Fixed Assets Tab

Manager Menu-Tabs > Fixed Assets Tabs > Fixed Assets Tab

Fixed Assets Tab

The Fixed Assets tab is used to record and monitor fixed asset purchases and disposals.

Fixed assets are tangible property owned by a business, such as buildings, machinery, furniture, vehicles, and equipment. To be considered a fixed asset, property must:

- Have a useful life longer than one major accounting period (usually one year)

- Cost more than the capitalization threshold (set either by company policy or local law)

- Be held for productive use rather than immediate sale (inventory is not included among fixed assets)

The acquisition cost of a fixed asset is recovered over its economic life through depreciation, rather than as an expense during a single accounting period.

Fixed Assets can be added, changed (edited), viewed, deleted, printed or made inactive.

Enable the Fixed Assets tab

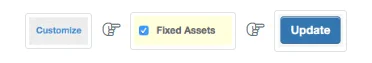

Before you can enter any transaction related to a fixed asset, the fixed asset itself must be created in Manager. If the Fixed Assets tab has not already been enabled, click Customize below the left navigation pane. Check the box for Fixed Assets and click Update below the list:

When the tab is enabled, four accounts are automatically activated in your chart of accounts:

- Fixed assets, at cost, an asset account recording the acquisition cost of all fixed assets

- Fixed assets, accumulated depreciaiton, a contra asset account summing depreciation to date of all fixed assets

- Fixed assets - depreciation, recording current depreciation expenses

- Fixed assets - loss on disposal, an expense account recording loss (gain) on disposal of fixed assets

These accounts cannot be disabled while the Fixed Assets tab is enabled, but they can be renamed under Settings Chart of Accounts.

Create a fixed asset

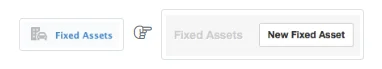

Return to the left navigation pane, click Fixed Assets, then New Fixed Asset:

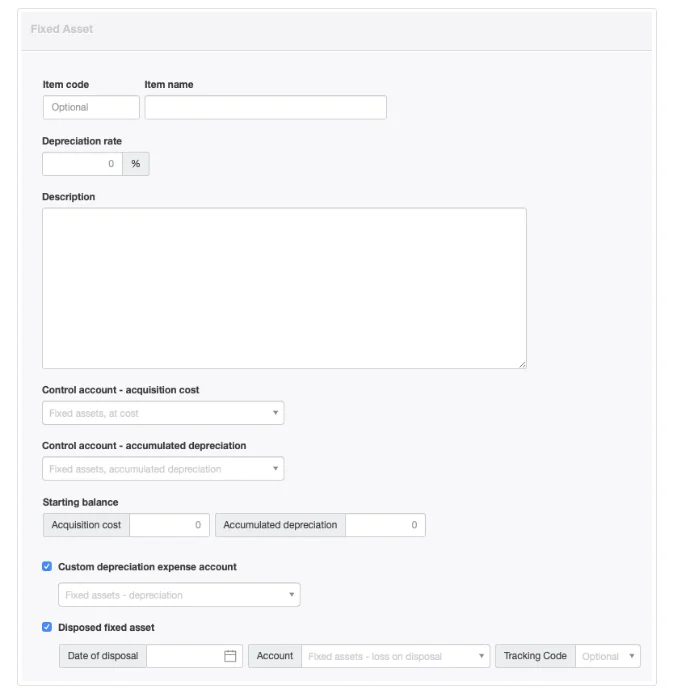

Complete the entry:

- Item code is an optional alphabetic or numeric designation for the fixed asset.

- Item name is the name that will appear for the fixed asset in reports and lists.

- Depreciation rate is the notional annual percentage depreciation rate for the asset. This rate will be used by the Depreciation Calculation Worksheet in the Reports tab to calculate a daily depreciation rate, which will be used in calculations.

- Description accepts detailed information about the fixed asset.

- The Control account — acquisition cost field appears only when a custom control account made up of fixed assets exists. Otherwise, the asset is assigned to the Fixed assets, at cost control account by default.

- The Control account — Accumulated depreciation field appears whenever a custom control account for fixed asset depreciation exists. Otherwise, the asset’s depreciation will be posted to Fixed assets, accumulated depreciation.

