Formal Financial Statements

Closing The Books

Prepare Income Statement

All the information that we need to prepare our Income Statement is found in the Revenue and Expense Accounts Section of our After Closing Trial Balance Worksheet. All we need to do is transfer all the figures from our Worksheet to our formal Income Statement.

Don't Believe me ?

Just Sum the Revenues and Subtract the Cost of Goods Sold and Operating Expenses to arrive at the Net Income/Loss amount.

This is the amount that is transferred (closed) to the Owner's Capital Account with a Closing Entry.

Shabby Computer Systems Income Statement For Year Ended December 31, xxxx | ||

| Sales | ||

Consulting Services | $50,000 | |

Computer Sales | 100,000 | |

Total Sales | $150,000 | |

Cost Of Goods Sold | 72,500 | |

Gross Profit | $77,500 | |

Operating Expenses | ||

Rent Expense | 6,000 | |

Utilities Expense | 4,800 | |

Office Supplies | 1,200 | |

Insurance Expense | 6,000 | |

Vehicle Operation Expense | 3,600 | |

Maintenance & Repairs | 3,100 | |

Depreciation Expense | 3,100 | |

Bad Debt Expense | 1,000 | |

Bank Charges | 240 | |

Advertising Expense | 4,250 | |

Professional Fees | 2,250 | |

Total Expenses | 35,340 | |

Net Income | $42,160 | |

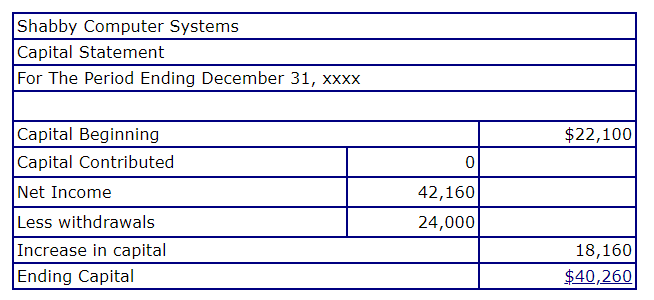

Prepare Capital Statement

All this statement does is show what caused the change in the Owner's Capital Account for the year. All the information needed to prepare this statement is contained in the Owner's Capital Account in our After Closing Trial Balance Worksheet.

Don't believe me ?

