Inventory Adjustments Tabs

Manager Menu-Tabs > Inventory/Products Tabs > Inventory Adjustments Tab

Inventory Write-offs

Write off inventory to record loss, damage, obsolescence, conversion to internal use, or other non-revenue reductions of inventory. When inventory items are written off, they are no longer available for sale or production, so they are no longer assets in the Inventory on hand account. Their value must be transferred to some expense account. This is done in the Inventory Write-offs tab.

Example

ACME Distributing gives away samples of its products at trade shows. To keep inventory records accurate, it writes off the items, allocating the expense to a Trade show advertising account. The balance of Inventory on hand declines.

ACME Distributing gives away samples of its products at trade shows. To keep inventory records accurate, it writes off the items, allocating the expense to a Trade show advertising account. The balance of Inventory on hand declines.

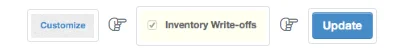

Enable the Inventory Write-offs tab

Click Customize below the left navigation pane, check the box to enable Inventory Write-offs, and click Update:

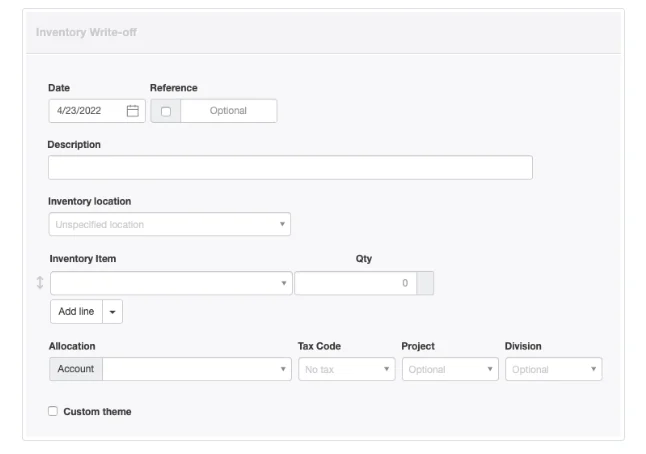

Enter the write-off

In the Inventory Write-offs tab, click New Write-Off:

Complete the form. Some fields appear only when relevant selections have been made in the Settings tab:

- Date will be today’s date by default. This may be edited.

- Reference can be used for any internal or external sequence. If the box within the field is checked, Manager will assign a number automatically. The program will find the highest existing number among all inventory write-offs and add 1. This field can be edited.

- Description is for a summary narration explaining the write-off.

- Inventory location (if any are defined under Settings) lets you select where the write-off is occurring.

- Inventory item is where you select the item being written off. Both item codes and item names show in the dropdown box.

- Qty is the number of items being written off.

- Add line allows you to add inventory items to the transaction.

- Allocation is where you select the account to be debited. Only expense accounts and certain balance sheet accounts can be chosen.

- Tax Code allows you to select a tax code if the disposition of the inventory item is subject to tax. Normally, this will only be the case under value-added tax schemes when tax paid to a supplier was claimed when the item was purchased and conversion for non-revenue usage is considered taxable by your tax authority. Consult a local accountant if you are unsure about this.

- Project is selected only when the write-off is specifically allocable to a defined project.

- Division lets you choose an applicable profit center.

Click Create to write off the inventory item(s) and make all necessary accounting adjustments.

Inventory Write-ons

Write on inventory to record upward adjustments (increases) of inventory when no purchases have occurred. Situations where write-ons may be necessary include:

- Physical stock verification

- Belated discovery of excess supplier deliveries

- Reversing erroneous inventory write-offs

When inventory items are written on, they are available for sale or production, so they must be added as assets in the Inventory on hand account. Their value must also be added to some income account or subtracted from some expense account to offset the increase to Inventory on hand.

