Invoice Billable Expenses

Manager Menu-Tabs > Billable Time- Expenses

Invoice Billable Expenses

Manager can directly invoice billable expenses.

When you first record a billable expense, its status will be set to Uninvoiced.

To invoice billable expenses to a customer, go to the Customers tab:

Under the Uninvoiced column, click the amount for the customer you are invoicing.

If the Uninvoiced column does not display, click the link for instructions.

Example

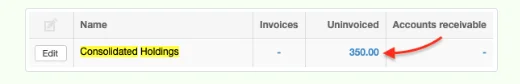

Sample Manufacturing searches for Consolidated Holdings, then clicks the uninvoiced balance:

Sample Manufacturing searches for Consolidated Holdings, then clicks the uninvoiced balance:

Select the items you want to bill to the customer, then click New Sales Invoice.

Example

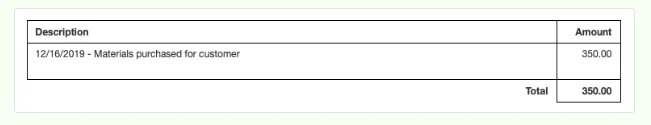

Sample selects the billable expense entry for 350 and clicks the button:

Sample selects the billable expense entry for 350 and clicks the button:

Notes

If a debit note was posted to Billable expenses covering any of the billable expenses to be invoiced, be sure to check the box for its negative entry, too. Otherwise, you will be overbilling your customer.

If you have also entered billable time for the customer, those entries will appear in the same list and can be selected for invoicing along with billable expenses. A sales invoice will be created instantly. The billable expense amount on the sales invoice is posted to Billable expenses - invoiced. The asset value in Billable expenses is transferred to the Billable expenses - cost expense account.

If a debit note was posted to Billable expenses covering any of the billable expenses to be invoiced, be sure to check the box for its negative entry, too. Otherwise, you will be overbilling your customer.

If you have also entered billable time for the customer, those entries will appear in the same list and can be selected for invoicing along with billable expenses. A sales invoice will be created instantly. The billable expense amount on the sales invoice is posted to Billable expenses - invoiced. The asset value in Billable expenses is transferred to the Billable expenses - cost expense account.

Example

Samples’ sales invoice lists the date and amount of the billable expense:

Samples’ sales invoice lists the date and amount of the billable expense:

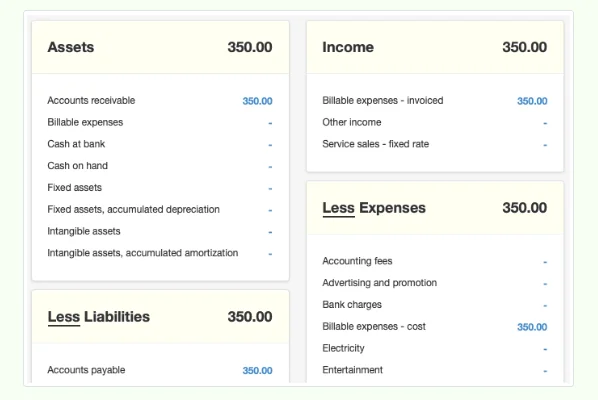

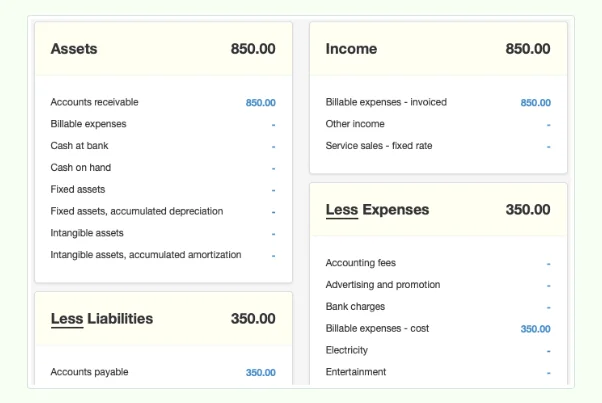

The financial statements (stripped of other transactions) show the results:

If you wish to modify the sales invoice—adding other line items, applying a discount, marking the expenses up for additional profit or down to forego expense recovery, or applying a tax code—click Edit. Make the changes, then click Update. Changing billable expense amounts on a sales invoice affects only the amount posted to Billable expenses - invoiced. The asset transfer to Billable expenses - cost remains the same. Any difference between the original cost and the invoiced amount will be reflected in net profit.

