Debit Notes Tab

Manager Menu-Tabs > Purchase Tabs > Debit Notes Tab

Debit Notes Tab

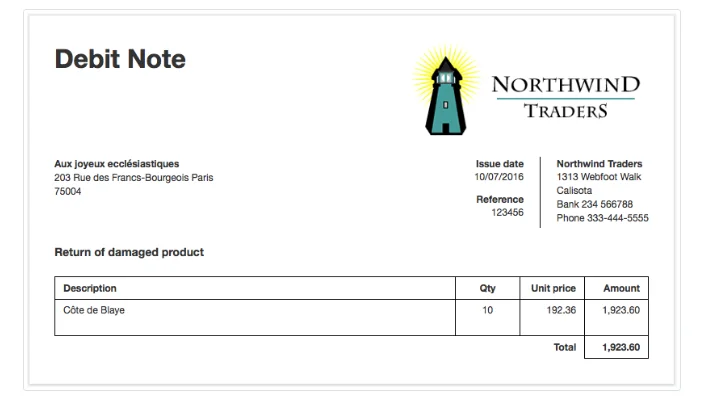

A debit note records an adjustment made by a supplier of the amount owed to that supplier by a business. Typically, a debit note is created in response to a credit note received by the business from a supplier, although not all supplier credits are formally documented. Debit notes are internal; that is, they are not normally provided to the supplier. They might be for:

- Return of goods

- Adjustment (refund) of price for goods or services previously delivered

- Overpayment of amounts billed

A debit note makes all necessary corrections to inventory, expense, and tax accounts. It does not record actual receipt of money from the supplier, but only adjusts the supplier’s balance in Accounts payable. A debit note can be created regardless of whether the supplier has yet been paid for the goods or services.

Notes

A debit note should not normally be used if the original transaction was a cash purchase, because the purchase will not have been recorded in the supplier’s subaccount in Accounts payable. In such situations, a direct receipt should usually be entered. In these cases, enter quantities returned to the supplier as negative numbers. However, if the cash seller has also been defined as a supplier and offers an account credit rather than a cash refund, a debit note may be used.

If a goods receipt originally recorded receipt of inventory items, another goods receipt must be created to record the return of goods (if any) on a debit note. In that case, enter a negative quantity on the goods receipt.

A debit note should not normally be used if the original transaction was a cash purchase, because the purchase will not have been recorded in the supplier’s subaccount in Accounts payable. In such situations, a direct receipt should usually be entered. In these cases, enter quantities returned to the supplier as negative numbers. However, if the cash seller has also been defined as a supplier and offers an account credit rather than a cash refund, a debit note may be used.

If a goods receipt originally recorded receipt of inventory items, another goods receipt must be created to record the return of goods (if any) on a debit note. In that case, enter a negative quantity on the goods receipt.

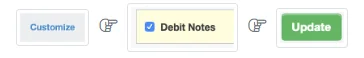

Enable the Debit Notes tab

Before debit notes can be created, the Debit Notes tab must be enabled. Click Customize below the left navigation pane, check the box for Debit Notes, and click Update below the list:

Debit notes can then be created three ways:

- Standard method

- Cloning

- Copying

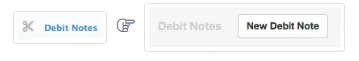

Standard method

In the Debit Notes tab, click on New Debit Note:

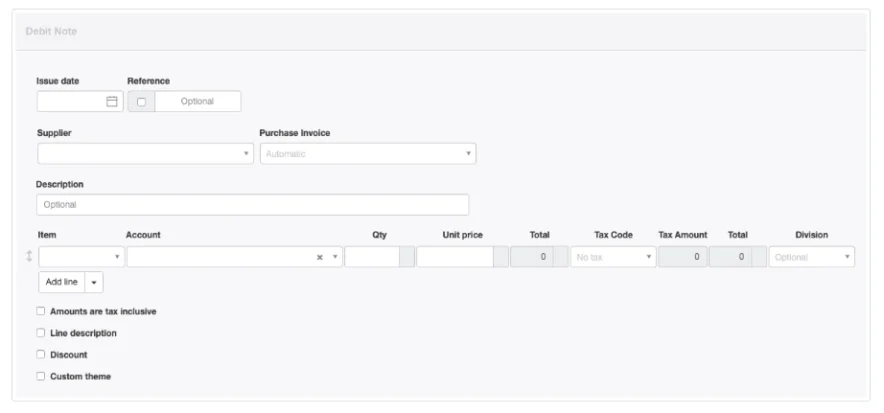

Complete the form:

