Purchases-Cash Payments

Purchases-Cash Payments

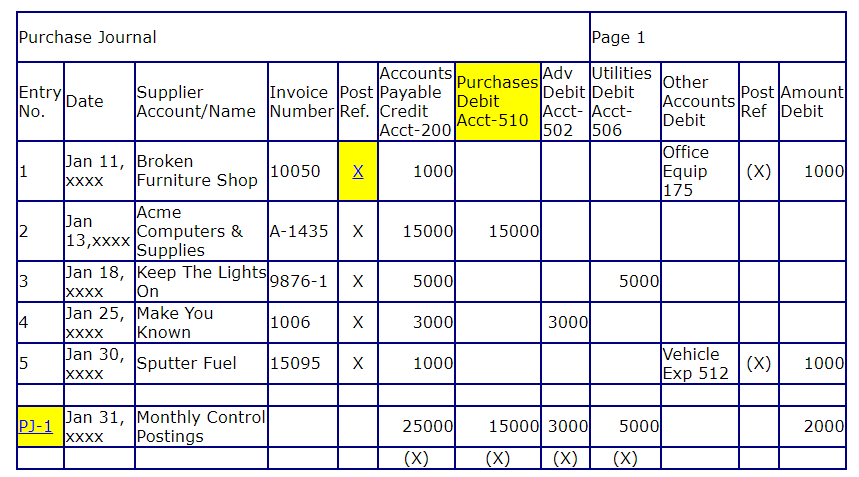

Purchase Journal

Definition & Purpose

The Purchases Journal is a special journal that is used to record all purchases and various expenses and other charges from suppliers that a business has an open account with (supplier allows the business to charge purchases).

The entries recorded in this journal are a debit to expense accounts or the purchases account and a credit to the accounts payable control account (a credit is also posted to the supplier's Accounts Payable Subsidiary Account).

Do you know the name of the record or ledger that works in conjunction with the purchases journal and cash disbursements journal to maintain the detailed supplier information ? Accounts Payable Subsidiary Ledger is the answer I was hoping for.

It should be obvious, but I'll state it anyway. All supplier invoices are recorded (posted) in the Purchase Journal and the Supplier's Account Payable Subsidiary Ledger. At the end of a period (month), the totals from the Purchase Journal are also recorded (posted) in the General Ledger Accounts.

The Purchases Journal lists all invoices and documents for purchases and expenses incurred during the month. All invoices are Debited to our Purchase and Expense Accounts and Credited to our Accounts Payable Control Account.

The Purchase Journal has these basic features:

- Header with the Name of the Journal and Page

- Entry Number used as a reference to a specific transaction on the journal's page

- Date Column to record the date of the transaction

- Description Column to record the name of the payee/supplier (who written to), and any other explanation or additional information about the transaction

- Invoice Number Reference Column to record our supplier's invoice number

- Posting Reference to provide information when a Subsidiary Ledger also needs to be updated - this tells us whether the Subsidiary Accounts Payable Ledger has also been posted (updated)

- Debit Columns for all regularly occurring types of expenses or expenditures and a Credit Column for our Accounts Payable Control Account

- Special Other Debits Column with its related Posting Reference Column

We use these three columns to record debits for any transactions that don't have their own debit account special column.

Our illustrated Purchases Journal has a Credit Amount Column for Accounts Payable and Debit Amount Columns for Purchases, Advertising, Utilities, and Other.

Sample Purchases Journal

The totals for the month are posted to the General Ledger Accounts. In this example, a summarized debit amount total of $15,000 is posted to the General Ledger Purchases Account and additional summarized total debit amounts are posted to various General Ledger Accounts and individual debit amounts are also posted to various General Ledger Accounts. A summarized credit amount total of $25,000 is posted to the General Ledger Accounts Payable Account (Control Account).

The (X)'s tell us that they have been posted to the General Ledger Accounts and the Yellow Highlighted PJ-1 (Purchases Journal - Page 1) is the reference used in the General Ledger Account to tell the source of the posting.

The Purchases Journal totals are normally posted to the General Ledger Accounts, Control Accounts and Regular Accounts at the end of the month.

The Yellow Highlighted X in the posting reference column tells us that our Purchase Invoice Number 10050 from Broken Furniture Shop has been posted to our Accounts Payable Subsidiary Ledger so that we can keep up with what we owe our suppliers.

