Average-Rising

Costing Methods

Average Calculations Using the Perpetual and Periodic Inventory System

Average Cost

An average cost is calculated using a weighted average method with periodic inventory systems and a moving average method with perpetual inventory systems.

Weighted Average Method - Periodic Inventory Method

Periodic - no detailed stock record (Subsidiary Ledger) is maintained.

Periodic - no detailed stock record (Subsidiary Ledger) is maintained.

Weighted Average Cost is simply the total cost of items available for sale divided by the total number of units available for sale.

- Total Cost of Items Available For Sale = Beginning Inventory Value + Purchases

- Total Units (Quantities) Available For Sale = Beginning Inventory Units + Purchased Units

- Weighted Average Cost Per Unit = Total Cost Of Items Available For Sale / Total Units Available For Sale

This Weighted Average Cost Per Unit is then multiplied by the quantity of inventory on hand to determine the value (costs assigned) of the ending inventory.

Moving Average Method - Perpetual Inventory Method

A detailed stock record card (Subsidiary Ledger) is maintained that records a running balance of the items and dollar value on hand, purchase quantities and unit costs, and quantities sold at what unit costs.

Average when used with the Perpetual Method performs calculations at the time of each purchase and sale. Costs are assigned to Cost Of Goods Sold at the time the goods are sold.

Moving Average is calculated in the same manner as the Weighted Average except that a new average unit cost is calculated each time a purchase is made. The costs of a new purchase are added to the prior value of the perpetual inventory and divided by the number of units on hand prior to the purchase plus the items currently purchased. Items sold are issued at the current value of the calculated moving average.

- Total Costs To Account For = Prior Costs Assigned to the Inventory (Prior To New Purchase) + Current Purchase

- Total Units To Account For = Prior Units On Hand (Prior To New Purchase) + Current Units Purchased

- Current Moving Average Cost Per Unit = Total Costs To Account For / Total Units To Account For

This Current Moving Average Cost Per Unit is then multiplied by the quantity of any items sold and assigned to the cost of the units sold (Cost Of Goods Sold). Any items still on hand are also valued at this current moving average cost per unit.

The Current Moving Average Cost Per Unit is recalculated each time a new purchase is made.

Rising Prices

Average Costing Method

Now, we're going to take a look at the Average Costing Method used with the Perpetual and Periodic Inventory Methods during a period of rising prices.

Moving Average with the Perpetual Inventory Method

Our Schedule of Purchases and Beginning Inventory

- Beginning Inventory is made up of 100 units with a cost per unit of $8.00 for a total cost assigned of $800.00.

- Purchases of Super Widget made during the year are as follows:

January 15, xxxx 200 $8.25 1,650 A-976123 Acme Products

March 5, xxxx 300 $8.50 2,550 7898000 Alternate Products

September 10, xxxx 200 $8.75 1,750 A-999999 Acme Products

December 20, xxxx 150 $9.00 1,350 B-789012 Acme Products

Total Purchases 850 7,300

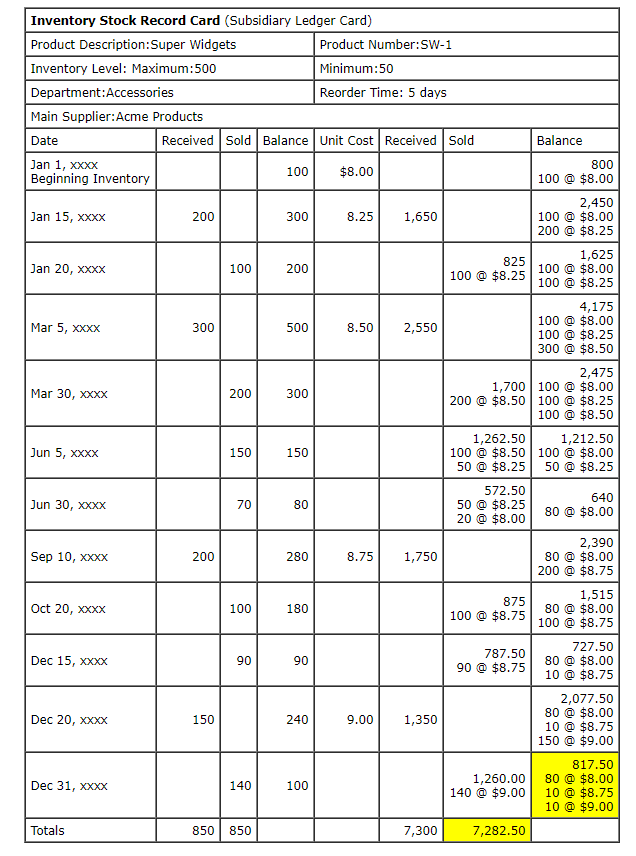

Our Stock Record Card (Subsidiary Ledger Card) for Super Widgets assuming an Average Cost Flow appears below:

(1) Our first entry on our Stock Ledger Card is our beginning inventory which is 800 units at a cost of $8.00 each resulting in a beginning value of $800. These units and costs were carried over from our prior year ending balances.

