Purchasing - Selling Inventory

Manager Menu-Tabs > Inventory/Products Tabs

Purchasing - Selling Inventory

Inventory comprises goods held by a business for sale or production. It does not include fixed assets, such as equipment or buildings. Nor does it include tools or consumable supplies used during operations. The value of inventory is an asset, because it can generate future income. Therefore, it appears on a company’s balance sheet. So inventory must be counted and valued. It must also be tracked as it is produced, bought, or sold.

Manager includes many features to help manage inventory. Some are essential; others are optional. Program behavior changes, depending on which tools are used.

- Inventory items are defined elements by which inventory is managed. They can have purchase and sales prices, specified tax codes to be applied, and individual units of measure. Their costs and revenues can be assigned to custom accounts. Most importantly, they have standard item codes, names, and descriptions by which they can be referenced.

- Purchase invoices record purchases of inventory items from suppliers on credit.

- Sales invoices record sales of inventory items to customers on credit.

- Goods receipts document receipt of goods at a location or from a supplier.

- Delivery notes document delivery of goods to a location or customer.

- Debit notes record return of goods to suppliers.

- Credit notes record return of goods to your business from customers.

- Cash receipts and payments record transactions of inventory items paid at the time.

- Production orders record in-house manufacture of inventory items from other inventory items and non-inventory cost inputs.

- Inventory kits are data entry shortcuts for combinations of inventory items stocked individually but sold together under a single identification. (The items may also be sold individually in other transactions.)

- Inventory locations are discrete places where inventory items are physically stored, such as different warehouses or shops.

- Inventory transfers record movement of inventory items between inventory locations.

- Inventory write-offs document the loss, damage, or other non-revenue-producing reduction of inventory.

- Inventory reports provide information on changes in quantities, values, or locations of inventory. They also list profitability and price of inventory items.

Note

Purchase orders and sales orders are not included in this discussion because they are not actual financial transactions and have no impact on inventory. They are convenient shortcuts for recording orders to suppliers or from customers. And they can by copied to other transactions that affect inventory. But in the current version of Manager, purchase orders do not adjust inventory availability or backorder status. Nor do sales orders commit inventory to a particular customer or future sales transaction.

Purchase orders and sales orders are not included in this discussion because they are not actual financial transactions and have no impact on inventory. They are convenient shortcuts for recording orders to suppliers or from customers. And they can by copied to other transactions that affect inventory. But in the current version of Manager, purchase orders do not adjust inventory availability or backorder status. Nor do sales orders commit inventory to a particular customer or future sales transaction.

Example

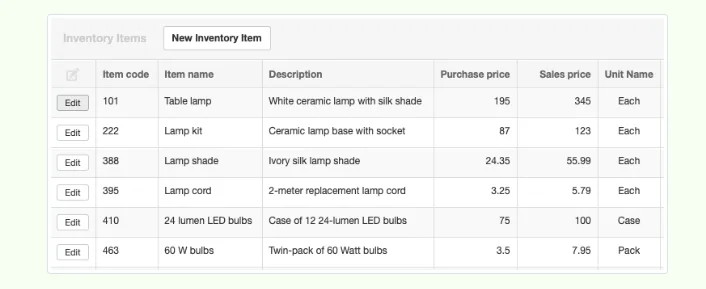

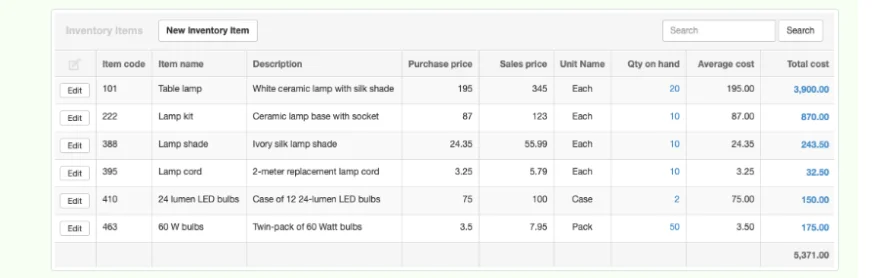

This Guide illustrates various aspects of inventory management using an example company, Brilliant Industries. Brilliant Industries sells electric lamps and lamp parts at wholesale. It is not required to collect or pay any taxes on sales or purchases in its jurisdiction. Brilliant has 6 different items in inventory and assigns 3-digit item codes:

This Guide illustrates various aspects of inventory management using an example company, Brilliant Industries. Brilliant Industries sells electric lamps and lamp parts at wholesale. It is not required to collect or pay any taxes on sales or purchases in its jurisdiction. Brilliant has 6 different items in inventory and assigns 3-digit item codes:

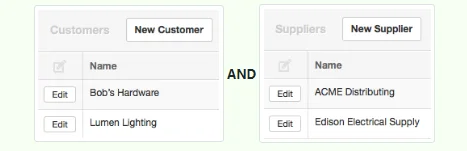

Brilliant currently has two customers and two suppliers:

So far, Brilliant Industries has enabled just three tabs related to inventory management (Reports is always enabled for all businesses):

- Customers

- Suppliers

- Inventory Items

Purchasing inventory

Inventory can be purchased with purchase invoices or cash payments.

Example

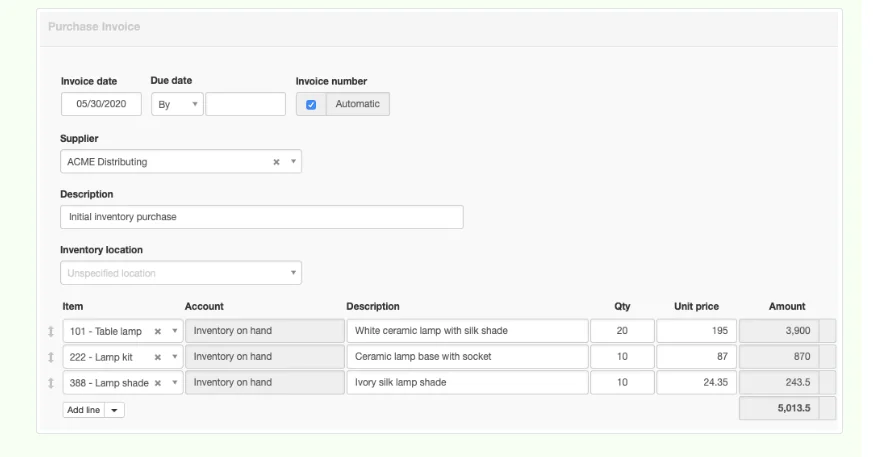

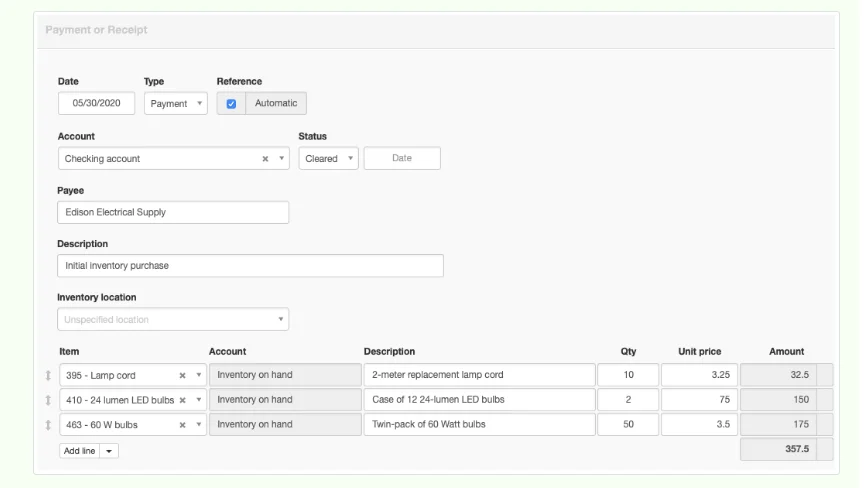

Brilliant Industries buys an initial stock of inventory via a combination of purchase invoice and cash payment. ACME Distributing presents its sales invoice upon delivery of the merchandise. So as soon as Brilliant enters the corresponding purchase invoice, the items are considered to be in stock. Edison Electrical Supply sells only over the counter. So Brilliant’s owner leaves Edison’s warehouse with purchased items in hand, having written a check on the spot.

