Adjust Billable Time

Manager Menu-Tabs > Billable Time- Expenses

Adjust Billable Time

Sometimes, you learn a customer will not reimburse you for billable time. Or you decide not to bill the customer for the full amount (or any) of time spent on a project. These situations can happen before, during, or after invoicing. When they do, you will need to write off or write down the billable time. Several paths are open to you.

Before invoicing

Complete write-off

To abandon any attempt at billing the time the customer, go to the Billable Time tab:

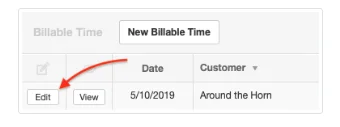

Find the billable time to be written off and click Edit:

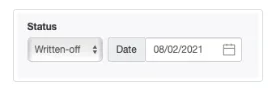

Change the Status field from Uninvoiced to Written-off. A Date field will appear:

Click Update to save the change.

From an accounting point of view, the billable time was a recoverable asset from the date it was recorded until you decided it should be written off because it was imputed income. When it is written off, it becomes worthless. The amount will be removed from the Billable time asset and Billable time - movement accounts. The record will, however, remain in the Billable Time tab.

Partial write down

If, for some reason, you decide to eventually invoice the customer for only part of the billable time, you can simply Edit the time entry. Reduce either the time spent or rate by an appropriate amount.

During invoicing

While creating a sales invoice with billable time from the Customers tab, you can write off or write down any billable time line item. First, follow the invoicing procedures described in another Guide. When the new sales invoice appears, immediately click the Edit button at the top of its view screen:

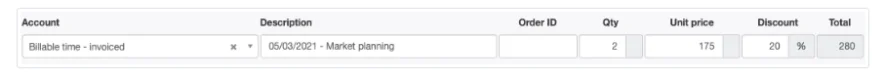

Check the Discount box. Select Percentage or Exact amount and enter the discount, 20% in this example:

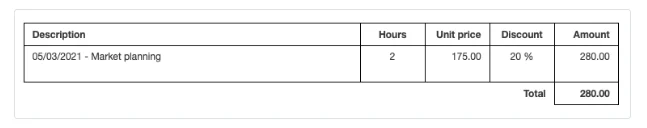

A 100% discount is financially equivalent to a complete write-off. A lower percentage means you are absorbing some of the customer’s expense, but not all. Either way, the sales invoice will indicate the discount you are providing the customer:

After invoicing

After invoicing, billable time is no different financially from any other invoice line item. If it cannot be recovered from the customer, it must eventually be written off or written down. This can be done by writing it off as a bad debt with a journal entry or by reducing the customer’s obligation with a credit note.

Write off as a bad debt

Writing off billable time converts it from an asset in Accounts receivable to an expense in your bad debts account. See another Guide for instructions on writing off bad debts. Note, in particular, that the journal entry will not write off billable time explicitly. Instead, it will write off all or a portion of Accounts receivable to the bad debts account.

You can however, use more than one expense account to post bad debts. If desired, you could add an account specifically for unrecoverable time billing and post billable time there as you write it off or down. Or, you could post it to ordinary expense accounts according to the nature of the time. For example, an unrecoverable travel time entry could be written off to your own wages account.

Write down with a credit note

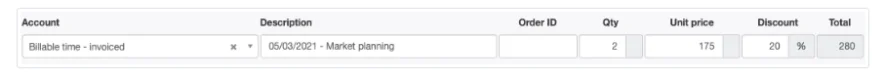

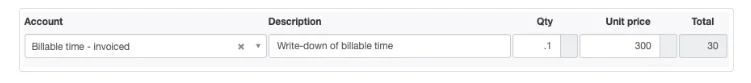

You can use credit notes to reduce specific amounts owed on sales invoices for unrecoverable billable time. The income from billable time was moved from the Billable time - movement income account to the Billable time - invoiced income account when the sales invoice was created. Manager will allow you post a credit note line item to Billable time - invoiced:

Such an entry reduces the balance in Accounts receivable for the customer selected. If the sales invoice number is selected on the credit note, the write-down will be applied to that specific invoice. Otherwise, it will be available for general application to amounts owed by the customer.