Purchase Order Tab

Manager Menu-Tabs > Purchase Tabs > Purchase Order Tab

Purchase Order Tab

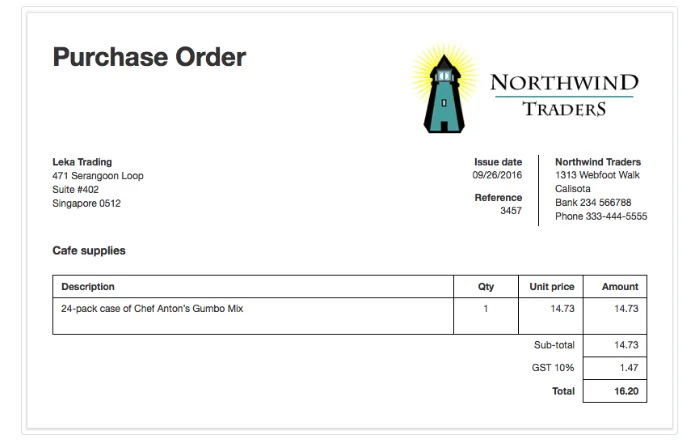

A purchase order is sent to suppliers to order goods or services. It authorizes the supplier to deliver items at listed prices and quantities by a specified date. Legally, it may be considered an offer to purchase which, if accepted by the supplier for the consideration enumerated, forms the basis of a contract.

Unlike most records in Manager, purchase orders have no financial or inventory impact. They do not involve actual provision of services, movement of inventory, or payment of money. Accordingly, they can be used for a variety of purposes:

- Internal requests for purchase authorization

- Documentation of order pricing

- Inventory planning

- Supplier communication

- Drafts of purchase or sales invoices

Enable Purchase Orders tab and define supplier

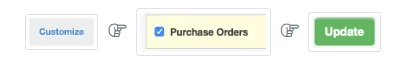

Before creating a purchase order, enable the Purchase Orders tab. Below the left navigation pane, click Customize, check the box for Purchase Orders, and click Update:

Next, be sure the supplier to whom the purchase order will be sent has been defined in the Suppliers tab. Manager allows purchase orders to be created in three different ways:

- Standard method

- Cloning

- Copying

Standard method

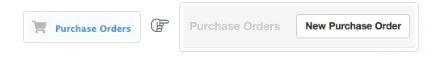

In the Purchase Orders tab, select New Purchase Order:

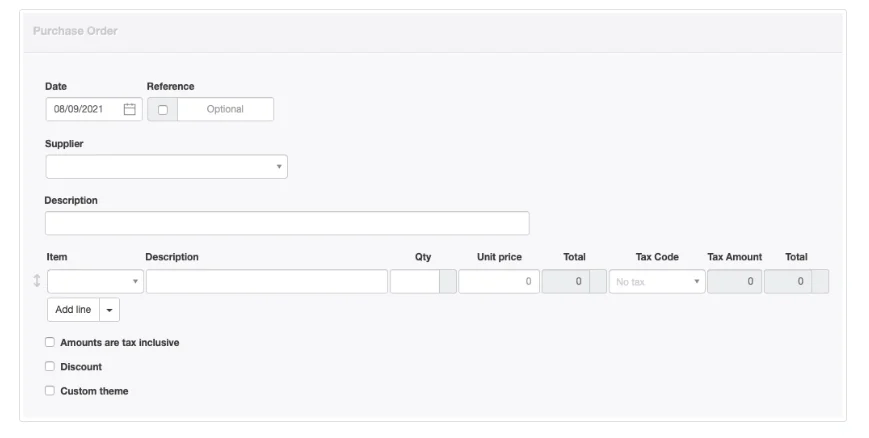

Complete the purchase order form:

- Date will be prefilled with today’s date, which may be edited.

- Reference is optional and may be used for internal or external sequences. If the box within the field is checked, Manager will number the transaction automatically. The program will search for the highest number among all existing purchase orders and add 1.

- A Supplier must be selected from the dropdown list.

- Line items can be entered semi-automatically by selecting inventory or non-inventory items in the Item field. Or they can be entered manually. Description, Qty, and Unit price for each line item are entered in their fields.

- Select an appropriate Tax Code. The principal benefit of selecting a tax code on a purchase order comes later, if the purchase order is copied to another transaction type. Tax codes on purchase orders have no financial impact.

Near the bottom of the screen are checkboxes for various options. Additional fields appear when some options are checked:

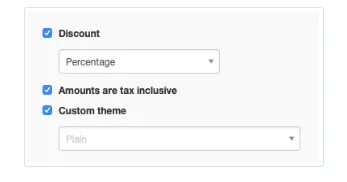

- When the Discount box is checked, options appear for Percentage or Exact amount . The discount entry must be made line item by line item.

- A box can be checked to indicate Amounts are tax inclusive.

- A Custom theme can be selected if any theme besides the default is active.

Footers

Cancelled

Withheld Tax

Click Create when finished:

Cloning

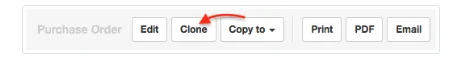

Repeat purchase orders can be entered by cloning previous ones. While viewing a similar purchase order, click Clone. The new purchase order need not be identical to the previous one. Anything can be edited or added:

Copying

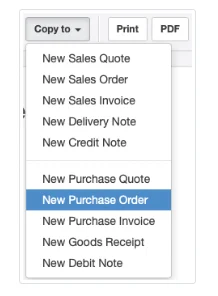

A purchase order can be created by copying any sales- or purchase-related transaction. While viewing the source transaction, select New Purchase Order in the Copy to dropdown box and edit as required:

Examples

If a sales quote was given to a customer including items that must be purchased from a supplier, a purchase order to the supplier can be generated directly from the sales quote. When items on the sales quote are purchased from several suppliers, several copies can be made and inapplicable line items deleted from each supplier’s purchase order.

If a sales order was created after receiving a customer’s order, a purchase order can be created directly from it.

If items are purchased only as the customer is invoiced for them (such as when inventory is shipped directly from the supplier), or if they are being purchased as part of a repeat sale, a purchase order can be generated from a sales invoice.