- By default, today’s Issue date is prepopulated. Normally, this date is edited to match the date of the supplier’s credit note.

- Reference can be used to enter the supplier’s credit note number. If the box within the field is checked, Manager will assign a number automatically. The program will find the highest number among all existing debit notes and add 1.Caution

If automatic sequencing is used, the number assigned will be higher than any previously assigned number, including suppliers’ numbers. Therefore, best practice is to use either all suppliers’ numbers or all automatic numbers. - A previously defined Supplier must be selected in the dropdown box.

- After a supplier has been selected, the optional Purchase invoice dropdown menu includes a list of that supplier’s purchase invoices. If the debit note applies to a specific invoice, select it here.

- Line items being returned or adjusted can be completed semi-automatically by selecting predefined inventory or non-inventory items in the Item field and entering quantities. Or, they may be entered manually.

- Qty and Unit price are self-explanatory.

- An applicable Tax Code can be selected.

- A Division can be selected, if divisions have been defined. This field appears only when an Account has been selected to which divisions could apply.

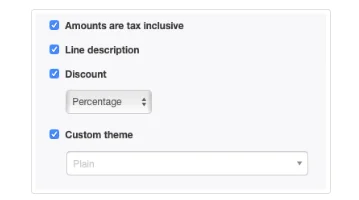

Checkboxes at the bottom of the form offer some of the same options as when creating purchase invoices. When some of these boxes are checked, additional fields appear:

- Amounts are tax inclusive lets you choose between tax-inclusive and tax-exclusive prices. If this box is checked, tax amounts are deducted from the unit price; otherwise they are added to it.

- Line description adds a Description field to each line item. Line descriptions are optional.

- If Discount is checked, further options appear for Percentage or Exact amount discounts. This selection governs the entire credit note, but discounts must be entered line item by line item.

- A Custom theme can be indicated.

Note: Additional Check Boxes have been added:

Also act as goods receipt - updates inventory

FootersSales Tax Amount Column

Save the transaction by clicking Create:

Cloning

For a repeat transaction, an existing debit note can be duplicated by cloning. While viewing the existing debit note, click Clone:

The clone can be edited before clicking Create.

Copying

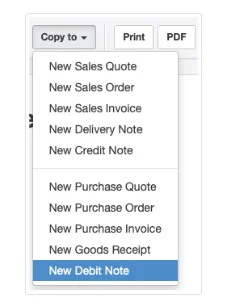

Debit notes can also be copied from other sales- or purchase-related transactions. While viewing a source transaction, click Copy to and select New Debit Note:

Relevant information will be carried over from the source transaction. However, if a sales-related transaction is copied to a debit note, customer information will not carry over.

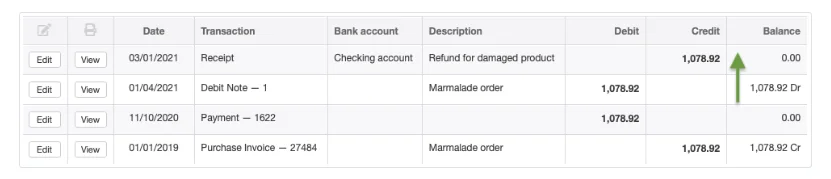

Receiving a refund

If a supplier refunds the credit balance, receive money into a bank or cash account, allocating the refund to Accounts payable and the supplier’s subaccount. When a receipt is recorded, the balance of Accounts payable to the supplier will move in the positive direction, that is, towards a credit and away from a debit balance: