Early Payment Discounts

Manager Menu-Tabs > Cash Tabs

Recording Early Payment Discounts

An early payment discount is a reduction of the balance due on a sales invoice offered to a credit customer for payment by a deadline earlier than the regular due date. Early payment discounts are usually offered as an incentive for faster payment and to minimize carrying costs of receivables. Procedures for offering early payment discounts are covered in another Guide.

Example

Brilliant Industries regularly extends credit to customers by issuing sales invoices net 30 days. In other words, the due date on each new invoice is 30 days in the future. But it offers a 5% early payment discount if customers pay within 10 days.

Brilliant Industries regularly extends credit to customers by issuing sales invoices net 30 days. In other words, the due date on each new invoice is 30 days in the future. But it offers a 5% early payment discount if customers pay within 10 days.

Early payment discounts are recorded in two steps:

- Entering the reduced receipt

- Creating a credit note to adjust account balances

Entering the receipt

When entering a receipt from a customer paying early, enter the amount actually paid, posting to Accounts receivable and the customer’s subaccount and invoice number. Do not apply any tax code. (The program will not let you, because tax was applied on the sales invoice.) Manager will automatically determine whether the payment qualifies for any early payment discount. If so, the discount will be shown on the sales invoice.

Example

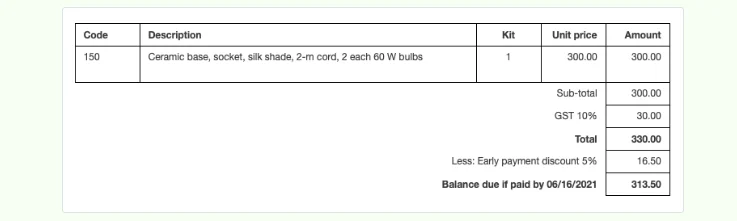

Brilliant Industries raises a sales invoice to Bob’s Hardware for 300.00 for a lamp kit. 10% tax is added. A 5% early payment discount is offered. The sales invoice looks like this:

Brilliant Industries raises a sales invoice to Bob’s Hardware for 300.00 for a lamp kit. 10% tax is added. A 5% early payment discount is offered. The sales invoice looks like this:

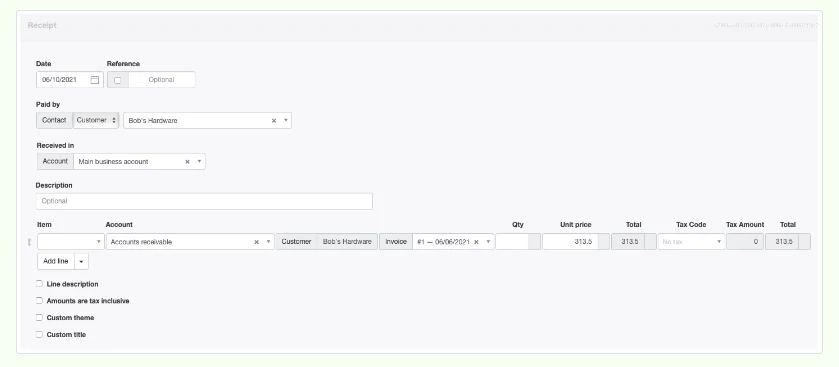

Bob’s Hardware pays 313.50 before the deadline. The receipt is entered as described:

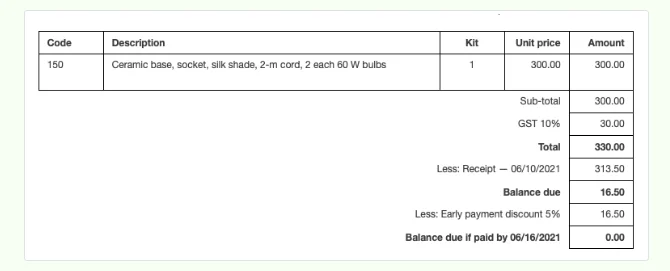

Manager determines the payment qualifies for the early payment discount and applies the discount to the sales invoice

Creating the credit note

At this point, the transaction is not yet complete. Although the early payment discount has been recorded against the sales invoice, balances of Accounts receivable and applicable income accounts have not been reduced. That must be accomplished via a credit note.

Note

The label, “Balance due if paid by …,” and the accompanying zero amount serve as a reminder the transaction is not complete. The format may seem unusual, but the sales invoice should never be sent to a customer at this stage.

The label, “Balance due if paid by …,” and the accompanying zero amount serve as a reminder the transaction is not complete. The format may seem unusual, but the sales invoice should never be sent to a customer at this stage.

The next time the Credit note tab is entered, a banner shows, indicating at least one sales invoice has a pending early payment discount:

After the banner is clicked, any credit notes required from pending early payment discounts are listed for review. Click Create. The Credit Notes tab is automatically enabled, if it is not already. Any necessary credit notes are created. Accounts receivable for the customer(s) involved and the relevant income account(s) are adjusted.

Example

Brilliant Industries clicks the notification banner and sees that Invoice #1 for Bob’s Hardware has a pending early payment discount:

Brilliant Industries clicks the notification banner and sees that Invoice #1 for Bob’s Hardware has a pending early payment discount:

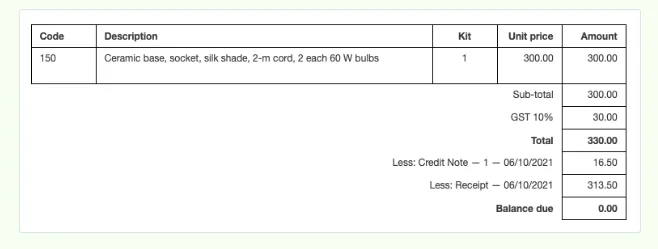

It clicks Create and recording of the receipt with early payment discount is complete. The final form of the sales invoice eliminates the reminder text, displaying more conventional information:

Note

By default, discounts on the credit note are posted to the same accounts as corresponding, original line items, using the same tax codes. These can be edited, though there is usually no need to do so. When the discount is a percentage, all line items are discounted by that same percentage. When a fixed-amount discount is involved, line items are discounted by proportionate amounts.

By default, discounts on the credit note are posted to the same accounts as corresponding, original line items, using the same tax codes. These can be edited, though there is usually no need to do so. When the discount is a percentage, all line items are discounted by that same percentage. When a fixed-amount discount is involved, line items are discounted by proportionate amounts.

Caution

In most jurisdictions, an early payment discount is considered a price reduction, because it was offered as a condition of the sale. So tax is due only on the reduced price of goods or services. But in some jurisdictions, tax may be due on the original sale price. In that case, remove the tax code on the discounted line item(s) on the credit note. You will then be paying the tax on behalf of your customer, a factor that should be considered when determining your early payment discount offer. Check with a local accountant or tax authority to confirm which situation applies.

In most jurisdictions, an early payment discount is considered a price reduction, because it was offered as a condition of the sale. So tax is due only on the reduced price of goods or services. But in some jurisdictions, tax may be due on the original sale price. In that case, remove the tax code on the discounted line item(s) on the credit note. You will then be paying the tax on behalf of your customer, a factor that should be considered when determining your early payment discount offer. Check with a local accountant or tax authority to confirm which situation applies.