Accounts Receivable

Manager Setup > Starting Balances > Accounts Receivables-Payables

Accounts Receivable Modified Setup Instructions

Starting balances exist only if you are transferring an existing business to Manager from another accounting system. In that case, you may need to set starting balances for customers who, on the day you begin using Manager, sometimes referred to as the start date:

- Have available credit unrelated to sales invoices, or

- Owe you money because of unpaid sales invoices.

Before you can enter starting balances for customers, the customers themselves must be created.

A Customer in Manager refers to an individual, business, or organization from whom you expect to receive or already receive payment, indicating an Accounts Receivable relationship. You don't need to set up someone as a customer for every sale. If a sale is paid for in cash immediately, you can process it without having to create a customer.

Initial Balance Setup

When a customer is created, their starting balance is zero. If migrating from another accounting system, enter unpaid invoices for this customer under the Sales Invoices tab. Take care when entering the invoice dates. They all should be prior to your start date.

Entering unpaid invoices individually ensures you can start issuing customer statements in Manager from day one. Use a dummy non-inv item so inventory balances are not affected.

Accrual Method Of Accounting

Enter unpaid sales invoices

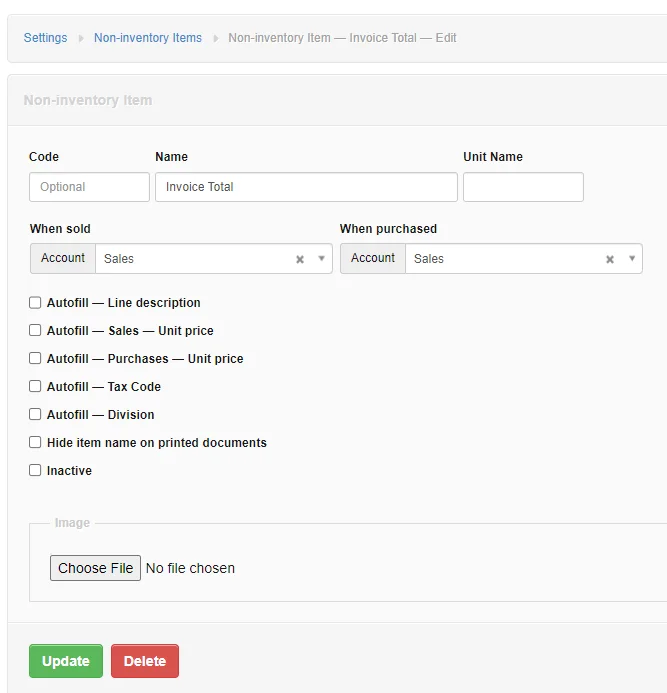

Setup Non-inventory item

If not already enabled, Enable the Settings for Non-inventory items

Add a Non-inventory item named Invoice Total

Click On New Non-inventory item

Enter Name - Invoice Total

Enter

When Sold

When PurchasedAccount - Sales

Account - Sales

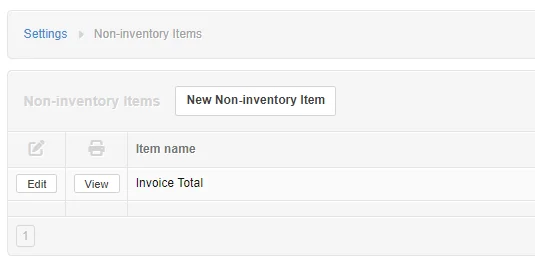

If you click on Non-inventory items a listing appears with all your non-inventory items. In our example we only have one.

Entering unpaid invoices:

Enter a starting-balance invoice in a similar manner as a regular sales invoice. The Issue date field will, by default, be prefilled with the current date. Edit this to match the original issue date from your old accounting system.

Manager uses these pre-start sales invoices to establish starting balances in Accounts receivable. They will not affect profit and loss statements during the current or later financial periods. If an invoice has been partially paid on the day you begin using Manager, only its remaining balance due should be entered.

When finished, click Create to save the invoice. Repeat for all open sales invoices preceding your start date.

Create an invoice for each customer's unpaid invoices using the Non-inventory item Invoice Total with the assigned account Sales.

Notes:

- Include any taxes invoiced in the total amount and not as a separate amount entered - doing this allows you to enter the actual beginning balance for the Tax payable account. If you don't, you need to adjust your beginning balance for the Tax payable account.

Beginning Balance = Actual balance - taxes entered on invoices

- Use your actual invoice numbers, payment terms, and invoice dates - this allows you to refer to your old invoices and see the actual detail items that make up the invoice and run accurate unpaid invoices and aging reports

- Using this method you do not need to adjust your beginning inventory quantities

Example

In our simple example, we'll be entering two starting unpaid customer invoices assuming our start date is June 1 and our beginning unpaid invoices are dated in May.