Brilliant enables the Purchase Invoices tab. The Bank Accounts and Receipts & Payments tabs were enabled when the company’s bank account was established. (As Brilliant enables tabs, it sets up all forms for automatic sequential reference numbers under Form Defaults.) The two transactions are entered as below:

Brilliant Industries buys an initial stock of inventory via a combination of purchase invoice and cash payment. ACME Distributing presents its sales invoice upon delivery of the merchandise. So as soon as Brilliant enters the corresponding purchase invoice, the items are considered to be in stock. Edison Electrical Supply sells only over the counter. So Brilliant’s owner leaves Edison’s warehouse with purchased items in hand, having written a check on the spot.

Brilliant enables the Purchase Invoices tab. The Bank Accounts and Receipts & Payments tabs were enabled when the company’s bank account was established. (As Brilliant enables tabs, it sets up all forms for automatic sequential reference numbers under Form Defaults.) The two transactions are entered as below:

Since all transactions were complete when they were entered, there is no need for Brilliant Industries to enable the Goods Receipts tab. The Inventory Items list shows the results of the two purchases:

Average cost

Manager employs the perpetual average cost method for inventory valuation. This method divides the total acquisition cost of units of an inventory item in stock by the number of that item in stock. Thus, if more units are acquired at a cost higher than the current average cost, the average cost of all units will go up, no matter how many units are acquired or in stock or what their individual costs were.

When items are produced, the cost of inventory consumed is transferred to the new finished goods at the average cost of each input item. Any non-inventory costs are also apportioned among the finished goods.

Producing inventory

When inventory items are produced in-house, production orders record consumption of resources and output of new finished goods.

Example

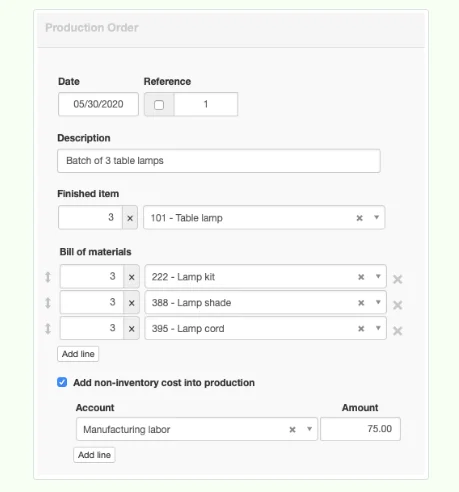

Brilliant Industries can buy finished table lamps from ACME Distributing. But it can also produce them from parts purchased from various suppliers. It decides to manufacture a batch of 3 table lamps. So it enables the Production Orders tab and enters the following production order:

Brilliant Industries can buy finished table lamps from ACME Distributing. But it can also produce them from parts purchased from various suppliers. It decides to manufacture a batch of 3 table lamps. So it enables the Production Orders tab and enters the following production order:

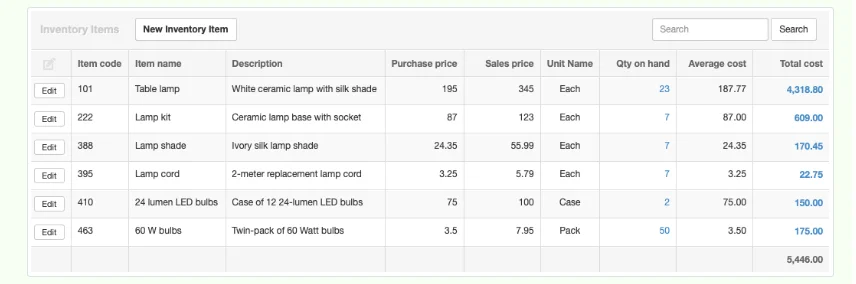

The inventory listing shows the increase in finished table lamps, as well as reductions in the three items that went into production. Also notice that average cost of table lamps has declined because of the production order. The cost of input items for a lamp (87.00 + 24.35 + 3.25 = 114.60) plus labor (75.00 / 3 = 25.00) is less (139.60) than the purchase cost of a finished lamp (195.00). In other words, Brilliant Industries can assemble table lamps itself for less than it can buy them, potentially allowing more profit:

Also note that total value of inventory has risen because of the 75.00 labor cost to manufacture 3 lamps. The company now has more invested in its inventory. But it can also sell that same inventory for much more because of the value added through manufacturing operations.