Note: Starting Balances for Equipment and Accumulated Depreciation are no longer entered using this form.

- When the Custom depreciation expense account box is checked, a dropdown field appears that allows you to select any regular expense account for posting current depreciation expenses for the asset. If nothing else is selected, current depreciation for the asset will be posted to Fixed assets - depreciation.

Click Create

Example

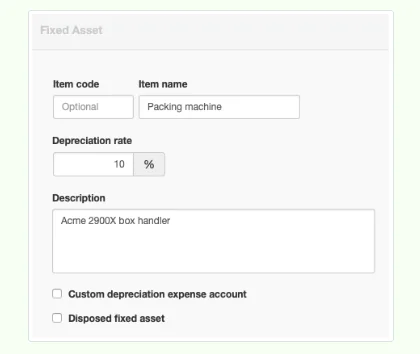

Brilliant Industries is adding a packaging machine in its factory. The machine has an expected life of 10 years and will be depreciated using a straight-line method, so a fixed asset is created:

Brilliant Industries is adding a packaging machine in its factory. The machine has an expected life of 10 years and will be depreciated using a straight-line method, so a fixed asset is created:

The fixed asset will show under the Fixed Assets tab with no book value:

Note

To this point, you have not recorded the purchase of the fixed asset. You have only set it up in Manager. Now you can record financial transactions related to the fixed asset.

To this point, you have not recorded the purchase of the fixed asset. You have only set it up in Manager. Now you can record financial transactions related to the fixed asset.

Purchase a fixed asset

Purchase of the fixed asset can be recorded under following tabs:

- Payments, if purchased without credit from the supplier

- Purchase Invoices, if purchased from a supplier on credit

- Expense Claims, if paid by you or someone else on behalf of the business

- Journal Entries, if purchase was financed by a loan

When recording the purchase of a fixed asset under any of these tabs, post the amount spent to the Fixed assets account (or the custom control account you created for the purpose) and the subaccount for the fixed asset you have purchased.If you purchase the fixed asset using a loan, you should also create a liability account in your chart of accounts with a name something like Loan before you record the purchase transaction. Then record the journal entry as a debit to the Fixed assets or other control account for the purchase cost and a credit to the Loan account of the same amount. Loan repayments must be posted to the Loan account. They have nothing to do with purchase cost, depreciation, or book value of the fixed asset.

Example

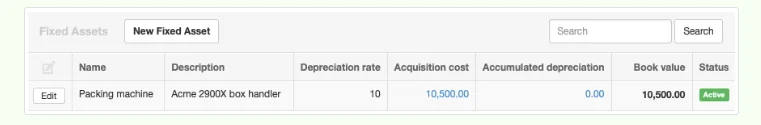

Brilliant Industries purchases its packaging machine on credit from the manufacturer, entering the 10,500 cost with a journal entry. The purchase cost now shows in the Fixed Assets tab register:

Brilliant Industries purchases its packaging machine on credit from the manufacturer, entering the 10,500 cost with a journal entry. The purchase cost now shows in the Fixed Assets tab register:

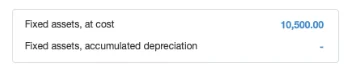

The purchase cost of the fixed asset will be combined with any other fixed assets’ costs and displayed under the Assets category on the Summary page:

Fixed Asset Disposal

When a fixed asset is removed from service, it must be disposed of in your accounting records. Several circumstances may exist. The fixed asset may have:

- Already been fully depreciated over its useful life

- Passed the end of its useful life, but have residual salvage or resale value

- Been only partially depreciated, with useful life and resale value remaining

- Been partially depreciated, but with no value remaining (worn out early)

Other circumstances could also apply, especially if special tax provisions covered purchase of the fixed asset. Regardless of the exact situation, the purchase cost of the fixed asset must be removed from the Fixed assets account and its accumulated depreciation must be removed from Fixed assets, accumulated depreciation. Otherwise, the balances of these two accounts would grow endlessly as the business purchases assets over the years, even if those assets are no longer owned. Finally, whether the fixed asset is sold, scrapped, or given away, the difference between its book value and any amount recovered through disposal must be recorded, either as income or expense.

To dispose of a fixed asset, go to the Fixed Assets tab, click the Edit button for the asset disposed, check Disposed fixed asset, then enter the date of disposal. This transfers the book value of the asset to the designated expense account and the book value on the balance sheet is reduced to zero.