Our purchase (supplier) invoices are posted to our Accounts Payable Subsidiary Ledger on a more frequent basis such as daily or weekly. Why ? We need to keep up with the current balances that we owe to our suppliers.

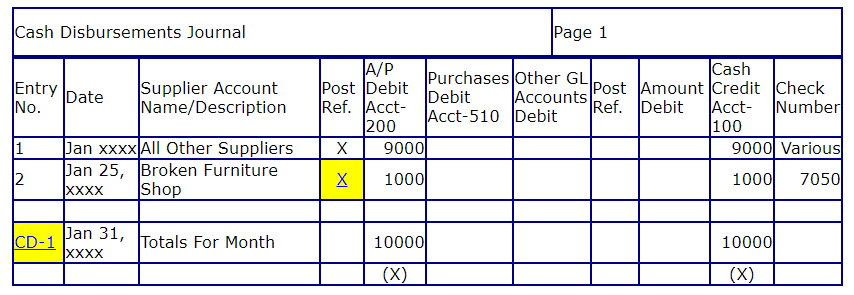

Cash Disbursements/Payments Journal

Definition & Purpose

The Cash Payments Journal is a special journal that is used to record all cash that is paid out by a business except for payroll. Businesses with just a few employees could also use this journal to record their payroll checks; however, I recommend that you use a special payroll journal in order to have all your payroll information in one place.

The entries recorded in this journal are a debit to expense accounts, the purchases account, or the accounts payable control account (a debit is also posted to the supplier's Accounts Payable Subsidiary Account) and a credit to the cash account.

It should be obvious, but I'll state it anyway. All our checks written to suppliers are recorded (posted) in the Cash Disbursements Journal and the Supplier's Account Payable Subsidiary Ledger. At the end of a period (month), the totals from the Cash Disbursements Journal are also recorded (posted) in the General Ledger Accounts.

The Cash Disbursements Journal lists all checks, in check number order, paid during the month. It posts total checks written as a credit entry to the Cash Account. All payments to suppliers that have an Accounts Payable Subsidiary Ledger Account are Debited to the Accounts Payable Control Account and Credited to our Cash Account.

The cash disbursements journal has these basic features:

- Header with the Name of the Journal and Page

- Debit and Credit Columns to record the amount of the transaction

- Check Number (Reference) Column to record the check number of all checks issued

- Date Column to record the date of the transaction

- Description Column to record the name of the payee/supplier (who written to), and any other explanation or additional information about the transaction

- Entry Number used as a reference to a specific transaction on the journal's page

- Posting Reference to provide information when a Subsidiary Ledger also needs to be updated - this tells us whether the Subsidiary ledger has also been posted (updated)

- Columns for each regularly occurring types of payment, expense, or expenditures and a column for cash

- Special Other Debits Column with its related Posting Reference Column

We use these three columns to record debits for any transactions that don't have their own debit account special column.

Our illustrated Cash Disbursements Journal has Debit Amount Columns for Accounts Payable, Purchases, and Other and a Credit Amount Column for Cash.

Sample Cash Disbursements Journal

The totals for the month are posted to the General Ledger Accounts. In this example, a debit amount total of $10,000 is posted to the General Ledger Accounts Payable (Control Account) and a credit amount total of $10,000 is posted to the General Ledger Accounts Cash Account. The (X)'s tell us that they have been posted to the General Ledger Accounts and the Yellow Highlighted CD-1 (Cash Disbursements - Page 1) is the reference used in the General Ledger Account to tell the source of the posting.

The Cash Disbursements Journal totals are normally posted to the General Ledger Accounts, Control Accounts and Regular Accounts at the end of the month.

The Yellow Highlighted X in the posting reference column tells us that Honest Bob's Used Cars Check # 605 has been posted to our Accounts Payable Subsidiary Ledger so that we can keep up with what our customer's owe us.

Our payments (checks,etc.) are posted to our Accounts Payable Subsidiary Ledger on a more frequent basis such as daily or weekly. Why ? We need to keep up with the current balances that our customers owe us.