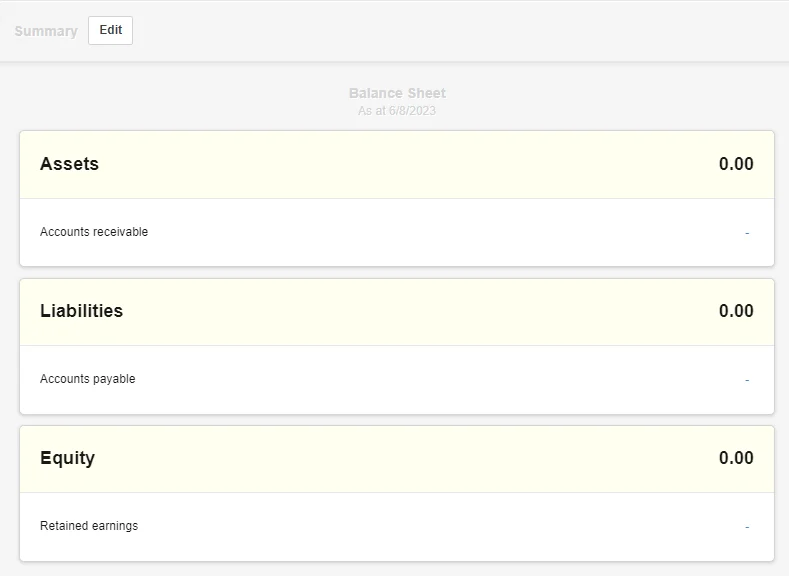

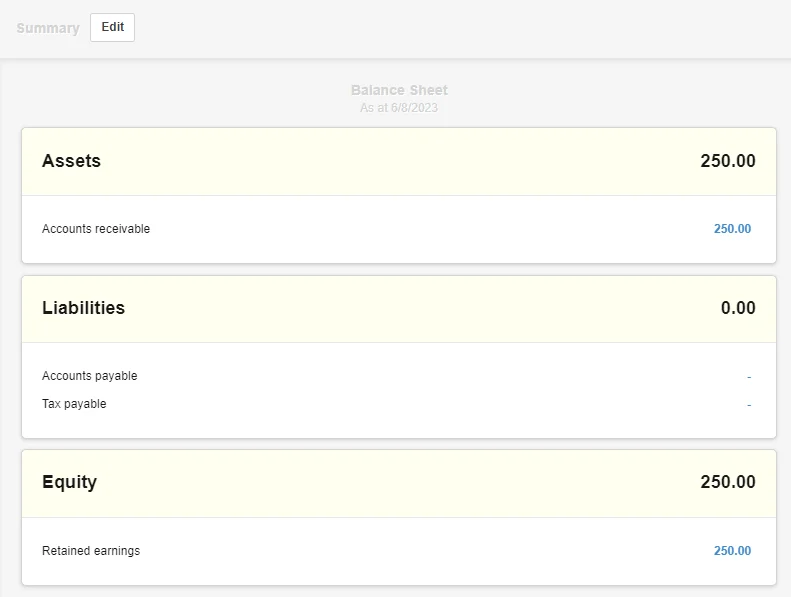

The below Summary Balance Sheet includes the Accounts Receivable account with no balances entered.

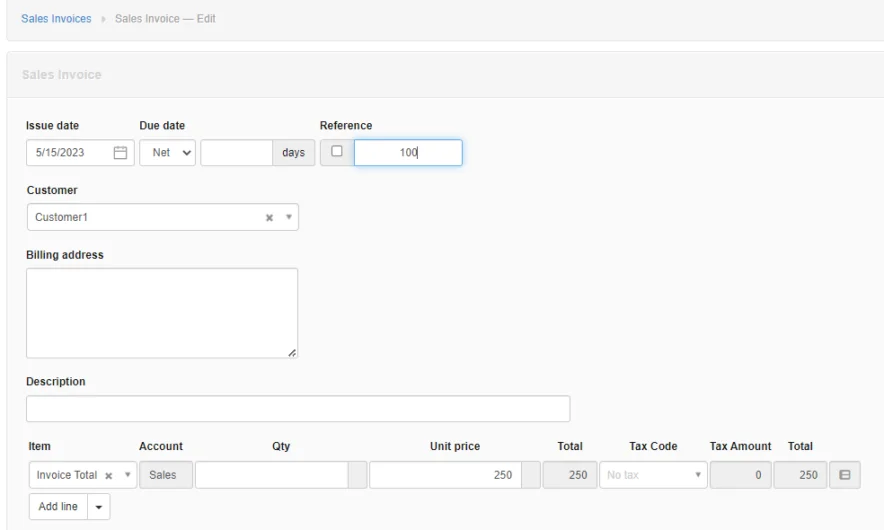

Our first invoice is Invoice Number 100 in the amount of 250 for Customer1 dated May 15 and terms of Net.

