Balance Sheet

Worksheets-Financial Statements

Balance Sheet

A Balance Sheet is simply a picture of a business at a specific point in time, usually the end of the month or year. By analyzing and reviewing this financial statement the current financial "health" of a business can be determined.

The balance sheet is derived from our accounting equation and is a formal representation of our equation

Assets = Liabilities + Owner's Equity.

If you recall, in an earlier lesson we learned that this equation is also called the Balance Sheet Equation.

The categories and format of the Balance Sheet are based on what are called Generally Accepted Accounting Principles (GAAP). These principles are the rules established so that every business prepares their financial statements the same way.

What makes up a Balance Sheet ?

Assets

Formal Definition:The properties used in the operation or investment activities of a business.

Informal Definition:All the good stuff a business has (anything with value). The goodies.

Additional Explanation:

The good stuff includes tangible and intangible stuff. Tangible stuff you can physically see and touch such as vehicles, equipment and buildings. Intangible stuff is like pieces of paper (sales invoices) representing loans to your customers where they promise to pay you later for your services or product. Examples of assets that many individuals have are cars, houses, boats, furniture, TV’s, and appliances. Some examples of business type assets are cash, accounts receivable, notes receivable, inventory, land, and equipment.

Assets are listed based on how quickly they can be converted into cash which is called liquidity. In other words, they’re ranked. The asset most easily converted into cash is listed first followed by the next easiest and so on. Of course since cash is already cash it’s the first asset listed.

Liabilities

Formal Definition:Claims by creditors to the property (assets) of a business until they are paid.

Informal Definition:Other’s claims to the business’s stuff. Amounts the business owes to others.

Additional Explanation:

Usually one of a business’s biggest liabilities (hopefully they are not past due) is to suppliers where they have bought goods and services and charged them. This is similar to us going out and buying a TV and charging it on our credit card. Our credit card bill is a liability. Another good personal example is a home mortgage. Very few people actually own their own home. The bank has a claim against the home which is called a mortgage. This mortgage is another example of a personal liability. Some examples of business liabilities are accounts payable, notes payable, and mortgages payable.

Liabilities are listed in the order of how soon they have to be paid. In other words, the liabilities that need to be paid first are also listed first.

Owner’s Equity (Capital)

Formal Definition:The owner’s rights to the property (assets) of the business; also called proprietorship and net worth.

Informal Definition:What the business owes the owner. The good stuff left for the owner assuming all liabilities (amounts owed) have been paid.

Additional Explanation:

Owner’s Equity represents the owner’s claim to the good stuff (assets). Most people are familiar

with the term equity because it is so often used with lenders wanting to loan individuals money based on their home equity. Home equity can be thought of as the amount of money an owner would receive if he/she sold their house and paid off any mortgage (loan) on the property.

Owner’s equity (or net worth or capital ) is increased by money or property contributed and any profits earned and decreased by owner withdrawals and losses.

All Balance Sheets contain the same categories of assets, liabilities, and owner’s equity.

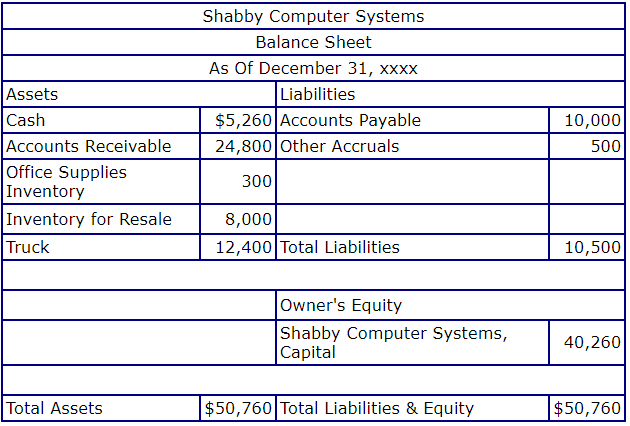

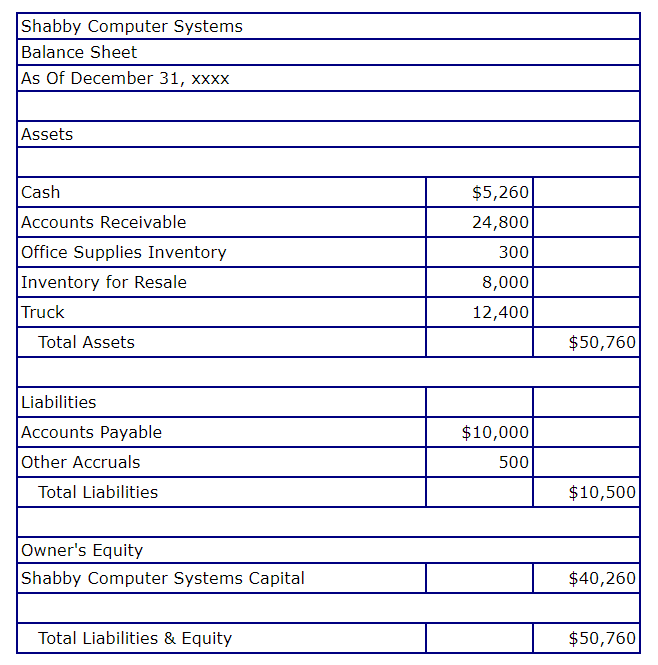

If you look below at our Balance Sheet for Shabby Computer Systems you can readily see that there are three main sections, assets, liabilities, and owner’s equity just like the accounting equation.

The major sections of a balance sheet are the heading, the assets,the liabilities, and the owner’s equity. The heading contains the name of the company, the title of the statement, and the date of the statement.

Sample Balance Sheets

Balance Sheet Account Format

In the Balance Sheet Account format, the balance sheet is divided into left and right sides. The assets are listed on the left hand side whereas both liabilities and owners' equity are listed on the right hand side of the balance sheet.

Balance Sheet Report Format

A report format balance sheet is a balance sheet that presents asset, liability, and equity accounts in a vertical format. Asset section listed first, followed by the Liabilities Section, and finally the Owner's Equity section.

What's Next ?

Adjusting & Closing Entries Video