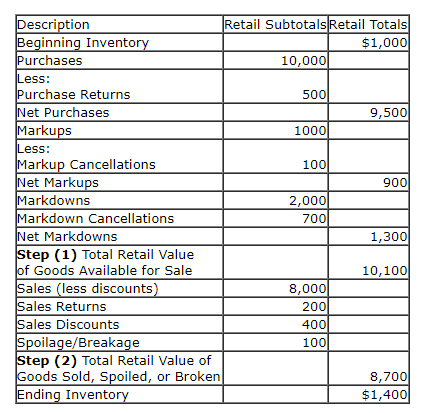

We obtained the following information from our detailed Sales and Accounting Records:

Sales (Less Discounts) $8,000

Sales Discounts 400

Sales Returns 200

Breakage 100

Markups 1,000

Markup Cancellations 100

Markdowns 2,000

Markdown Cancellations 700

Beginning Inventory 1,000 700

Purchases 10,000 7,500

Purchase Returns 500 400

Step (1)

Our first step is to calculate our Goods Available For Sale at Retail. This is done the same way regardless of the Cost Flow Assumption.

Our first step is to calculate our Goods Available For Sale at Retail. This is done the same way regardless of the Cost Flow Assumption.

Step (2) Calculate our Ending Inventory At Retail by subtracting our Total Retail Value Of Our Goods Sold, Spoiled, or Damaged from our Goods Available For Sale At Retail.

Step (3)

Calculate the cost-to-retail ratio to summarize the relationship between cost and retail value. (This ratio is calculated differently for different retail methods.)

Calculate the cost-to-retail ratio to summarize the relationship between cost and retail value. (This ratio is calculated differently for different retail methods.)

Step (4)

Convert the ending inventory stated at retail to ending inventory stated at cost by multiplying by the cost-to-retail ratio.

Convert the ending inventory stated at retail to ending inventory stated at cost by multiplying by the cost-to-retail ratio.

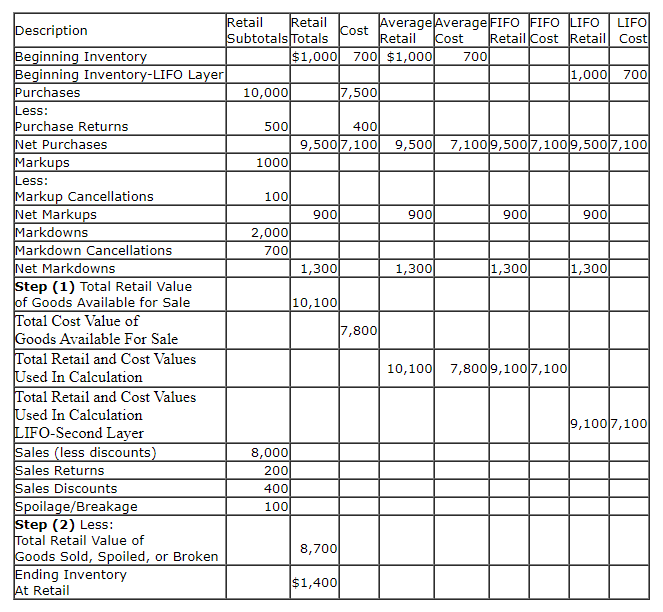

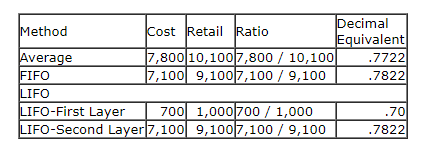

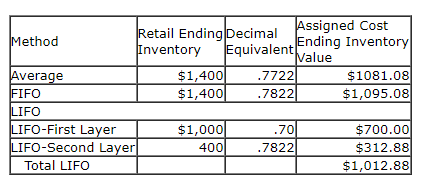

Three versions assuming Average, FIFO, and LIFO of the retail method are illustrated below.

Step (3)

Step (4)

Average Flow Computations

Retail Value includes the retail value of Beginning Inventory, Net Purchases , Net Markups, and Net Markdowns.

Retail Value includes the retail value of Beginning Inventory, Net Purchases , Net Markups, and Net Markdowns.

Cost Includes the cost of Beginning Inventories and Net Purchases.

The average method pools the beginning inventory and purchases and assumes that ending inventory is representative of this "pool" to arrive at an Average Cost-To-Retail Ratio which considers both the "mix" of the beginning inventory and purchases.

FIFO Flow Computations

Retail Value includes the retail value of Net Purchases , Net Markups, and Net Markdowns. Cost Includes the cost of Net Purchases.

Retail Value includes the retail value of Net Purchases , Net Markups, and Net Markdowns. Cost Includes the cost of Net Purchases.

Note:Beginning Inventory Retail Values and Cost are omitted from our calculation.

Can you think of a good reason for doing this ? The definition of the FIFO Cost Flow provides an excellent clue. Since FIFO assumes that the oldest or first goods purchased are sold first, the ending inventory is made up of the last or latest goods purchased. Since we assume that are beginning inventory has been sold, our Cost-To-Retail Ratio calculation for converting our ending inventory at retail to cost only uses the Cost and Retail Value of our Current Purchases. In addition, all the Net Markups and Net Markdowns are assumed to relate to our current purchases.

Observation:If in our example our sales had been less than the Dollar Retail Value Of our Beginning Inventory amount of $1,000, we would have had two Layers for our FIFO example and two Cost-To-Retail calculations.

LIFO Flow Computations

Since LIFO assumes that the latest purchases are sold first and ending inventory contains the oldest goods purchased, more than likely our Ending Inventory will be made up of some items from our Beginning Inventory and some items from our Current Purchases.

Since LIFO assumes that the latest purchases are sold first and ending inventory contains the oldest goods purchased, more than likely our Ending Inventory will be made up of some items from our Beginning Inventory and some items from our Current Purchases.

In our example, our Ending Inventory At Retail is $1,400 which represents $1,000 of Retail Value from our Beginning Inventory and $400 of Retail Value from our Current Purchases. In other words our year end inventory is composed of two cost "layers." In any period where net purchases exceed the cost of the items sold a new layer would be added to our Ending Inventory.

Observation:Actually, the IRS treasury regulations govern the use of the LIFO Costing Method with the Retail Inventory Method. This method is often referred to as the LIFO Retail Method. The example presented was simplified and did not include the use of price indexes which are actually required when using this method.

Dollar Value LIFO

Another method that you may run across but wasn't discussed is called Dollar Value LIFO. This method also uses price indexes to value the "layers" of the ending inventory.

Another method that you may run across but wasn't discussed is called Dollar Value LIFO. This method also uses price indexes to value the "layers" of the ending inventory.

What's Next ?

Lower Of Cost or Market