By default, disposal gains or losses are posted to Fixed assets - loss on disposal, a control account activated automatically when the Fixed Assets tab is enabled. If desired, the disposal gain or loss can be posted to any regular expense account.

Example

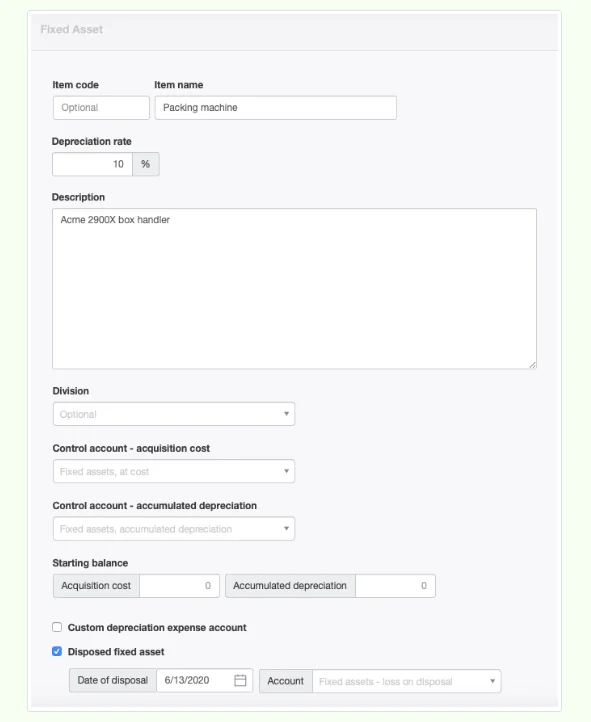

Brilliant Industries decides to replace the packaging machine it purchased in January with a more capable model, even though only three months of its useful life have passed. The disposal is recorded as below:

Brilliant Industries decides to replace the packaging machine it purchased in January with a more capable model, even though only three months of its useful life have passed. The disposal is recorded as below:

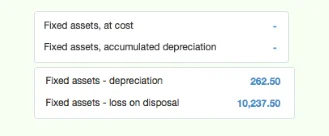

After Brilliant Industries’ disposal action, its Balance Sheet shows no balance for either Fixed assets, at cost or Fixed assets, accumuated depreciation. The Profit and Loss Statement shows three months’ worth of depreciation expense and the large remaining book value:

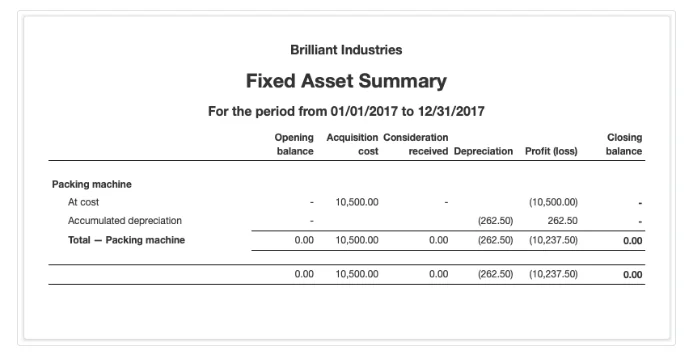

Unless Brilliant Industries can find a buyer for the used packaging machine, this situation will look like a serious business mistake. Like fixed asset purchases and depreciation, disposals are reported on the Fixed Asset Summary in the Reports tab:

Notes

In the Fixed Asset Summary, the Acquisition cost column includes all purchases and upwards revaluations. Consideration received includes all sales posted to the asset’s subaccount (see below) and downwards revaluations.

Depreciation includes all depreciation during the reporting period.

Profit (loss) includes amounts transferred to other accounts when the asset is disposed.

Two methods can be used when a disposed fixed asset is sold.

The first is to post a receipt in the Receipts & Payments tab to Fixed assets, at cost and the specific asset’s subaccount prior to recording disposal. This reduces the purchase cost balance, decreasing any loss on disposal. Such a receipt would show up in the Consideration received

column.

The second method is to post the transaction to Fixed assets - loss on disposal after disposal. The net effects are the same, but the second method would not show on the Fixed Asset Summary, because the transaction would not be posted directly to the asset’s subaccount.