Ordinary Accounts

Manager Settings > Accounts and General Ledger

Ordinary Accounts

Some accounts in your chart of accounts are present by default when you add a business and cannot be deleted. Others are activated as various tabs are enabled and remain unless the tab is disabled (which is only possible if no transactions have been entered within it). Still others are control accounts with subsidiary ledgers.

When necessary, you can add an ordinary account to either your Balance Sheet or Profit and Loss Statement. These accounts stand on their own and are not dependent upon any other tab or account. Sometimes, they are referred to as custom accounts, because you customize them as required. Ordinary accounts offer more flexibility than automatic, control, or other built-in accounts.

Ordinary accounts are added under Settings Chart of Accounts:

Add a Balance Sheet Account

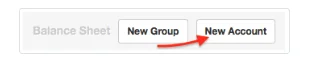

Click on New Account on the Balance Sheet side of the chart of accounts:

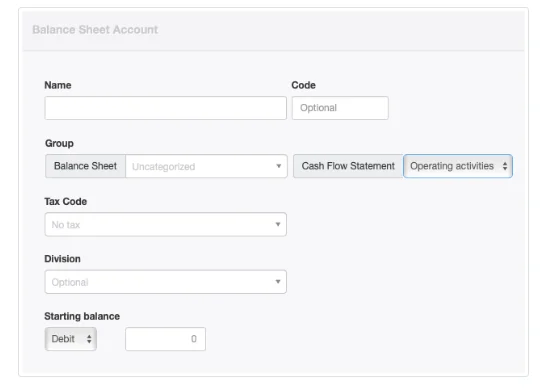

Define the account:

- Name should be a short description of the account’s purpose.

- Code is optional. See another Guide for more information on account codes.

- Choose the Group under which the account will be reported. (Groups must be defined before accounts can be assigned to them.)

- Cash Flow Statement lets you select the category where the account will be reported on the Cash Flow Statement report. Options include Operating activites, Investing activites, and Financing activities.Note

Some automatic or built-in accounts can only be reported under one category. In such cases, the Cash Flow Statement menu does not appear. - Select a Tax Code if all or most transactions posted to this account will have the same tax code applied. For Balance Sheet accounts, this field is often left blank. The field will not appear unless at least one tax code has already been defined under Settings.

- Select a Division if the balance of this account will belong to only one division. Leave the default, Optional, selection if the balance applies to the entire business. This field also will not appear unless at least one division has been defined.

Note:

Starting Balances are no longer entered using this form.

Click Create to save the new account.

Add a Profit and Loss Statement account

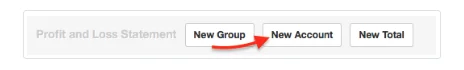

Click on New Account on the Profit and Loss Statement side of the chart of accounts:

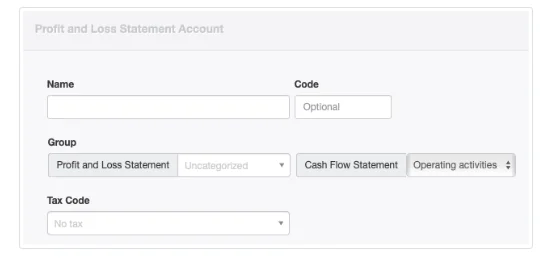

Define the account:

Fields available for Profit and Loss Statement accounts have the same purpose as similarly named fields for Balance Sheet accounts.

A Tax Code is more commonly selected for Profit and Loss Statement accounts than for Balance Sheet accounts, because income and expense transactions posted to them are more frequently subject to the same taxes. The Tax Code field is, nevertheless, optional.

Click Create when finished.