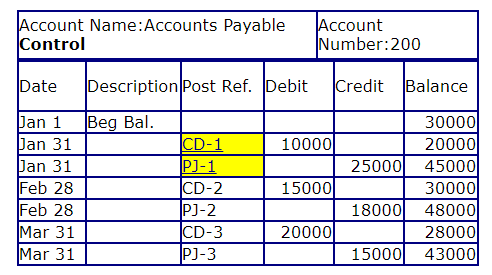

General Ledger- Accounts Payable Control Account

A Control Account is a general ledger account that provides a summarized balance of the detailed balances of the individual records maintained in a subsidiary ledger. Summary Entries are posted from both the Purchases and Cash Disbursements Journals to the Accounts Payable Control Account.

The Yellow Highlighted Posting Reference PJ-1 refers to the Purchases Journal Page 1 where this entry came from (source). Likewise, the Yellow Highlighted Posting Reference CD-1 refers to the Cash Disbursements Journal Page 1 where this entry came from (source).

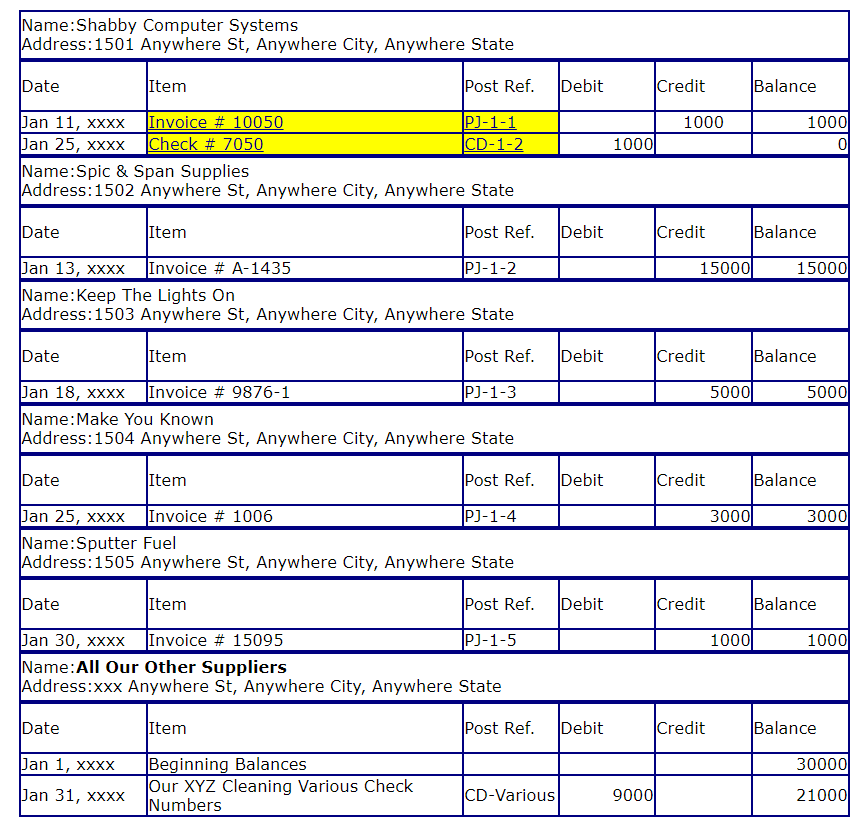

Accounts Payable Subsidiary Ledger

The Accounts Payable Subsidiary Ledger's purpose is to provide detail information about transactions that are summarized in the Accounts Payable Control Account. Both the Purchases and the Cash Disbursements Journals provide information needed for maintaining our Accounts Payable Subsidiary Ledger.

This "book" contains a detailed record for each of your suppliers. What information do you think you might want to keep up with about each of your suppliers ? Let's make a list of some information that you would include.

- General Information

- Supplier's Name and/or Account Number

- Phone Number

- Address

- Contact Person

- Credit Limit

- Credit Terms

- Supplier Financial Information

- Each Invoice Billed By The Supplier

- Each Payment (Check) Sent To The Supplier

- Total Balance Owed To Supplier

- Posting Reference-what journal the information was posted from

Normally all the information posted will come from the Purchases and Cash Disbursements Journals.

Sample Accounts Payable Subsidiary Ledger

Total Balance of All Supplier Accounts as of January 31,xxxx $45,000

The Yellow Highlighted Invoice # 10050 in our supplier Shabby Computer Systems Account is just to emphasize that our Purchase Invoices initially recorded in our Purchases Journal are also recorded in our Supplier Accounts in our Accounts Payable Subsidiary Ledger.

