Inventory Records

Inventory Reords

Inventory Records

Earlier you were introduced to the Perpetual and Periodic Inventory Methods and the records needed and used. The intent of this lesson is to provide additional explanation and clarification by using detailed illustrations.

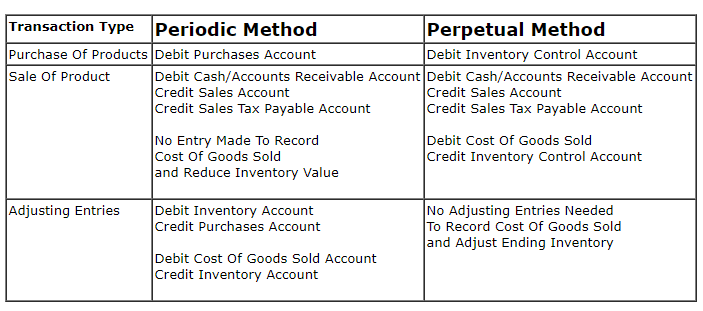

Summary Of Accounting/Bookkeeping Entries

For The Perpetual and Periodic Inventory Methods

Quick Refresher

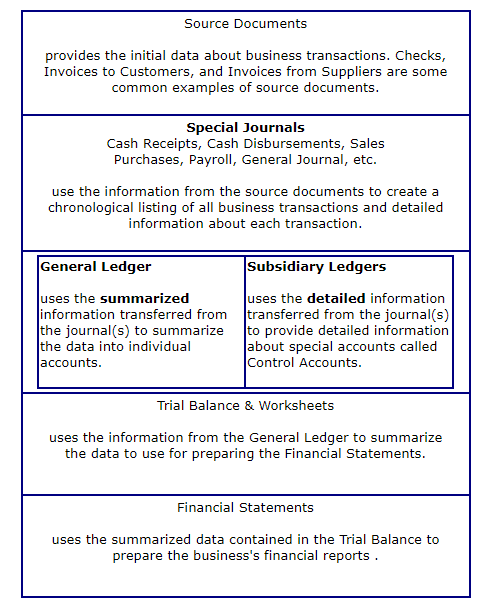

Flow of Information Thru The Bookkeeping Records

Inventory Records

A Control Account is a general ledger account that provides a summarized balance of the detailed balances of the individual records maintained in a subsidiary ledger.

Subsidiary Ledgers provide the detail information about what makes up the balance in the control account.

After posting all transactions the balance of the Control Account and the sum of the detailed records in the Subsidiary Ledger should always be the same. In other words, a control account deals with summarized information while a subsidiary ledger deals with detailed information.

When used with Inventory, the Control Account is Merchandise Inventory Control and the Subsidiary Ledger is often referred to as the Inventory Stock Record Cards.

Does the balance of the Subsidiary Ledger always equal the balance of the Inventory Control Account ? No, the detailed Stock Records total will not always equal the Inventory Control Account. The totals will only agree after the General Ledger Inventory Control account has been updated (posted) from the Journals. At the end of each accounting period they should always agree.

The Inventory Control Account and Stock Ledger Cards are only used with the Perpetual Inventory Method.

I hope you recall, especially those of you who have taken my Special Journals Tutorial, that entries are initially recorded in our Special Journals. The main journals used for recording our inventory transactions are the Sales and Purchases Journals.

Example Of Records Used For Recording and Maintaining Inventory

Let's revisit our Super Widgets Example from an earlier lesson. The following information about our product Super Widget will be used to illustrate the record keeping involved using the Periodic and Perpetual Inventory Methods with the FIFO Costing Method. I could just as easily have chosen the LIFO or Average Cost Costing Method to use for our example. The record keeping requirements depend more on the Inventory Method (Periodic, Perpetual, Retail) selected rather than the costing method selected.

Since we learned how to perform the calculations used with the different costing methods all we're going to do in this lesson is concentrate on the requirements and different records used with the Perpetual and Periodic Inventory Methods.

Our first illustration will deal with the Perpetual Inventory Method followed by an illustration of the Periodic Method.

- Beginning Inventory is made up of 100 units with a cost per unit of $8.00 for a total cost assigned of $800.00.

