LIFO-Rising

Costing Methods

LIFO Calculations Using the Perpetual and Periodic Inventory System

Rising Prices

LIFO - Last-in First-out

Now we're going to take a look at the LIFO Costing Method used with the Perpetual and Periodic Inventory Methods during a period of rising prices.

LIFO with the Perpetual Inventory Method

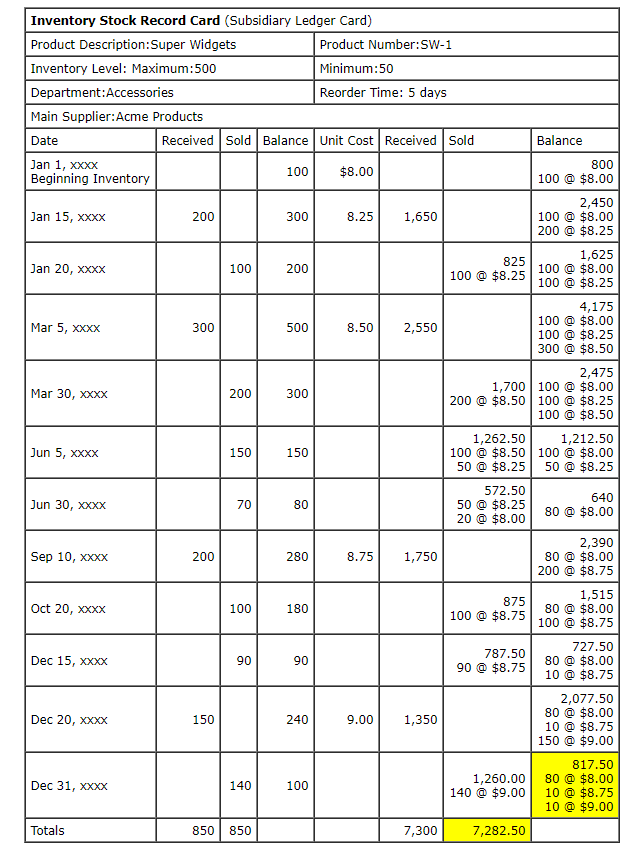

The following information about our product Super Widget will be used to illustrate the calculations involved using the Periodic and Perpetual Inventory Methods with the LIFO Costing Method (Cost Flow Assumption).

Our Schedule of Purchases and Beginning Inventory

- Beginning Inventory is made up of 100 units with a cost per unit of $8.00 for a total cost assigned of $800.00.

- Purchases of Super Widget made during the year are as follows:

January 15, xxxx 200 $8.25 1,650 A-976123 Acme Products

March 5, xxxx 300 $8.50 2,550 7898000 Alternate Products

September 10, xxxx 200 $8.75 1,750 A-999999 Acme Products

December 20, xxxx 150 $9.00 1,350 B-789012 Acme Products

Total Purchases 850 7,300

Our Stock Record Card (Subsidiary Ledger Card) for Super Widgets assuming a LIFO Cost Flow appears below:

(1) Our first entry on our Stock Ledger Card is our beginning inventory which is 800 units at a cost of $8.00 each resulting in a beginning value of $800. These units and costs were carried over from our prior year ending balances.

(2) Our second entry is our Jan 15, xxxx purchase of 200 units at a unit cost of $8.25. We now have two cost "layers" of inventory totalling 300 units with a total cost assigned of $2,480 composed of our original beginning balance of 100 units @ $8.00 and our new layer of 200 units @ $8.25.

(3) Our third entry is our Jan 20, xxxx sale of 100 units. Since we are using the LIFO (Last-in First-out) Cost Flow method, the 100 units sold come from our newest purchases which in this case represent 100 units from our purchase made Jan 15, xxxx. The 100 units sold are assigned an $8.25 per unit cost cost which is the cost assigned to our newest units.

Our remaining balance is now made up of 200 units with a total cost assigned of $1,625 composed of our original beginning balance of 100 units @ $8.00 and 100 @ $8.25 units remaining in our second (most current) layer.