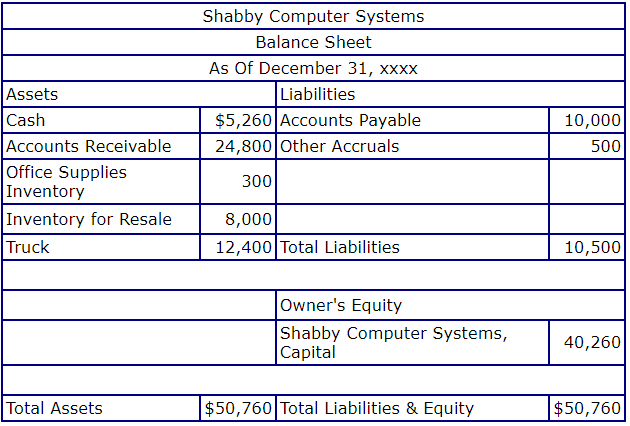

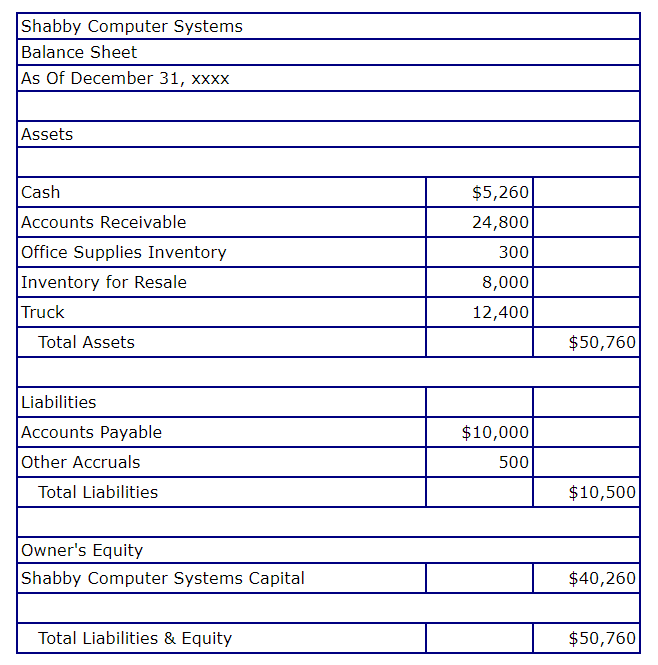

Prepare Balance Sheet

All the information that we need to prepare our Balance Sheet is found in the Balance Sheet Area of our After Closing Trial Balance Worksheet. All we need to do is transfer all the figures from the After Closing Trial Balance Column to our formal Balance Sheet.

Don't believe me ?

It's really quite simple. After all our closing entries have been posted, the only accounts that have a balance are our Balance Sheet Accounts- Assets, Liabilities, and Equity. Of course as you already know, the Balance Sheet is only made up of the Asset, Liability, and Equity Accounts.

This layout is called the account form. In this form the major categories are presented side by side.

Another layout sometimes used is called the report form. In this form the major categories are stacked on top of each other. An example of the report form follows.

General Journal

Finishing Touches

Hang tight, we've almost completed closing our books. Just a few more tasks. We've been using Worksheets as an aid for closing our books and recording our adjusting and closing entries in these worksheets.

It's time to use this information to prepare and record these entries in our formal General Journal and post our General Journal Entries to our formal General Ledger and any Subsidiary Ledgers.

Well, let's prepare our Formal General Journal Entries and Post To Our General Ledger.

General Journal Formal Adjusting Entries

| General Journal | Page | ||||

| Entry No | Date | Account Name | Post Ref. | Debit | Credit |

Adjusting Entries | |||||

| 1 | Dec 31, xxxx | Office Supplies | X | 1200 | |

Office Supplies Inventory | X | 1200 | |||

Record Supplies Expense and Adjust Inventory Account | |||||

| 2 | Dec 31, xxxx | Bad Debt Expense | X | 1000 | |

Accounts Receivable | X/X | 1000 | |||

Record Write off of Bad Debt of Joe The Deadbeat | |||||

| 3 | Dec 31, xxxx | Insurance Expense | X | 6000 | |

Prepaid Insurance | X | 6000 | |||

Record Insurance Expense & Adjust Prepaid Balance | |||||

| 4 | Dec 31, xxxx | Inventory For Resale | X | 70000 | |

Cost Of Goods Sold | X | 72500 | |||

Purchases | X | 70000 | |||

Inventory For Resale | X | 72500 | |||

Record Cost Of Goods Sold & Adjust Inventory For Resale Balance | |||||

| 5 | Dec 31, xxxx | Bank Charges | X | 240 | |

Cash | X | 240 | |||

Record Bank Charges & Adjust Cash | |||||

| 6 | Dec 31, xxxx | Depreciation Expense | X | 3100 | |

Truck | X | 3100 | |||

Record Depreciation Expense & Adjust Truck Balance | |||||

| 7 | Dec 31, xxxx | Maintenance & Repairs Expense | X | 500 | |

Other Accruals | X | 500 | |||

Record Unrecorded & Unbilled Repair Expense & Liability | |||||

| 8 | Dec 31, xxxx | Professional Fees | X | 250 | |

Advertising Insurance | X | 250 | |||

Correct Error In Recording Expenses | |||||

Where did we get the information for preparing the formal journal entries for our Adjusting Entries ? Would you believe our Adjusted Trial Balance Worksheet.