(2) Our second entry is our Jan 15, xxxx purchase of 200 units at a unit cost of $8.25. With the average cost method we pool layers so we always only have one cost layer that makes up our total inventory value. We combined the costs and units in our beginning inventory with our current purchase cost and units to arrive at our current inventory value of $2,450 and our moving average cost of $8.166.

(3) Our third entry is our Jan 20, xxxx sale of 100 units. Since we are using the Average Cost Flow Method (moving average), the 100 units sold and the remaining 200 units on hand are both valued at the $8.166 moving average unit cost. The 100 units sold are assigned a cost of 100 @ $8.166 or a total amount of $816.66 and the remaining 200 units on hand are assigned a value $1,633.40 (200 @ $8.1666).

The remaining purchase and sales transactions included in our Stock Record Card follow the same logic. When purchases are made units and dollars are pooled to arrive at a new moving average cost.

The yellow highlighted balances represent our Cost Of Goods Sold and Ending Inventory amounts at the end of our period.

Did you notice that a new average cost was calculated each time we received (purchased) items ? Isn't that exactly what I said earlier ? These are the only times a new moving average needs to be calculated.

The moving average was calculated by:

- Adding the total cost of the inventory prior to the purchase to the cost of the purchased goods.

- Likewise, the quantity (number of units) in inventory prior to the purchase was added to the quantity purchased.

- The Moving Average was calculated simply by dividing the total cost of the current inventory by the current quantity.

This average cost is used as the cost to assign cost to items sold until another purchase is made.

Once a new purchase is made, a new average cost is calculated and used to assign cost to items sold (Cost Of Goods Sold). This process is repeated throughout the year (period) whenever a new purchase is made.

Weighted Average with the Periodic System

As required with the Periodic Inventory Method we first perform a physical count of the goods on hand. After counting our Super Widgets, we recorded 100 units on our count sheet.

Now that we have the quantity, we need to assign costs to the cost of the units sold (Cost Of Goods Sold) and our remaining units on hand (Ending Inventory).

the calculation of our weighted average cost to use to assign costs to our ending inventory and cost of goods sold is simple. Simple that is, if we maintained some kind of detailed purchase record during the year. What about the amounts we that we recorded in our Special Purchases General Ledger Account during the year ? Doesn't that let us off the hook ? The dollars recorded give us the total dollar amount of our purchases for all our product purchases. We need the dollar amount purchased for each and every one of our products. We also need the quantities (units) that were purchased for each and everyone of our products.

Thank goodness our accountant that Bean Counter guy told us about the benefit of maintain a Purchasing Schedule even if we use the Periodic Inventory Method !

Our Schedule of Purchases and Beginning Inventory

- Beginning Inventory is made up of 100 units with a cost per unit of $8.00 for a total cost assigned of $800.00.

- Purchases of Super Widget made during the year are as follows:

January 15, xxxx 200 $8.25 1,650 A-976123 Acme Products

March 5, xxxx 300 $8.50 2,550 7898000 Alternate Products

September 10, xxxx 200 $8.75 1,750 A-999999 Acme Products

December 20, xxxx 150 $9.00 1,350 B-789012 Acme Products

Total Purchases 850 7,300

Using the data from our Schedule, the calculation of the cost used to assign cost to our Ending Inventory and our Cost of Goods Sold is straight forward.

Beginning Inventory $800 100

Purchases $7,300 850

Total Cost and Units To Account For $8,100 950

Calculation of weighted Average Cost:

Weighted Average Cost Per Unit = Total Costs To Account For / Total Units To Account For

Weighted Average Cost Per Unit = $8,100 / 950

Weighted Average Cost Per Unit = $8.526

Weighted Average Cost Per Unit = Total Costs To Account For / Total Units To Account For

Weighted Average Cost Per Unit = $8,100 / 950

Weighted Average Cost Per Unit = $8.526

Cost Assigned To Ending Inventory:

Cost Assigned To Ending Inventory = Units On Hand x Weighted Average Cost Per Unit

Cost Assigned To Ending Inventory = 100 x $8.526

Cost Assigned To Ending Inventory = $852.60

Cost Assigned To Ending Inventory = Units On Hand x Weighted Average Cost Per Unit

Cost Assigned To Ending Inventory = 100 x $8.526

Cost Assigned To Ending Inventory = $852.60

What about the cost assigned to Cost Of Goods Sold ? As Sherlock Holmes (the mystery book detective) often said to his sidekick Dr. Watson -"that's elementary Watson".

Cost Of Goods Sold Calculation:

Total Dollars To Account For $8,100.00

Less: Costs Assigned To Ending Inventory 852.60

Costs Assigned To Cost Of Goods Sold $7,247.40

What's Next ?

Average-Decreasing Prices