Capital Accounts

Manager Settings > Accounts and General Ledger > Capital Accounts

Capital Accounts

Capital accounts track contributions from, distributions of earnings to, and drawings of owners or others with financial interests in a business entity. They can be adapted to suit any type of entity, including sole proprietors, partnerships, corporations, trusts, and funds.

To set up capital accounts, enable the Capital Accounts tab. The tab will appear in the left navigation pane. The number in the window indicates the number of capital accounts established:

Notes

Manager automatically creates the Retained earnings account. The starting balance of the Retained earnings account is determined automatically by the program as other starting balances are entered.

To set up types of ownership such as Partnerships and LLCs, Click on the Capital Accounts tab.

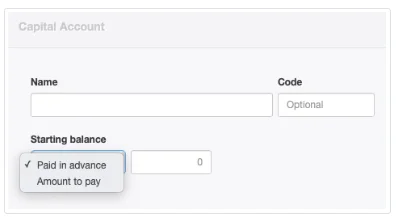

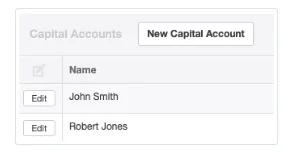

In the Capital Accounts tab, click New Capital Account to define a member or owner of a capital account:

- Name is the owner of the capital account.

- Code is optional and can be any alphanumeric entry.

Starting balances are no longer entered using this form.

Click Create to save.

Sole proprietorships require only a single capital account. Partnerships and Limited Liability Companies (LLC's) require a capital account for each partner or member. Trusts require one for each beneficiary. Funds require a capital account for each member. Repeat the process described until all capital accounts have been established:

If capital account members leave the company, they cannot simply be deleted, because there are transactions that reference them. Instead, make them inactive by editing them and checking the Inactive box:

Inactive members appear in gray at the end of the Capital Accounts list. They can be reactivated after clicking the Edit button.

By default, all capital accounts are combined as Capital accounts in the Equity section of the Balance Sheet.

Capital Sub-Accounts

Each capital account you create automatically has the following subaccounts:

- Drawings

- Funds contributed

- Share of profit

Subaccounts are useful for segregating movements to and from capital accounts. Default subaccounts are sufficient for most businesses, but you can add, remove or rename subaccounts under the Settings tab by selecting Capital subaccounts:

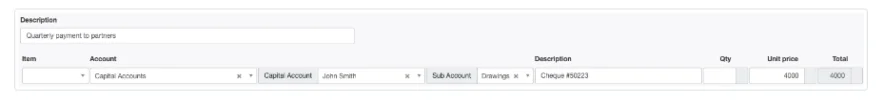

Drawings

Drawings tracks money a partner, beneficiary, or member withdraws from the business. When you transfer funds from a bank account to a member, or if the business pays a private expense on behalf of a member, the transaction should be posted to the Drawings subaccount:

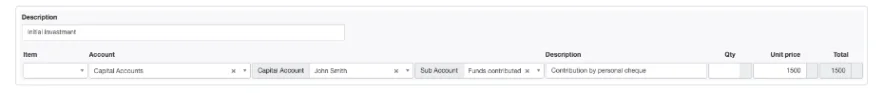

Funds contributed

Funds contributed tracks money a member has contributed to the business. When a member deposits personal funds into a business account, the transaction should be posted to the Funds contributed subaccount:

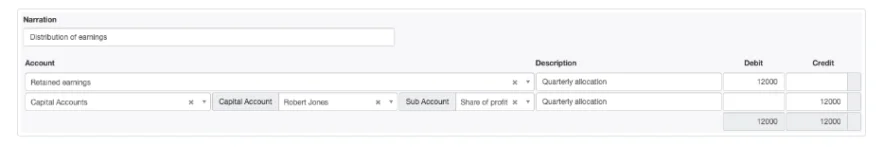

Share of profit

Share of profit is used to allocate net profit from Retained earnings to Capital accounts. Only certain types of legal entities are required to distribute profit to owners. Such distributions are often done by an accountant at the end of a financial period using journal entries:

They prevent earnings from accumulating endlessly in Retained earnings. Such distributions show that funds are no longer available for general business operations, but have been earmarked for the capital account owner.

They prevent earnings from accumulating endlessly in Retained earnings. Such distributions show that funds are no longer available for general business operations, but have been earmarked for the capital account owner.

Capital (Equity) Accounts for Corporations

Corporations are made up of many owners called shareholders and do not heve to use subaccounts.

To setup Corporations, you use the Settings tab and you do not need to enable the Capital Accounts Tab.

Corporation Equity Accounts

Common stock represents the owners’ or shareholder’s investment in the business as a capital contribution. This account represents the shares that entitle the shareholders to vote and their residual claim on the company’s assets. The value of common stock is equal to the par value of the shares times the number of shares outstanding. For example, 1 million shares with $1 of par value would result in $1 million of common share capital on the balance sheet.