The X in the Posting Reference Column (Post Ref.) tells us that the entry has been posted to the General Ledger Accounts. The X/X denotes that the entry has been posted to the General Ledger Account and Subsidiary Accounts Receivable Ledger.

General Journal Formal Closing Entries

| General Journal | Page | ||||||

| Entry No | Date | Account Name | Post Ref. | Debit | Credit | ||

Closing Entries | |||||||

Close Drawing Account | |||||||

a | Dec 31, xxxx | Shabby Computer Systems, Capital | X | 24000 | |||

Shabby Computer Systems, Drawing | X | 24000 | |||||

Close Drawing Account to Capital Account | |||||||

Close Income/Expense Accounts | |||||||

b | Dec 31, xxxx | Consulting Services | X | 50000 | |||

Income Summary | X | 50000 | |||||

Close Revenue Account Consulting Services to Income Summary Account | |||||||

c | Dec 31, xxxx | Computer Sales | X | 100000 | |||

Income Summary | X | 100000 | |||||

Close Revenue Account Computer Sales To Income Summary Account | |||||||

d | Dec 31, xxxx | Cost of Goods Sold | X | 72500 | |||

Income Summary | X | 72500 | |||||

Close Expense Account Cost of Goods Sold To Income Summary Account | |||||||

e | Dec 31, xxxx | Rent Expense | X | 6000 | |||

Income Summary | X | 6000 | |||||

Close Expense Account Rent To Income Summary Account | |||||||

f | Dec 31, xxxx | Utilities | X | 4800 | |||

Income Summary | X | 4800 | |||||

Close Expense Account Utilities To Income Summary Account | |||||||

g | Dec 31, xxxx | Office Supplies | X | 1200 | |||

Income Summary | X | 1200 | |||||

Close Expense Account Office Supplies To Income Summary | |||||||

h | Dec 31, xxxx | Insurance Expense | X | 6000 | |||

Income Summary | X | 6000 | |||||

Close Expense Account Insurance To Income Summary Account | |||||||

i | Dec 31, xxxx | Vehicle Operation Expense | X | 3600 | |||

Income Summary | X | 3600 | |||||

Close Expense Account Vehicle Operation To Income Summary Account | |||||||

j | Dec 31, xxxx | Maintenance & Repairs | X | 2900 | |||

Income Summary | X | 2900 | |||||

Close Expense Account Maintenance & Repairs To Income Summary Account | |||||||

k | Dec 31, xxxx | Depreciation Expense | X | 3100 | |||

Income Summary | X | 3100 | |||||

Close Expense Account Depreciation To Income Summary Account | |||||||

l | Dec 31, xxxx | Bad Debt Expense | X | 1000 | |||

Income Summary | X | 1000 | |||||

Close Expense Account Bad Debts To Income Summary Account | |||||||

m | Dec 31, xxxx | Bank Charges | X | 240 | |||

Income Summary | X | 240 | |||||

Close Expense Account Bank Charges To Income Summary Account | |||||||

n | Dec 31, xxxx | Advertising | X | 4250 | |||

Income Summary | X | 4250 | |||||

Close Expense Account Advertising To Income Summary Account | |||||||

o | Dec 31, xxxx | Professional Fees | X | 2250 | |||

Income Summary | X | 2250 | |||||

Close Expense Account Professional Fees To Income Summary Account | |||||||

p | Dec 31, xxxx | Income Summary Account | X | 42160 | |||

Shabby Computer Systems, Capital | X | 42160 | |||||

Close Income Summary Account And Transfer Ending Balance To Owner's Capital Account (Balance Is Profit/Loss For Period) | |||||||

Where did we get the information for preparing the formal journal entries for our Closing Entries ? Would you believe our After Closing Trial Balance Worksheet.

The X in the Posting Reference Column (Post Ref.) tells us that the entry has been posted to the General Ledger Accounts.

What's Next ?

Closing The Books Video