- Sales of Super Widgets made during the year at a constant selling price of $15.00 throughout the year are as follows:

January 20, xxxx 100 1,500 Big Bob's Office Supply 5050

March 30, xxxx 200 3,000 Honest Bob's Used Cars 5051

June 5, xxxx 150 2,250 Super Flic Movies 5052

June 30, xxxx 70 1,050 Shaggy Dog Vet 5053

October 20, xxxx 100 1,500 Greasy Spoon 5054

December 15, xxxx 90 1,350 Tiny's Gym 5055

December 31, xxxx 140 2,100 Whisper's Lounge 5056

Total Sales 850 12,750

- Purchases of Super Widget made during the year are as follows:

January 15, xxxx 200 $8.25 1,650 A-976123 Acme Products

March 5, xxxx 300 $8.50 2,550 7898000 Alternate Products

September 10, xxxx 200 $8.75 1,750 A-999999 Acme Products

December 20, xxxx 150 $9.00 1,350 B-789012 Acme Products

Total Purchases 850 7,300

FIFO with the Perpetual Inventory Method

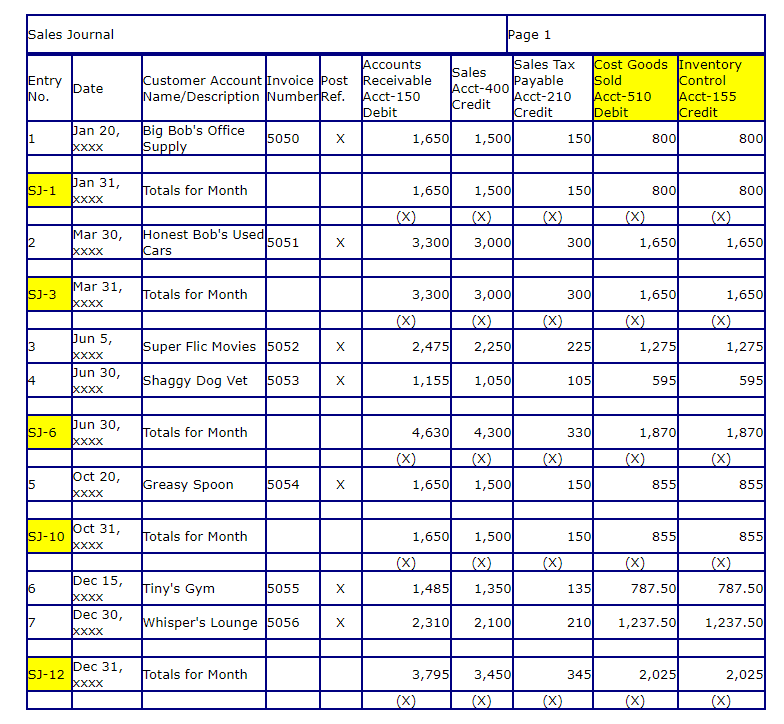

Special Journals Sales and Purchases

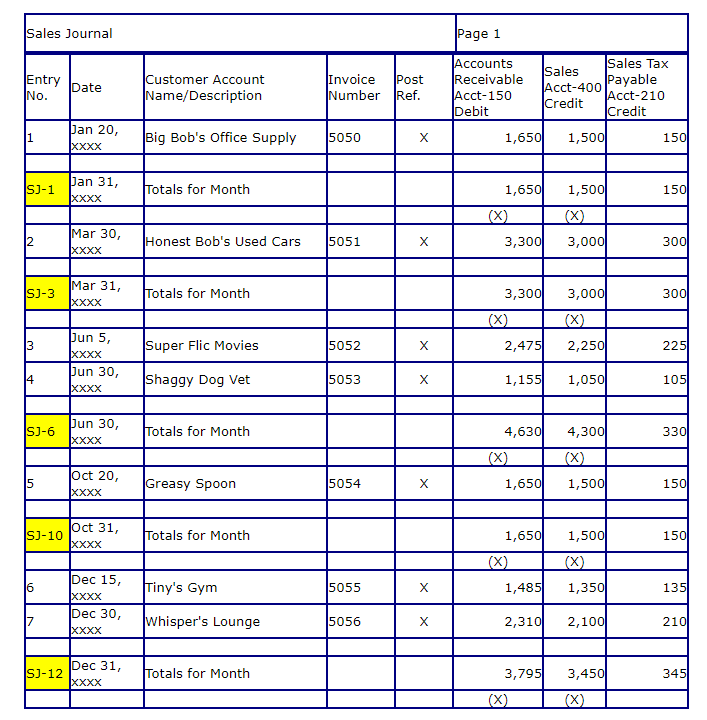

Sales Journal-Comments and Observations

(1) Post Ref

The X in this column is used to indicate that the customer's account in the Accounts Receivable Subsidiary Ledger has been posted.