The remaining purchase and sales transactions included in our Stock Record Card follow the same logic. Cost layers are added with purchases and decreased by sales from the most current cost layer(s).

The yellow highlighted balances represent our Cost Of Goods Sold and Ending Inventory amounts at the end of our period.

LIFO with the Periodic System

Of course our first step is taking a physical inventory of the goods on hand as of the end of our year (period). After counting our Super Widgets, we recorded 100 units on our count sheet.

Now that we have the quantity, we need to assign costs to the cost of units that were sold (Cost Of Goods Sold) and our remaining units on hand (Ending Inventory). We worked backward in our example of FIFO with the Periodic Inventory Method.

This time, we're going to work forward beginning with the oldest purchases (supplier invoices) in order to gather the unit cost(s) to use for valuing (assigning cost) to our Ending Inventory. Since the LIFO Inventory Method assumes that the newest (last) goods purchased are sold first, then logically the goods on hand (Ending Inventory) would have the earliest (oldest) cost assigned. Fortunately, as I recommended earlier, although not absolutely necessary in our example we maintained a detail record of our purchases for the year. If we had not, we would have to dig through supplier invoices in order to find the unit cost(s) to use. As I stated earlier, this can be a real time consuming "hassle".

Our Schedule of Purchases and Beginning Inventory

- Beginning Inventory is made up of 100 units with a cost per unit of $8.00 for a total cost assigned of $800.00.

- Purchases of Super Widget made during the year are as follows:

January 15, xxxx 200 $8.25 1,650 A-976123 Acme Products

March 5, xxxx 300 $8.50 2,550 7898000 Alternate Products

September 10, xxxx 200 $8.75 1,750 A-999999 Acme Products

December 20, xxxx 150 $9.00 1,350 B-789012 Acme Products

Total Purchases 850 7,300

Purchased Dollars Purchased Units

40 units @ $8.00 =$320

Working forward (from the oldest to the newest) from our schedule or search and analysis of our beginning inventory and invoices, our first oldest or earliest purchase is represented by our Beginning Inventory. By chance, the beginning balance is made up of 100 units with a unit cost of $8.00.

We lucked out. Since we only need to find the unit cost for 100 units from our count and that make up our Ending Inventory, the Beginning Inventory unit cost of $8.00 per unit is the only unit cost we need to assign cost to our units on hand and remaining in Inventory.

All our Super Widgets (100 in inventory) are assigned a unit cost of $8.00 resulting in an Ending Inventory Value of $800.00 (100 units @ $8.00).

Using the data from our Schedule, the calculation of the cost assigned to our units sold (Cost Of Goods Sold) is straight forward.

Beginning Inventory $800 100

Purchases $7,300 850

Total Cost and Units To Account For $8,100 950

Costs Assigned to Cost Of Goods Sold

Cost Of Goods Sold Calculation: Dollars Units

Total Dollars and Units To Account For $8,100.00 950

Less: Costs and Units Assigned To Ending Inventory 800.00 100

Costs and Units Assigned To Cost Of Goods Sold $7,300.00 850

Let's make one additional assumption in order to illustrate assigning cost to the ending inventory. We're going to assume that we had only had 40 units at a unit cost of $8.00 in our Beginning Inventory.

In this case, working forward from our earliest beginning inventory and purchases (invoices) are calculation for assigning costs to our 100 units would be as follows:

60 units @ $8.25 =$495

Ending Inventory 100 units =$815

The logic behind calculating the assigned costs to Inventory using the Periodic Method and LIFO is really quite simple. If the last goods purchased are the first goods to "go out the door" (sold), it logically follows that the earliest goods purchased are the goods that make up the Ending Inventory. All we need to do is find the units cost(s) that relate to these purchases and multiply by the quantities. Often this is easier said than done unless we maintain detailed records for our purchases.

What's Next ?

LIFO-Decreasing Prices