Example

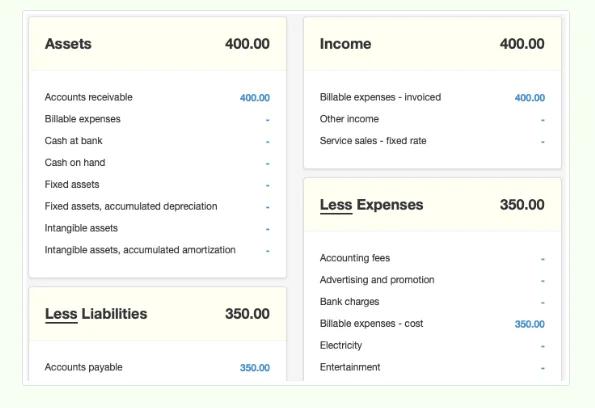

Sample Manufacturing decides to mark up the billable expense to 400, so it edits the sales invoice. The financial statements show the result:

Sample Manufacturing decides to mark up the billable expense to 400, so it edits the sales invoice. The financial statements show the result:

Adding billable expenses to a sales invoice

A billable expense can also be recorded directly on an existing sales invoice. This approach can be used when a billable expense is anticipated, but has not been incurred. It can also be used when the billable expense has been recorded but is forgotten during the normal invoicing process. You cannot post directly to Billable expenses on a sales invoice. Instead, post the line item to Billable expenses - invoiced. This bypasses the Billable expenses account and posts the billable expense directly to the Billable expenses - invoiced income account and Accounts receivable. Adding expense before the purchase if no purchase has yet been recorded, the invoiced billable expense will be pure revenue.

Example

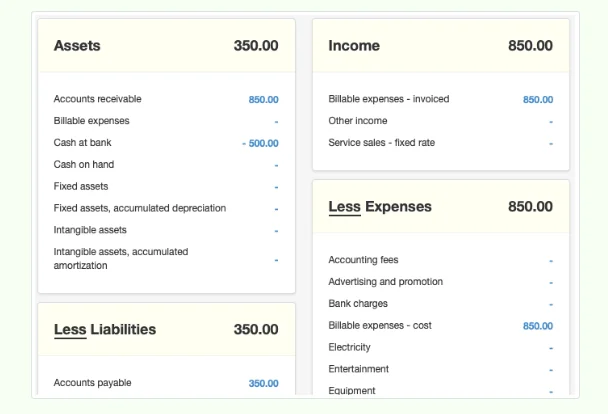

Sample knows it will pay a 500 meeting expense on behalf of Consolidated Holdings, so it adds that billable expense onto the sales invoice for 350 just created. Financial statements reveal higher income, but not higher costs:

Sample knows it will pay a 500 meeting expense on behalf of Consolidated Holdings, so it adds that billable expense onto the sales invoice for 350 just created. Financial statements reveal higher income, but not higher costs:

Later, when recording the purchase for the billable expense, post the line item to Billable expenses Customer Invoice. The cost of the billable expense will appear in the Billable expenses - cost expense account.

Example

Sample Manufacturing later pays the meeting expenses, allocating the payment as described above. The financial statements reflect the change to Billable expenses - cost and Cash at bank shows the offsetting credit:

Sample Manufacturing later pays the meeting expenses, allocating the payment as described above. The financial statements reflect the change to Billable expenses - cost and Cash at bank shows the offsetting credit:

Adding expense after the purchase

If a billable expense has already been recorded, but is added to a sales invoice directly rather than through the normal process, revisit the original purchase transaction and select the sales invoice to which it was added. The expense will then be removed from Billable expenses and posted to Accounts receivable, Billable expenses - invoiced, and Billable expenses - cost.

Caution

If the pre-existing purchase transaction is not revisited and edited as described above, the billable expense will remain in the Billable expenses account. This will erroneously inflate your net income and overstate your assets.

For this reason, it is always best to enter billable expenses before creating a sales invoice in the Customers tab. Then, be sure to select all desired billable expenses before creating the sales invoice.

If the pre-existing purchase transaction is not revisited and edited as described above, the billable expense will remain in the Billable expenses account. This will erroneously inflate your net income and overstate your assets.

For this reason, it is always best to enter billable expenses before creating a sales invoice in the Customers tab. Then, be sure to select all desired billable expenses before creating the sales invoice.