(1) Post Ref

The X in this column is used to indicate that the customer's account in the Accounts Receivable Subsidiary Ledger has been posted.

(2) Entry No.

Yellow highlights used to emphasize the Sales Journal posting references.

SJ-1 - Sales Journal January

SJ-3 - Sales Journal March and so on.

Yellow highlights used to emphasize the Sales Journal posting references.

SJ-1 - Sales Journal January

SJ-3 - Sales Journal March and so on.

(3) (X)

The (X) indicates that the monthly totals have been posted to the General Ledger Accounts.

The (X) indicates that the monthly totals have been posted to the General Ledger Accounts.

(4) The Yellow Highlighted Cost Of Goods Sold and Inventory Control is used to emphasize that these columns are included in the Sales Journal when the Perpetual Inventory Method is used. They are omitted from the Sales Journal when the Periodic Inventory Method is used.

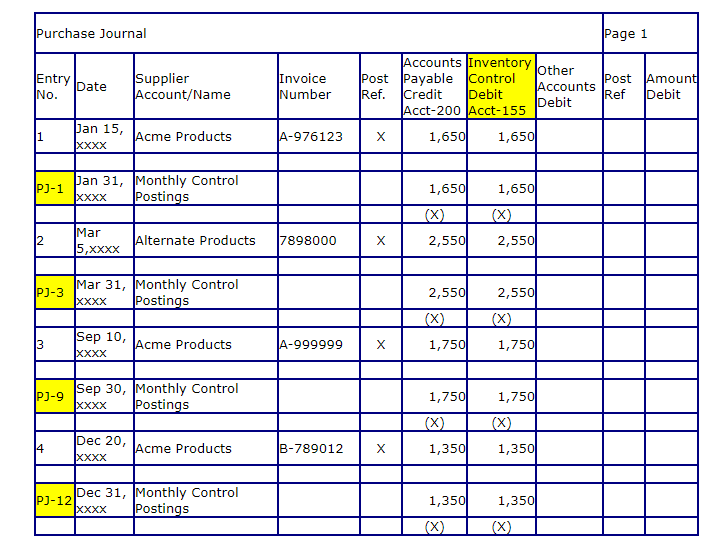

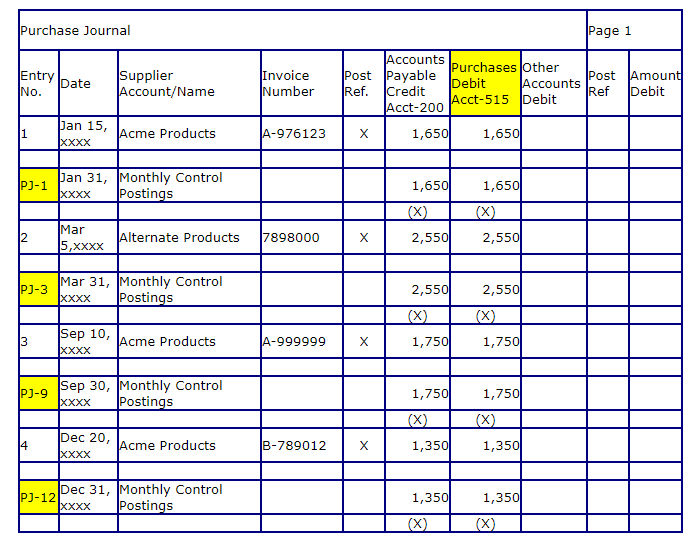

Purchase Journal-Comments and Observations

(1) Post Ref

The X in this column is used to indicate that the supplier's account in the Accounts Payable Subsidiary Ledger has been posted.

(1) Post Ref

The X in this column is used to indicate that the supplier's account in the Accounts Payable Subsidiary Ledger has been posted.

(2) Entry No.

Yellow highlights used to emphasize the Purchase Journal posting references.

PJ-1 - Purchase Journal January

PJ-3 - Purchase Journal March and so on.

Yellow highlights used to emphasize the Purchase Journal posting references.

PJ-1 - Purchase Journal January

PJ-3 - Purchase Journal March and so on.

(3) (X)

The (X) indicates that the monthly totals have been posted to the General Ledger Accounts.

The (X) indicates that the monthly totals have been posted to the General Ledger Accounts.

(4) The Yellow Highlighted Inventory Control is used to emphasize that this Account is used when the Perpetual Inventory Method is used. The Purchases Account is used when the Periodic Inventory Method is used.

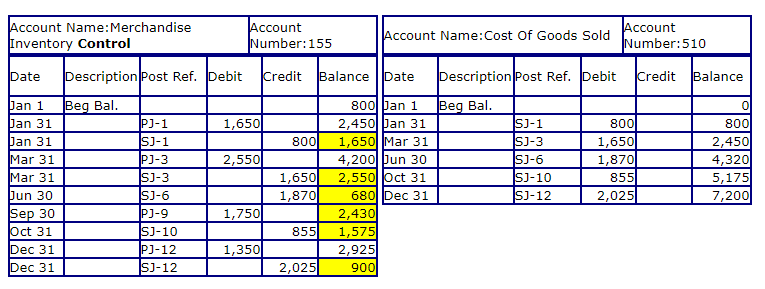

General Ledger Accounts

Comments and Observations

(1) The Inventory Control Account and Cost Of Goods Sold Account are posted on a monthly basis when the Perpetual Inventory Method is used. This provides us with the capability of preparing monthly (interim) financial statements.

(1) The Inventory Control Account and Cost Of Goods Sold Account are posted on a monthly basis when the Perpetual Inventory Method is used. This provides us with the capability of preparing monthly (interim) financial statements.

(2) Post Ref

Identifies the Special Journal (source) of the monthly posting entries. The Merchandise Inventory Control Account has entries posted from the Purchases (increase) and Sales (decrease) Journals. The Cost Of Goods Sold Account only has entries posted from the Sales Journal.

PJ-1 Purchases Journal January

SJ-1 Sales Journal January

and so on.

Identifies the Special Journal (source) of the monthly posting entries. The Merchandise Inventory Control Account has entries posted from the Purchases (increase) and Sales (decrease) Journals. The Cost Of Goods Sold Account only has entries posted from the Sales Journal.

PJ-1 Purchases Journal January

SJ-1 Sales Journal January

and so on.

(3) The yellow highlighted balances indicate the balance of the Inventory Control Account as of the end of the month (period).

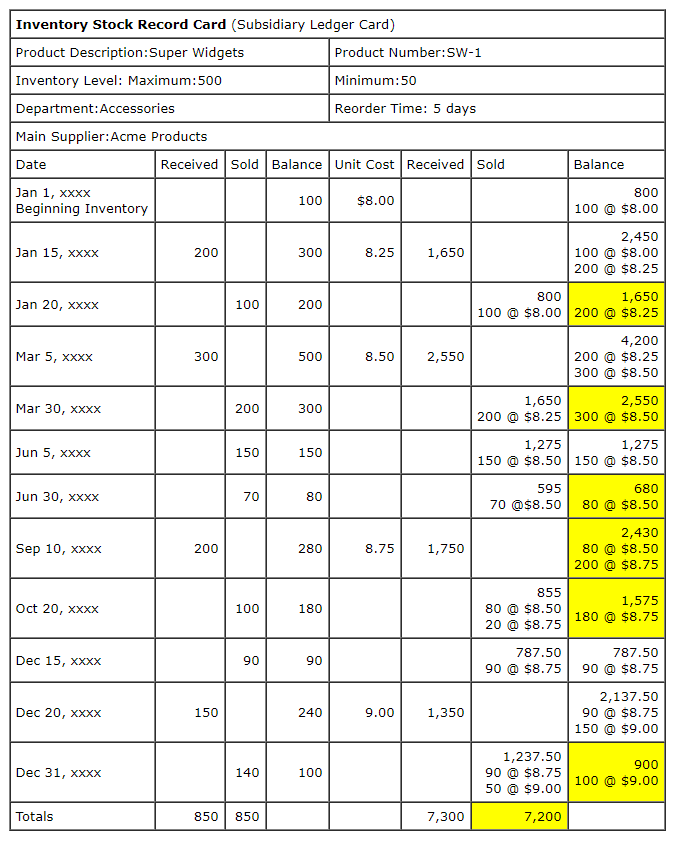

Subsidiary Ledger

Comments and Observations

(1) The Inventory Stock Record Card (Subsidiary Ledger) is only maintained when the Perpetual Inventory Method is used. The end of period amounts should agree with the General Ledger Merchandise Inventory Control Account.

