LIFO-Periodic

Costing Methods

LIFO-Last-in First-out

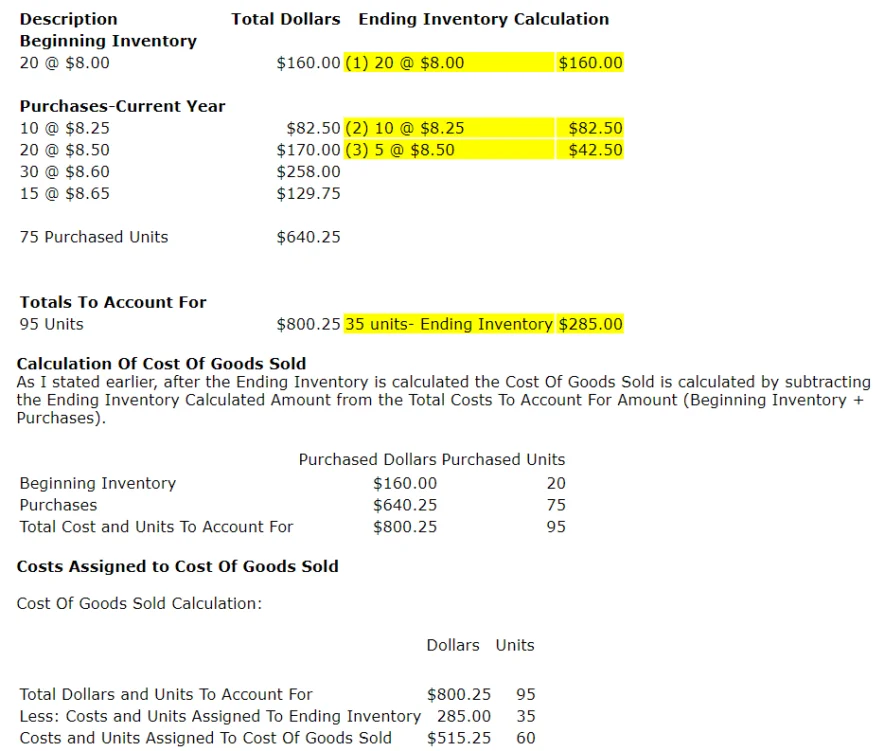

LIFO Periodic - no detailed stock record (Subsidiary Ledger) is maintained. LIFO when used with the Periodic Method performs the calculations and assigns cost to Cost Of Goods Sold and Ending Inventory after a Physical Inventory is taken at the end of your accounting year.

Of course our first step is taking a physical inventory of the goods on hand as of the end of our year (period).

After we have the quantity, we need to assign costs to the cost of units that were sold (Cost Of Goods Sold) and our remaining units on hand (Ending Inventory). With LIFO and the Periodic Inventory Method the main emphasis is first on calculating the cost assigned to the Ending Inventory.

We need to work forward from our earliest (oldest) purchases (supplier invoices) in order to gather the unit cost(s) to use for valuing our ending inventory. Since the LIFO Costing Method assumes that the newest goods are sold first, then the goods on hand would have the earliest (oldest) costs assigned to them.

The logic behind calculating the assigned costs to Inventory using the Periodic Method and LIFO is really quite simple. If the last goods purchased are the first goods to "go out the door" (sold), it logically follows that the earliest (oldest) goods purchased are the goods that make up the Ending Inventory. All we need to do is find the units cost(s) that relate to these purchases and multiply by the quantities.

After the Ending Inventory is calculated the Cost Of Goods Sold is calculated by subtracting the Ending Inventory Calculated Amount from the Total Costs To Account For Amount (Beginning Inventory + Purchases).

Our example to illustrate the calculations follows.

Assumptions:

- Beginning Inventory 20 units @ $8.00

- Purchases During The Year Listed in the order incurred (oldest to newest) with their quantities, unit costs, and total dollars amounts.

10 @ $8.25 $82.50

20 @ $8.50 $170.00

30 @ $8.60 $258.00

15 @ $8.65 $129.75

75 units $640.25

- Ending Inventory On Hand- 35 units (calculated by counting the items)

Let's calculate out Total Units and Costs To Account For.

Our total units and costs include our units and dollars included in our beginning inventory and our units and dollars purchased during our year. The extra units and dollars in our table below are due to including our Beginning Inventory amounts.

Our total units and costs include our units and dollars included in our beginning inventory and our units and dollars purchased during our year. The extra units and dollars in our table below are due to including our Beginning Inventory amounts.

The items are listed in order of the oldest to the newest. Why is our Beginning Inventory the first item listed ? The answer should be obvious. Our Beginning Inventory is the units and amounts carried over to our new year from our Ending Inventory Amounts of our prior year. Since our Beginning Inventory is made up of prior year purchase amounts , the oldest purchases are contained in our Beginning Inventory Amounts.

Beginning Inventory 20 @ $8.00 $160.00

Purchases-Current Year

10 @ $8.25 $82.50

20 @ $8.50 $170.00

30 @ $8.60 $258.00

15 @ $8.65 $129.75

Totals To Account For

95 units $800.25

Let's next assign our costs to our Ending Inventory of 35 units obtained from our Physical Inventory (count of goods on hand).

Remember, we work forward from our earliest (oldest) to our newest purchase unit costs in order to obtain the unit costs needed for assigning costs to our 35 units of Ending Inventory.

(1) Our first calculation accounts for 20 of our 35 units at a cost of $8.00 per unit and a total amount of $160.00. We now have 15 units still remaining that we need to assign costs to.

(2) Still working forward, we determine that the next 10 units are assigned a cost of $8.25 per unit and a total amount of $82.50. We now have 5 units still remaining that we need to assign costs to.

(3) Still working forward, we determine that the last 5 units are assigned a cost of $8.50 per unit and a total amount of $42.50.

Since all 35 units of our Ending Inventory have been accounted for, our task of assigning costs to our Ending Inventory is complete.

What's Next ?

FIFO-Rising Prices