FIFO-Rising

Costing Methods

FIFO Calculations Using the Perpetual and Periodic Inventory System

Rising Prices

FIFO - First-in First-out

Our analysis, will look at the systems assuming that the purchase cost is increasing (Rising Prices) during the period and later in this Lesson take a look at the results when the cost of the item purchased is decreasing (Decreasing Prices) during the period.

First, we'll take a look at the FIFO Costing Method used with the Perpetual and Periodic Inventory Methods during a period of rising prices.

FIFO with the Perpetual Inventory Method

By now, you should know that the Perpetual Inventory Method requires us to maintain detail inventory records. The main record(s) is the Stock Record Card(s) also referred to as the Subsidiary Product Ledger. A detail stock record (ledger card) is maintained for each product that uses the Perpetual Inventory Method. If we use the perpetual inventory for five of our products we'll have five ledger cards. If we use the method for one hundred of our products how many stock record cards will we have ? If you answered anything but one hundred I'm sorry but I'm going to have to put the dunce cap on you and send you to the corner. These detail cards (subsidiary ledgers) maintain a "running" current balance of the quantity and cost of the items we have on hand.

The following information about our product Super Widget will be used to illustrate the calculations involved using the Periodic and Perpetual Inventory Methods with the FIFO Costing Method (Cost Flow Assumption).

- Beginning Inventory is made up of 100 units with a cost per unit of $8.00 for a total cost assigned of $800.00.

- Sales of Super Widgets made during the year at a constant selling price of $15.00 throughout the year are as follows:

January 20, xxxx 100 1,500

March 30, xxxx 200 3,000

June 5, xxxx 150 2,250

June 30, xxxx 70 1,050

October 20, xxxx 100 1,500

December 15, xxxx 90 1,350

December 31, xxxx 140 2,100

Total Sales 850 12,750

Date Quantity Unit Cost Extended Cost Invoice Number Supplier

- Purchases of Super Widget made during the year are as follows:

January 15, xxxx 200 $8.25 1,650 A-976123 Acme Products

March 5, xxxx 300 $8.50 2,550 7898000 Alternate Products

September 10, xxxx 200 $8.75 1,750 A-999999 Acme Products

December 20, xxxx 150 $9.00 1,350 B-789012 Acme Products

Total Purchases 850 7,300

As you can easily determine from our Purchases Table we'll first be dealing with the different Costing Methods assuming Rising Prices. Costs increase from $8.25 per unit to $9.00 per unit during the period.

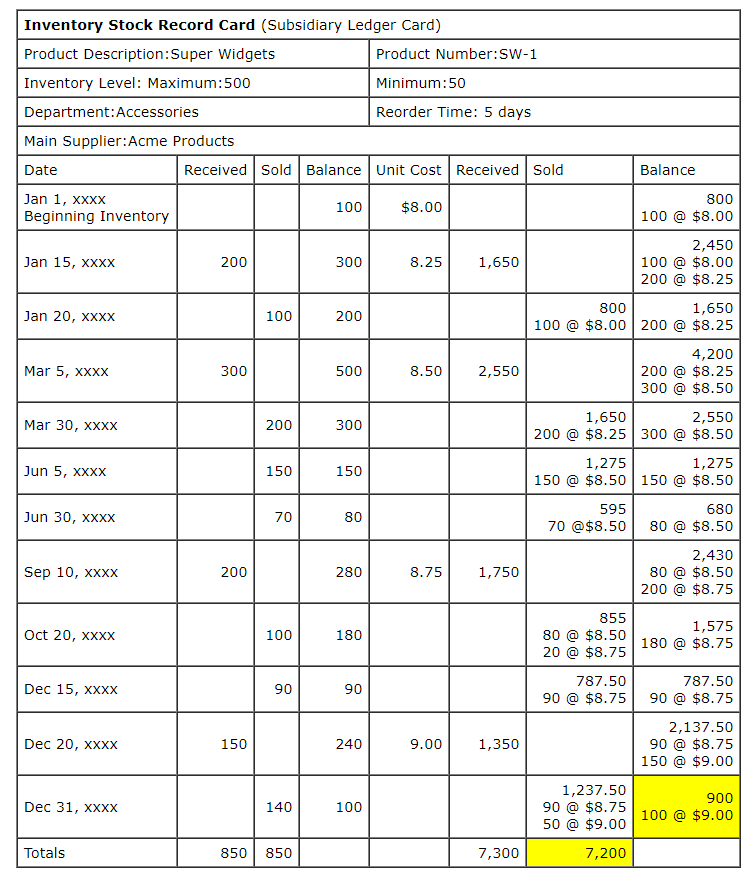

Our Stock Record Card (Subsidiary Ledger Card) for Super Widgets assuming a FIFO Cost Flow appears below:

(1) Our first entry on our Stock Ledger Card is our beginning inventory which is 800 units at a cost of $8.00 each resulting in a beginning value of $800. These units and costs were carried over from our prior year ending balances.