Select the Sales Invoice Tab and enter a New Invoice

- Enter Customer1

- Enter Invoice Date of May 15

- Enter Terms of Net

- Select the Item and select the Non-inventory item Invoice Total

- The assigned Sales account Sales displays

- Enter the amount of 250

Select Create

The Summary Balance Sheet now displays an Accounts Receivable Balance of 250.

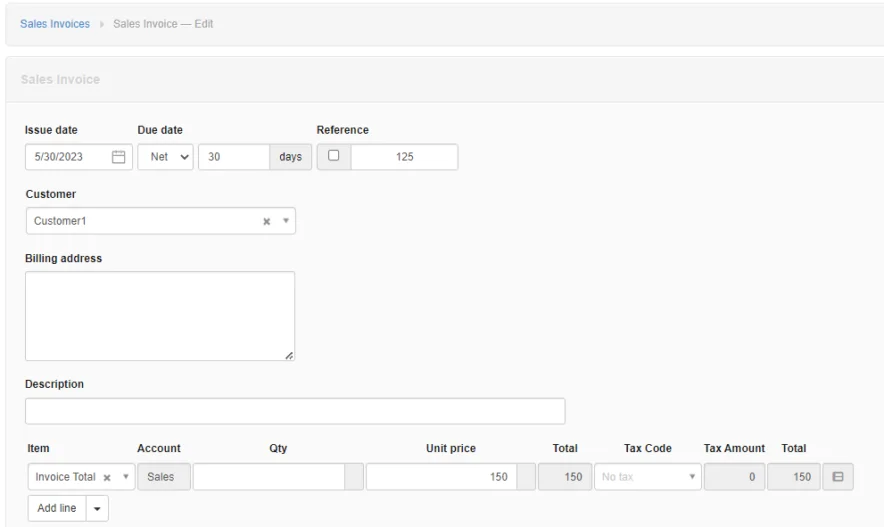

Our second invoice is Invoice Number 125 in the amount of 150 for Customer1 dated May 30 and terms of Net30.

Select the Sales Invoice Tab and enter a New Invoice

- Enter Customer1

- Enter Invoice Date of May 30

- Enter Terms of Net 30

- Select the Item and select the Non-inventory item Invoice Total

- The assigned Sales account Sales displays

- Enter the amount of 150

Select Create

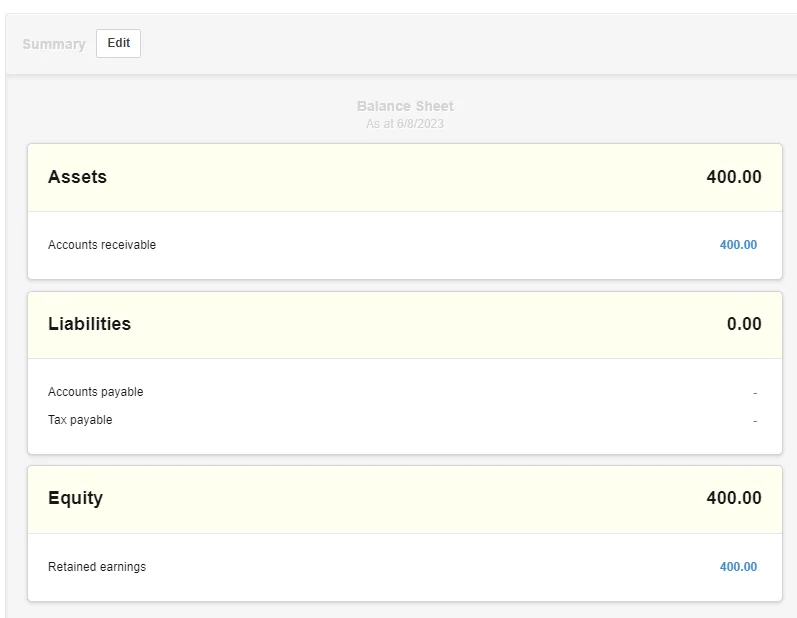

The Summary Balance Sheet now displays an Accounts Receivable Balance of 400, the total of the two invoices entered.

If you click on the Sales Invoices tab, the sales invoice listing displays the invoices entered and the total amount of 400.

Continue to do this for all your customer unpaid invoices.

Cash Method Of Accounting

If using the Cash Basis of accounting you need to create an expense account in your Chart Of Accounts named Prior Purchases and use this account for purchases instead of the Sales account used above when using the Accrual Basis.

Click On New Non-inventory item

Enter Name - Invoice Total

Enter

When Sold

When PurchasedAccount - Sales

Enter your unpaid invoices as explained above using the accrual method of accountingAccount - Prior Purchases

Note

By using a Non-inventory item no adjustments are needed when entering the inventory quantities or costs.