Additional Paid-In Capital represents any amount paid over the par value paid by investors for stocks purchases that have a par value. This account also holds different types of gains and losses resulting in the sale of shares or other complex financial instruments.

Example: The company issues 100,000 $1 par value shares for $10 per share. $100,000 (100,000 shares x $1/share) goes to common stock, and the excess $900,000 (100,000 shares x ($10-$1)) goes to Contributed Surplus.

Retained Earnings is the portion of net income that is not paid out as dividends to shareholders. It is instead retained for reinvesting in the business or to pay off future obligations.

Dividends are the payments paid by a company to its shareholders out of its profits. This account is a "temporary account" closed into the retained earnings account at the end of the accounting period.

Setting Up Corporation Equity Accounts:

Go to the Settings tab and click on the Chart of Accounts Icon

Note

These accounts are what Manager considers as Ordinary Accounts

Starting balances can be entered now as you add the accounts or later - I prefer later and enter all the starting balances at the same time

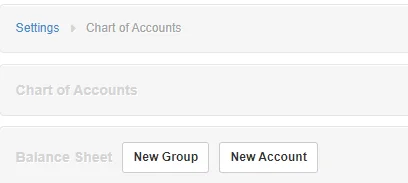

Click on Balance Sheet New Account

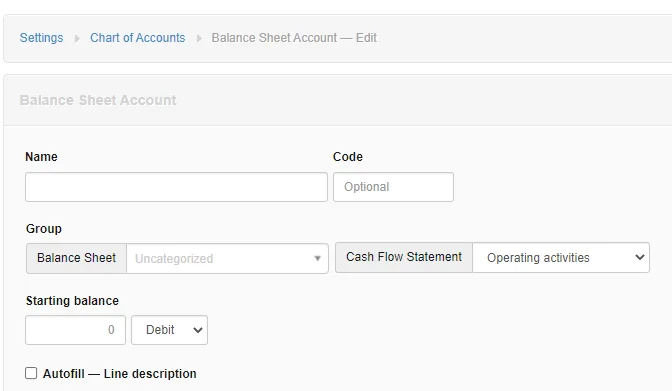

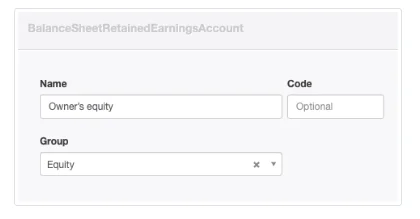

Account Entry Screen Appears

Note: Starting Balances are no longer entered using this form.

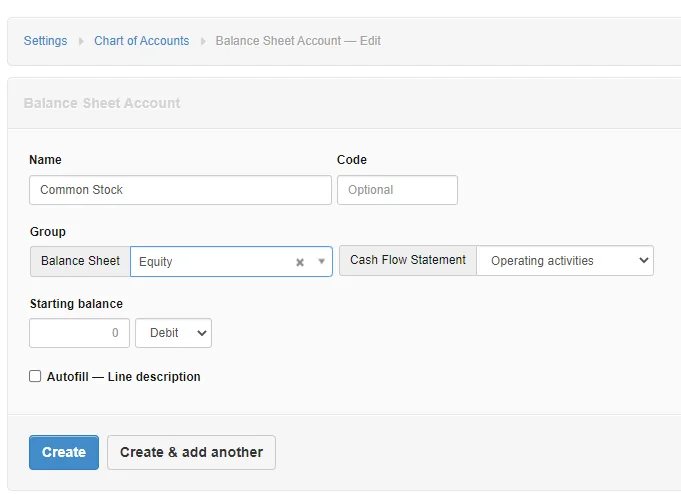

Enter your information:

- Name

- Code - Optional

- Group - Enter Equity for all the accounts

- Starting Balance

Create your corporation capital accounts:

Note

Manager automatically creates the Retained Earnings account

Common Stock

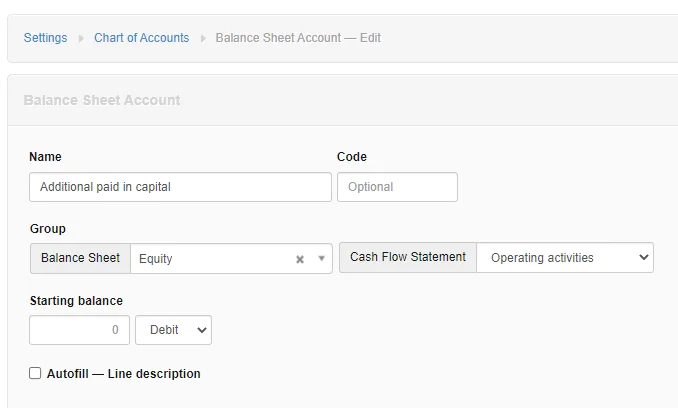

Additional paid in capital

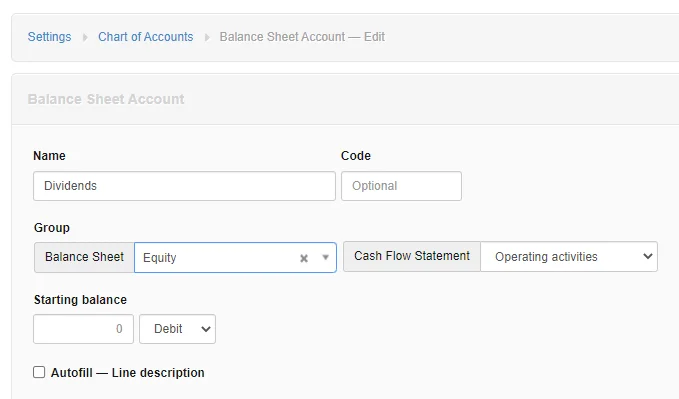

Dividends

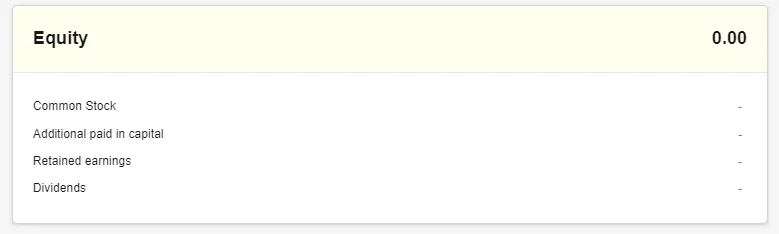

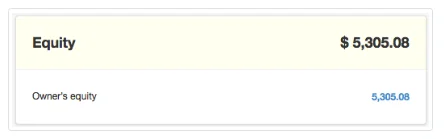

After adding these accounts, your Equity Section of the Balance Sheet displayed on the Summary page should look like the following:

Simplify Capital Accounts

Many small businesses are owned by a single person, often called a sole trader or sole proprietor. But Manager’s default account structure accommodates other, more intricate business organizations. So it may encourage more complexity in the chart of accounts than necessary.

Every new business created in Manager automatically includes a Retained earnings account, essentially the net of all inflows and outflows, adjusted for various transfers, dividends, etc., since creation of the business. In many cases, the Capital Accounts tab is also enabled, where members (owners of capital accounts) are designated, investment contributions and draws are recorded, and so forth. Frequently, journal entries transfer amounts between Retained earnings and various subaccounts of Capital accounts. And both Retained earnings and Capital accounts are included under the Equity heading on the Balance Sheet. But for the sole proprietor, things can often be simpler.

As sole owner of the business, a proprietor owns the Retained earnings account. So no real reason for separate capital accounting exists. Retained earnings can be renamed as Owner’s equity, eliminating the need for other equity accounts. Benefits include fewer tabs enabled in Manager and reduction of equity transfers with journal entries. Unnecessary reports disappear from the Reports tab. Any transactions that might have involved Capital accounts can instead be allocated directly to Owner’s equity, bypassing needless steps.

Eligibility for simple equity accounting

You must satisfy two requirements to use this simple equity accounting:

- You must be the sole owner of the business, with no partners or shareholders involved.

- You must personally be entitled to all profits and liable for all debts of the business. (Loans are permissible, but outside investors with capital interests are not.)

Setting up simple equity accounting

Rename Retained earnings under Settings Chart of Accounts:

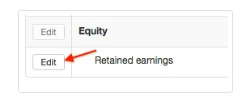

Click Edit to the left of the Retained earnings account name:

Rename the account as Owner’s equity. Add an account code if desired. Click Update when finished:

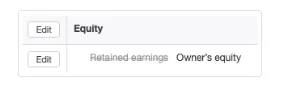

Your chart of accounts will now show the new name, with the original, default name in gray strike-through text, revealing the automatic origin of the account:

Your Balance Sheet will show a very straightforward equity account structure:

In essence, Owner’s equity shows how much value you have invested in your business at a given moment, taking into account all forms of assets and liabilities, including unbilled time and expenses, cash and equivalents, fixed assets, loans, accounts payable and receivable, and so forth.

Note

One characteristic of this simple equity structure is absence of a drawing account revealing how much you have drawn from the business since the previous accounting period closed. (Drawing accounts are normally zeroed out at the end of each period, requiring more transactions.) A drawing account is unnecessary because the information is more readily available in Manager in the Statement of Changes in Equity report. Follow three simple steps:

One characteristic of this simple equity structure is absence of a drawing account revealing how much you have drawn from the business since the previous accounting period closed. (Drawing accounts are normally zeroed out at the end of each period, requiring more transactions.) A drawing account is unnecessary because the information is more readily available in Manager in the Statement of Changes in Equity report. Follow three simple steps:

- Post all draws to Owner’s equity.

- Enter the description Draw for withdrawal line items.

- Create a Statement of Changes in Equity report in the Reports tab covering the full account period.

The sum of your draws to date during the accounting period will appear as a single total in the report. Current information will always be just a few clicks away.