Write on inventory with a journal entry

Upward adjustments of inventory are recorded with journal entries. The debit leg of the journal entry is posted to Inventory on hand (or another control account if the inventory item in question has been assigned to one besides the default account). The credit leg is posted to an account designated for the purpose. The specific account used is not as important as consistency. Options include:

- An inventory adjustments income account

- An inventory adjustments expense account (where it will be a contra entry)

- A miscellaneous income account

Determine the write-on value

While the adjustment quantity is known, write-on value is not always easy to determine. Several possibilities exist:

- Average cost. One convenient approach is to look up the current average cost of the inventory item in the Inventory Items tab and use that. This approach may not be absolutely correct, but it is reasonable and will generally be accepted by an auditor. It assumes that newly found inventory items are as valuable as the ones already in stock.

- Write-off cost. Upward adjustments sometimes result from locating misplaced inventory that was previously written off. If an inventory write-off record for the specific item exists, use the average cost from that transaction. This ensures the amount formerly written off is exactly reversed, even if average cost has since changed.

- Purchase price. When an inventory item has not been purchased recently, prices may have changed, making average cost a poor indicator of current value. In that case, a recent price quote from a supplier may be a better representation of an item’s value.

Note

Local law or accounting standards may dictate how write-ons should be valued. Be sure to follow any such guidance.

Local law or accounting standards may dictate how write-ons should be valued. Be sure to follow any such guidance.

However you determine unit cost, multiply by the number of units being added and enter the product as the debit amount of the journal entry. (Manager will not perform this calculation automatically as it does in many other transactions. However, you can enter the calculation into the Debit field to avoid manual calculation.) The credit amount, of course, must balance. Multiple inventory items can be adjusted with a single journal entry by including additional debit line items. Only one credit line for the total amount is necessary.

Example

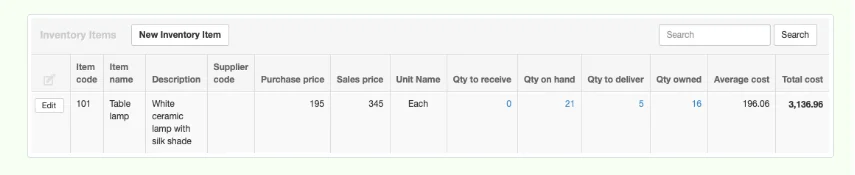

Brilliant Industries conducts a year-end physical count of stock on hand and discovers two more table lamps than its records show. The listing in the Inventory Items tab initially looks like this:

Brilliant Industries conducts a year-end physical count of stock on hand and discovers two more table lamps than its records show. The listing in the Inventory Items tab initially looks like this:

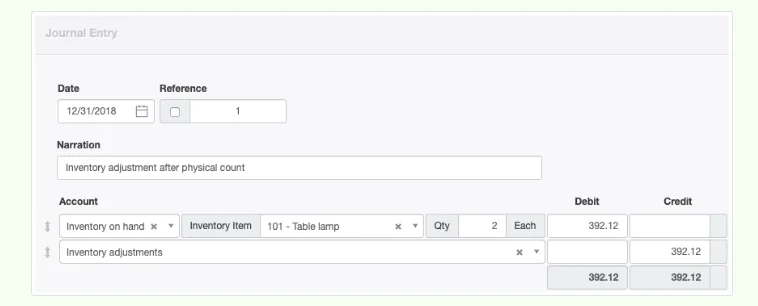

Brilliant creates a journal entry, debiting Inventory on hand and selecting the table lamp. It uses the average cost method, multiplying 196.06 by the two units, for a total debit of 392.12:

The two units are added to the quantity on hand (and owned) without altering average cost. But the total cost of table lamps in Inventory on hand goes up:

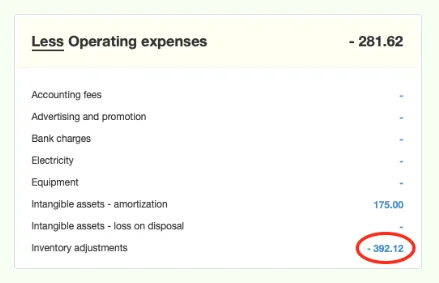

The credit from the journal entry appears in the Inventory adjustments account. Because Brilliant expected most inventory adjustments to be write-offs rather than write-ons, it set this account up as an expense account. So the 392.12 became a contra entry, moving the balance of the account in a negative direction:

Note

If a different costing method had been used in the example above, average cost of table lamps would have changed.