Selling inventory

Inventory can be sold with sales invoices or cash receipts.

Example

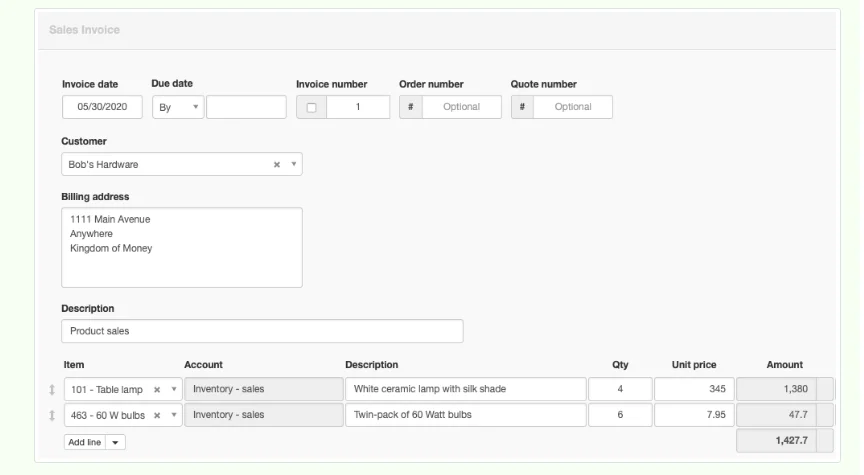

Brilliant Industries sells products to Bob’s Hardware. It enables the Sales Invoices tab and records the sale on the following sales invoice:

Brilliant Industries sells products to Bob’s Hardware. It enables the Sales Invoices tab and records the sale on the following sales invoice:

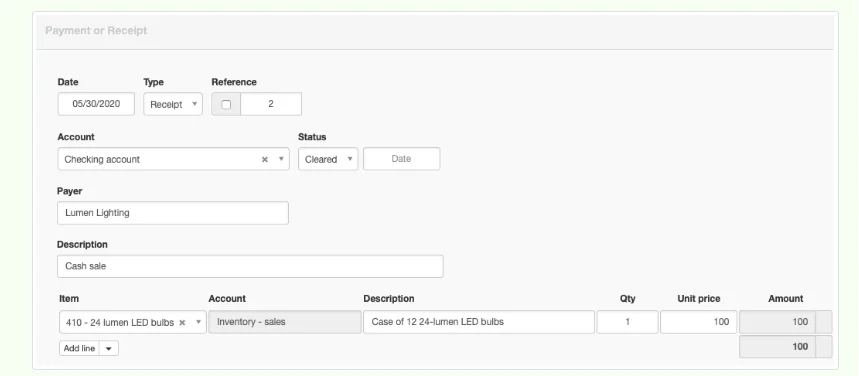

It also sells 1 case of LED bulbs to Lumen Lighting for cash, and enters that transaction as a receipt:

Quantities on hand have decreased for table lamps, 60 Watt bulbs, and LED bulbs:

Because the goods were delivered immediately and either accompanied by a sales invoice or a cash receipt, Brilliant Industries did not use the Delivery Notes tab. Manager treated all inventory movements as having happened immediately.

Understanding backorders

When you have sold more inventory items than you own (have on hand) the situation is described as a backorder. That term is somewhat misleading, because additional stock has not necessarily been ordered. This situation shows up in Manager as negative inventory quantities. The negative quantity indicates how many units of the inventory item must be purchased or produced to satisfy existing sales.

Example

If Brilliant Industries had sold 3 cases of LEDs to Lumen Lighting in the previous example, a backorder situation would exist, because only 2 had been purchased and were on hand. The inventory list would show a quantity on hand of -1:

If Brilliant Industries had sold 3 cases of LEDs to Lumen Lighting in the previous example, a backorder situation would exist, because only 2 had been purchased and were on hand. The inventory list would show a quantity on hand of -1:

Notice that total cost of this item has dropped to zero, and average cost is non-existent because there is no inventory.