(1) The Inventory Stock Record Card (Subsidiary Ledger) is only maintained when the Perpetual Inventory Method is used. The end of period amounts should agree with the General Ledger Merchandise Inventory Control Account.

(2)The yellow highlighted balances indicate the balances on hand as of the end of the month (period).

(3)Note how the ending balances of the General Ledger Inventory Control Account presented earlier agree with the yellow highlighted detail ending balances of the Stock Record Card.

(4)Also note how at times the detail Stock Record Card and the General Ledger Inventory Control Account do not agree. This occurs because the stock record card is updated as transactions actually occur and the General Ledger Account is only updated at the end of the month.

FIFO with the Periodic Inventory System

Our Schedule of Purchases, Sales and Beginning Inventory

- Beginning Inventory is made up of 100 units with a cost per unit of $8.00 for a total cost assigned of $800.00.

- Sales of Super Widgets made during the year at a constant selling price of $15.00 throughout the year are as follows:

January 20, xxxx 100 1,500 Big Bob's Office Supply 5050

March 30, xxxx 200 3,000 Honest Bob's Used Cars 5051

June 5, xxxx 150 2,250 Super Flic Movies 5052

June 30, xxxx 70 1,050 Shaggy Dog Vet 5053

October 20, xxxx 100 1,500 Greasy Spoon 5054

December 15, xxxx 90 1,350 Tiny's Gym 5055

December 31, xxxx 140 2,100 Whisper's Lounge 5056

Total Sales 850 12,750

Date Quantity Unit Cost Extended Cost Invoice Number Supplier

- Purchases of Super Widget made during the year are as follows:

January 15, xxxx 200 $8.25 1,650 A-976123 Acme Products

March 5, xxxx 300 $8.50 2,550 7898000 Alternate Products

September 10, xxxx 200 $8.75 1,750 A-999999 Acme Products

December 20, xxxx 150 $9.00 1,350 B-789012 Acme Products

Total Purchases 850 7,300

Special Journals Sales and Purchases

Sales Journal-Comments and Observations

(1) Post Ref

The X in this column is used to indicate that the customer's account in the Accounts Receivable Subsidiary Ledger has been posted.

(1) Post Ref

The X in this column is used to indicate that the customer's account in the Accounts Receivable Subsidiary Ledger has been posted.

(2) Entry No.

Yellow highlights used to emphasize the Sales Journal posting references.

SJ-1 - Sales Journal January

SJ-3 - Sales Journal March and so on.

Yellow highlights used to emphasize the Sales Journal posting references.

SJ-1 - Sales Journal January

SJ-3 - Sales Journal March and so on.

(3) (X)

The (X) indicates that the monthly totals have been posted to the General Ledger Accounts.

The (X) indicates that the monthly totals have been posted to the General Ledger Accounts.

(4) Note that the Inventory Control Account and Cost Of Goods Sold Account are omitted from the Sales Journal when the Periodic Inventory Method is used.

Purchase Journal-Comments and Observations

(1) Post Ref

The X in this column is used to indicate that the supplier's account in the Accounts Payable Subsidiary Ledger has been posted.

(2) Entry No.

Yellow highlights used to emphasize the Purchase Journal posting references.

PJ-1 - Purchase Journal January

PJ-3 - Purchase Journal March and so on.

Yellow highlights used to emphasize the Purchase Journal posting references.

PJ-1 - Purchase Journal January

PJ-3 - Purchase Journal March and so on.

(3) (X)

The (X) indicates that the monthly totals have been posted to the General Ledger Accounts.

The (X) indicates that the monthly totals have been posted to the General Ledger Accounts.

(4) The Yellow Highlighted Purchases is used to emphasize that this Account is used when the Periodic Inventory Method is used. The Inventory Control Account is used when the Perpetual Inventory Method is used.

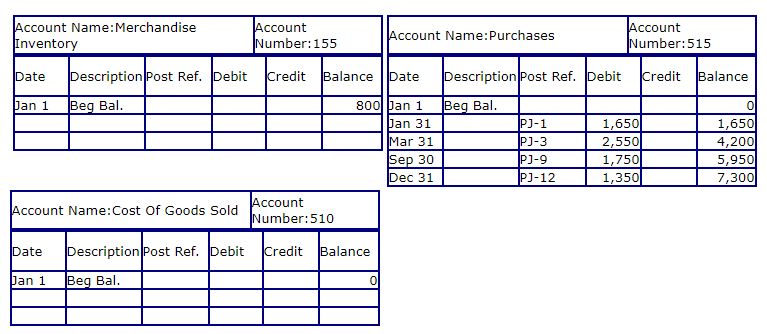

General Ledger Accounts

Comments and Observations

(1) Note that the only General Ledger Inventory related account that had any transactions posted during the year was the Purchases Account. The Merchandise Inventory Account has the beginning balance and no other transactions posted and the Cost Of Goods Sold Account likewise has no transactions posted.