The Yellow Highlighted Posting Reference Number PJ-1-1 in our supplier Shabby Computer Systems Account tells us that Invoice # 10050 was posted from the Purchases Journal and the posting reference PJ-1-1 refers to our Purchases Journal - January - Entry Number 1.

Likewise, the Yellow Highlighted Check Number 7050 in our supplier Shabby Computer Systems Account tells us that Check #7050 was posted from our Cash Disbursements Journal and the Yellow Highlighted Posting Reference CD-1-2 refers to our Cash Disbursements Journal - January - Entry Number 2.

Accounts Payable Control and Accounts Payable Subsidiary Ledger Balances

After posting the Purchases and Cash Disbursements Journals to the Accounts Payable Control Account and posting the individual items to the Accounts Payable Subsidiary Ledger the balance of the Accounts Payable Control Account and the sum of the detailed records in the Accounts Payable Subsidiary Ledger should always be the same. In other words, a control account deals with summarized information while a subsidiary ledger deals with detailed information.

So you know, the Special Journals post to the General Ledger Accounts Payable Control Account a summarized total for the main accounts at the end of the month and post each detail entry (invoice) daily or as needed to the Accounts Payable Subsidiary Ledger. The totals will not be the same until the monthly posting is made to the General Ledger Accounts Payable Control Account.

Why the different posting times ? We need to update the Accounts Payable Subsidiary Ledger on a more frequent basis such as daily or weekly so we can maintain and monitor the current balance of what we owe to our suppliers.

Let's see if our totals do agree after posting our Sales and Cash Receipts Special Journals.

The Total Amount Owed to our Suppliers in our Accounts Payable Subsidiary Ledger as of January 31,xxxx is $45,000.

Now let's take a look at our Accounts Payable Control Account.

| Description | Amounts |

January 1,xxxx Beginning Balance | $30,000 |

Plus: Credit Balance Posted from our Purchases Journal for the month of January xxxx Reference Number: PJ-1 | 25,000 |

Less Debit Balance Posted from our Cash Disbursements Journal for the month of January xxxx Reference Number: CD-1 | 10,000 |

January 31,xxxx Ending Balance | $45,000 |

Sure enough the balance of the Accounts Payable Control Account and the balance of The Accounts Payable Subsidiary Ledger are the same.

Payment Terms

Let's first formally define what credit or payment terms are. Credit Terms are an agreement and understanding between a buyer and seller as to when payment will be made and any discounts that will be allowed. The terms of payment are normally included on the supplier's invoice. Some terms even try to encourage early payment by providing cash discounts.

Common Terms Used and How They're Stated (Abbreviated):

- Payment At The Time Of Sale

- Cash or Net Cash

- Payment at The Time Of Delivery

- COD-Cash On Delivery

- Payment is Due Upon Receiving the Invoice

- Due Upon Receipt

- Number of Days Due From the Invoice Date

- Net 30 days-payment is due 30 days from the invoice date

- Net 60 days-payment is due 60 days from the invoice date

- End Of Month Terms -n10/EOM-all purchases made in a given month are due by the 10Th of the following month

- Terms with Discounts -2/10, Net 30-2% discount allowed if paid within 10 days from the date of the invoice; otherwise full amount due within 30 days from the date of the invoice.

Note: These are the same terms that are used for your billings (Sales Invoices) to your customers.

Accounts Payable Aging Report

Since our suppliers grant us payment terms, we need a way of tracking to determine if we are paying our suppliers when their invoices are due. Our Accounts Payable Subsidiary Ledger provides the information we need for preparing our Accounts Payable Aging Report. An Accounts Payable Aging Report report, also known simply as an A/P report or aging A/P report, is used by many business owners to keep track of what payments are due to their suppliers. The main information an accounts payable aging report shows is:

- What payments are owed

- When those payments are due, and

- Owed to what supplier

An A/P aging report will typically list suppliers on one side (either alphabetically or by size of debt, depending on how it’s filtered) with invoice amounts in 30-day columns going across to 90 days plus.

Note: When using a manual bookkeeping system, preparing an Aging Report becomes a tedious and time consuming process.

Sample Accounts Payable Aging Report

| Shabby Computer Systems Accounts Payable Aging Report as of December 31,xxxx | ||||||

| Supplier | Current | 1-30 Days | 31-60 Days | 61-90 Days | > 90 Days | Total |

| Totals | ||||||

What's Next ?

Purchases and Cash Payment Journals Video