FIFO-Decreasing

Costing Methods

FIFO Calculations Using the Perpetual and Periodic Inventory System

Decreasing Prices

FIFO - First-in First-out

Earlier, we took a look at the effects of rising prices on our Inventory Calculations, now it's time to take a look at the effect of decreasing prices used with the FIFO Perpetual and Period Costing Methods.

You should now be somewhat familiar with the calculations and computations used with the different costing and inventory methods. Whether prices are increasing, declining, or fairly steady the calculations and computations used are the same. Price fluctuations do; however, affect the results that the different costing methods produce.

FIFO with the Perpetual Inventory Method

The following information about our product Super Widget will be used to illustrate the record keeping and calculations involved using the Periodic and Perpetual Inventory Methods and the different Costing Methods (Cost Flow Assumptions).

- Sales of Super Widgets made during the year at a constant selling price of $15.00 throughout the year are as follows:

January 20, xxxx 100 1,500

March 30, xxxx 200 3,000

June 5, xxxx 150 2,250

June 30, xxxx 70 1,050

October 20, xxxx 100 1,500

December 15, xxxx 90 1,350

December 31, xxxx 140 2,100

Total Sales 850 12,750

Date Quantity Unit Cost Extended Cost Invoice Number Supplier

Our Schedule of Purchases and Beginning Inventory

- Beginning Inventory is made up of 100 units with a cost per unit of $8.00 for a total cost assigned of $800.00.

- Purchases of Super Widget made during the year are as follows:

January 15, xxxx 200 $7.50 1,500 A-976123 Acme Products

March 5, xxxx 300 $7.25 2,175 7898000 Alternate Products

September 10, xxxx 200 $7.00 1,400 A-999999 Acme Products

December 20, xxxx 150 $6.75 1,012.50 B-789012 Acme Products

Total Purchases 850 6,087.50

Notice that the cost per unit of purchasing our Super Widgets decreases from $7.50 to $6.75 during the period.

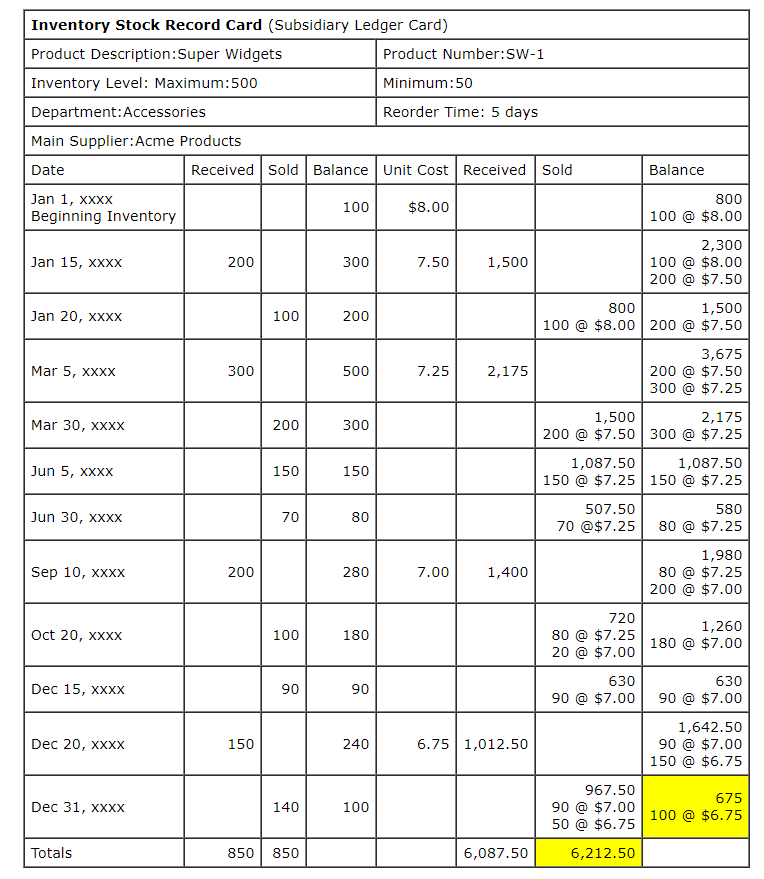

Our Stock Record Card (Subsidiary Ledger Card) for Super Widgets assuming a FIFO Cost Flow appears below:

FIFO with the Periodic Method

I'm getting a little lazy. We should know by now that we get the same results for the costs assigned to our Ending Inventory and Cost Of Goods Sold whether we use FIFO with the Perpetual or Periodic Method.

Our costs are assigned as follows:

$675.00 $6,212.50 $6,887.50

Date Quantity Unit Cost Extended Cost Invoice Number Supplier

Purchased Dollars Purchased Units

Don't believe me, huh ! I know, I'll prove it. Let's take a look at our Schedule Of Beginning Inventory and Purchases.

Our Schedule of Purchases and Beginning Inventory

- Beginning Inventory is made up of 100 units with a cost per unit of $8.00 for a total cost assigned of $800.00.

- Purchases of Super Widget made during the year are as follows:

January 15, xxxx 200 $7.50 1,500 A-976123 Acme Products

March 5, xxxx 300 $7.25 2,175 7898000 Alternate Products

September 10, xxxx 200 $7.00 1,400 A-999999 Acme Products

December 20, xxxx 150 $6.75 1,012.50 B-789012 Acme Products

Total Purchases 850 6,087.50

Remember with FIFO we work backward starting with our newest (last) unit purchase cost. From our schedule or search and analysis of invoices, our newest invoice is from our supplier Acme Products, dated December 20, xxxx, Invoice Number B-789012, for 150 units at a unit cost of $6.75. Since we only have 100 units remaining in our ending inventory, we lucked out.

All our Super Widgets will be assigned a unit cost of $6.75 using the unit cost from Invoice Number B-789012 dated December 20, xxxx resulting in an Ending Inventory Value of $675.00 (100 units @ $6.75).

Using the data from our Schedule, the calculation of the cost assigned to our units sold (Cost Of Goods Sold) is straight forward.

Beginning Inventory $800.00 100

Purchases $6,087.50 850

Total Cost and Units To Account For $6,887.50 950

Costs Assigned to Cost Of Goods Sold

Cost Of Goods Sold Calculation:

Dollars Units Total Dollars and Units To Account For $6,887.50 950

Less: Costs and Units Assigned To Ending Inventory 675.00 100

Costs and Units Assigned To Cost Of Goods Sold $6,212.50 850

What's Next ?

LIFO-Rising Prices