(2) Our second entry is our Jan 15, xxxx purchase of 200 units at a unit cost of $8.25. We now have two cost "layers" of inventory totalling 300 units with a total cost assigned of $2,480 composed of our original beginning balance of 100 units @ $8.00 and our new layer of 200 units @ $8.25.

(3) Our third entry is our Jan 20, xxxx sale of 100 units. Since we are using the FIFO (First-in First-out) Cost Flow method, the 100 units sold come from our oldest purchases which in this case represent the 100 units from our beginning inventory. The 100 units sold are assigned an $8.00 per unit cost cost which is the cost assigned to our oldest units.

Our remaining balance is now made up of only one layer of 200 units @ $8.25 for a total cost of $1,650.

The remaining purchase and sales transactions included in our Stock Record Card follow the same logic. Cost layers are added with purchases and decreased by sales from our oldest cost layer(s).

The yellow highlighted balances represent our Cost Of Goods Sold and Ending Inventory amounts at the end of our period.

FIFO with the Periodic Inventory System

Of course our first step is taking a physical inventory of the goods on hand as of the end of our year (period). After counting our Super Widgets, we recorded 100 units on our count sheet.

Now that we have the quantity, we need to assign costs to the cost of units that were sold (Cost Of Goods Sold) and our remaining units on hand (Ending Inventory).

We need to work backward from our most recent purchases (supplier invoices) in order to gather the unit cost(s) to use for valuing our ending inventory. Since the FIFO Costing Method assumes that the earliest (oldest) goods are sold first, then the goods on hand would have the newest costs assigned to them.

Fortunately, as I recommended earlier, although not absolutely necessary in our example we maintained a detail record of our purchases for the year. If we had not, we would have to dig through supplier invoices in order to find the unit cost(s) to use. This can be a very time consuming process. Why ? Just think of all the supplier invoices you receive in a year. To make matters worse, most invoices contain many products that are billed on the same invoice.

Our Schedule of Purchases and Beginning Inventory

- Beginning Inventory is made up of 100 units with a cost per unit of $8.00 for a total cost assigned of $800.00.

- Purchases of Super Widget made during the year are as follows:

Date Quantity Unit Cost Extended Cost Invoice Number Supplier

January 15, xxxx 200 $8.25 1,650 A-976123 Acme Products

March 5, xxxx 300 $8.50 2,550 7898000 Alternate Products

September 10, xxxx 200 $8.75 1,750 A-999999 Acme Products

December 20, xxxx 150 $9.00 1,350 B-789012 Acme Products

Total Purchases 850 7,300

From our schedule or search and analysis of invoices, our newest invoice is from our supplier Acme Products, dated December 20, xxxx, Invoice Number B-789012, for 150 units at a unit cost of $9.00. Since we only have 100 units remaining in our ending inventory, we lucked out.

All our Super Widgets will be assigned a unit cost of $9.00 using the unit cost from Invoice Number B-789012 dated December 20, xxxx resulting in an Ending Inventory Value of $900.00 (100 units @ $9.00).

Using the data from our Schedule, the calculation of the cost assigned to our units sold (Cost Of Goods Sold) is straight forward.

Purchased Dollars Purchased Units

Beginning Inventory $800 100

Purchases $7,300 850

Total Cost and Units To Account For $8,100 950

Costs Assigned to Cost Of Goods Sold

Cost Of Goods Sold Calculation:

Dollars Units

Total Dollars and Units To Account For $8,100.00 950

Less: Costs and Units Assigned To Ending Inventory 900.00 100

Costs and Units Assigned To Cost Of Goods Sold $7,200.00 850

Let's make one additional assumption in order to illustrate assigning cost to the ending inventory. We're going to assume that we had two more purchases at the end of our year.

Our New Purchases Schedule

- Purchases of Super Widget made during the year are as follows:

Date Quantity Unit Cost Extended Cost Invoice Number Supplier

January 15, xxxx 200 $8.25 1,650 A-976123 Acme Products

March 5, xxxx 300 $8.50 2,550 7898000 Alternate Products

September 10, xxxx 200 $8.75 1,750 A-999999 Acme Products

December 20, xxxx 150 $9.00 1,350 B-789012 Acme Products

December 27, xxxx 20 $9.50 190 578643 Alternate Products

December 30, xxxx 25 $10.00 250 654189 Alternative Products

Total Purchases 895 7,740

Assuming our same Ending Inventory of 100 units on hand. In this case, working backward from our newest (invoices) are calculation for assigning costs to our 100 units would be as follows:

25 units @ $10.00 =$250 Invoice 654189 Dec 30, xxxx

20 units @ $9.50 = $190 Invoice 578643 Dec 27, xxxx

55 units @ $9.00 = $495 Invoice B-789012 Dec 20, xxxx

Ending Inventory 100 units =$935

The logic behind calculating the assigned costs to Inventory using the Periodic Method and FIFO is really quite simple. If the first goods purchased are the first goods to "go out the door" (sold), it logically follows that the last goods purchased are the goods that make up the Ending Inventory. All we need to do is find the units cost(s) that relate to these purchases and multiply by the quantities. Often this is easier said than done unless we maintain detailed records for our purchases.

What's Next ?

FIFO-Decreasing Prices