(2) Without ending inventory balances and cost of goods sold balances during the year, we are unable to prepare monthly (interim) financial statements without performing a physical count and making adjusting entries.

Of course our first step in determining our inventory is taking a physical inventory of the goods on hand as of the end of our year (period). After counting our Super Widgets, we recorded 100 units on our count sheet.

Now that we have the quantity, we need to assign costs to the cost of units that were sold (Cost Of Goods Sold) and our remaining units on hand (Ending Inventory). We need to work backward from our most recent purchases (supplier invoices) in order to gather the unit cost(s) to use for valuing our ending inventory. Since the FIFO Costing Method assumes that the earliest (oldest) goods are sold first, then the goods on hand would have the newest costs assigned to them.

Fortunately, as I recommended in Lesson 1, although not absolutely necessary in our example we maintained a detail record of our purchases for the year. If we had not, we would have to dig through supplier invoices in order to find the unit cost(s) to use. This can be a very time consuming process. Why ? Just think of all the supplier invoices you receive in a year. To make matters worse, most invoices contain many products that are billed on the same invoice.

From our schedule or search and analysis of invoices, our newest invoice is from our supplier Acme Products, dated December 20, xxxx, Invoice Number B-789012, for 150 units at a unit cost of $9.00. Since we only have 100 units remaining in our ending inventory, we lucked out.

All our Super Widgets will be assigned a unit cost of $9.00 using the unit cost from Invoice Number B-789012 dated December 20, xxxx resulting in an Ending Inventory Value of $900.00 (100 units @ $9.00).

Using the data from our Schedule, the calculation of the cost assigned to our units sold (Cost Of Goods Sold) is straight forward.

Beginning Inventory $800 100

Purchases $7,300 850

Total Cost and Units To Account For $8,100 950

Costs Assigned to Cost Of Goods Sold

Cost Of Goods Sold Calculation:

Dollars Units

Total Dollars and Units To Account For $8,100.00 950

Less: Costs and Units Assigned To Ending Inventory 900.00 100

Costs and Units Assigned To Cost Of Goods Sold $7,200.00 850

General Journal

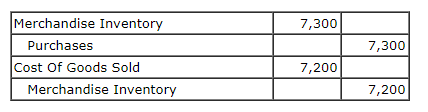

After determining the values for our Ending Inventory and Cost Of Goods Sold the Periodic Method requires adjusting entries in order to update our General Ledger Inventory and Cost Of Goods Sold Accounts. We saw earlier that the only inventory related account that had any transactions posted was the Purchases Account that is used with the Periodic Inventory Method.

JE #50 - Entry to record Ending Inventory and Cost Of Goods Sold for the year.

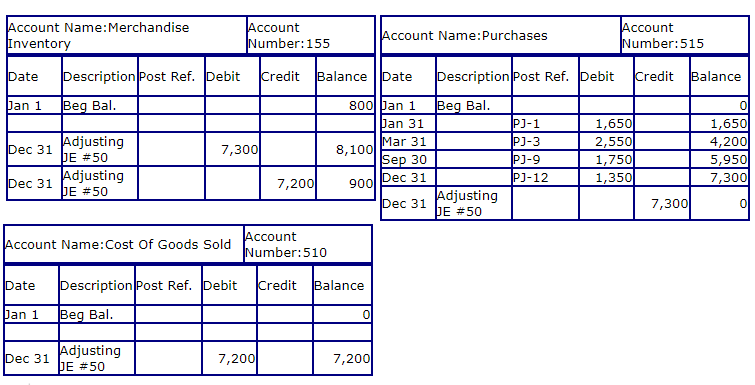

Our General Ledger Accounts after posting our adjustments appear below.

General Ledger Accounts

Well you've almost made it thru another journey into the world of bookkeeping with me. I hope your adding machine didn't run out of tape following along with the examples and doing the calculations and checking mine. You did do this didn't you ? I know I didn't tell you to, but if you didn't you might want to review this tutorial and actually perform some of the calculations on your own.

What's Next ?

Inventory Records Video