Creating Manager Reports

Reports-Queries > Reports > Creating Reports

Reports

Manager includes many predefined reports to summarize, analyze, and present transaction data. Access them in the Reports tab in the left navigation pane:

Enabling reports

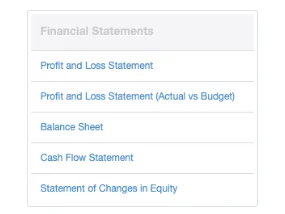

Many reports are available to users whenever tabs related to them are enabled. By default, when a new business is added in Manager, a few tabs are already enabled, so a few reports common to all businesses can be generated:

As more tabs are enabled, more reports are available. For example, when Customers and Suppliers tabs are enabled, aging reports and statements can be produced:

Reports are available related to tax codes, fixed assets, inventory, expense claims, capital accounts, and other aspects of accounting.

Creating reports

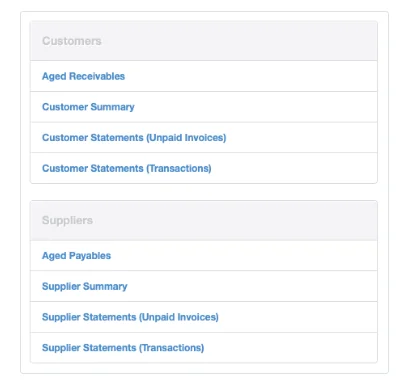

Begin creating a new report by clicking on the report’s name under the Reports tab. Then, in most cases, click New Report. (One exception is Custom Reports, which is not covered by this Guide.) Depending on which report is being created, various fields will appear. Some have default content, shown in grey. This content can be overwritten to customize a report. Other fields, such as dates, may be required. Some reports offer options for adding explanatory information, showing account codes, or excluding zero balances. For example, a new Cash Account Summary entry screen is shown below:

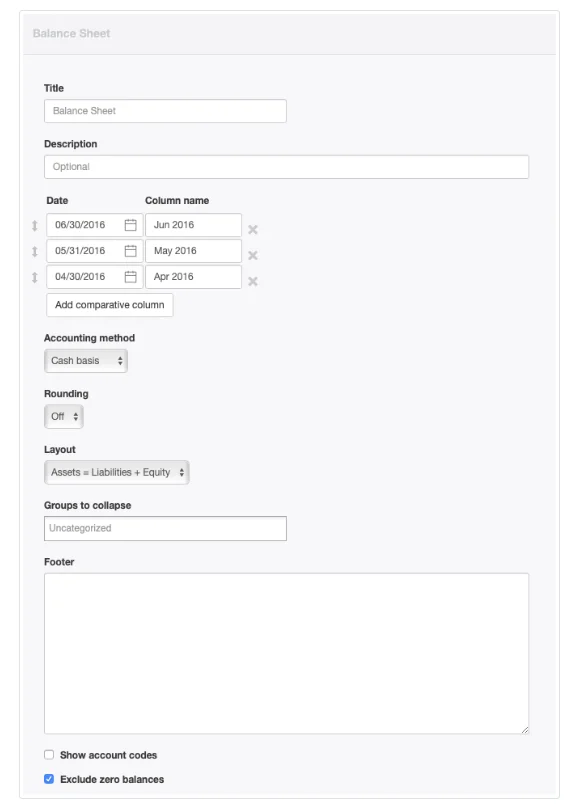

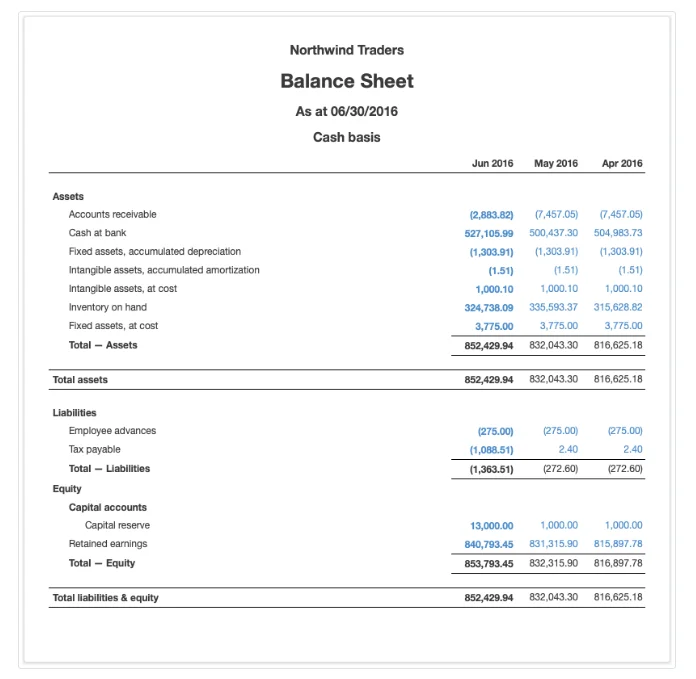

For some reports, comparative columns can be added. These can be useful for comparing current performance with past accounting periods. Note that, on some reports, columns can be named. Their order can be adjusted by dragging the double-arrow symbols at the left up or down. The top-listed column will appear at the left on the report in bold type. Other comparative columns will appear to the right of that column. For example:

produces the following Balance Sheet:

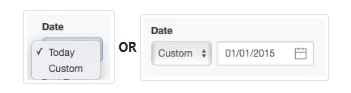

Occasionally, an option exists to set the end or as-of date as Today. When that choice is selected, the report will always be up to date when viewed. A custom date can also be entered:

Reports that are simple lists can be copied for further manipulation in a spreadsheet by clicking Copy to clipboard at the top of the screen:

Saving and editing reports

Most reports can be saved. (Customer and Supplier Statements cannot, because they change according to the as-of date or period specified.) Every report that can be is automatically saved when Create is clicked. Frequently used reports are then readily available without creating new ones. In fact, it may be convenient to define common reports for a full accounting period (such as through the end of a year). A report defined that way will be accurate through the current date whenever viewed, until the end of the accounting period. Of course, the displayed end date may be wrong.

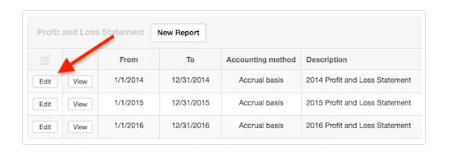

Saved reports can be edited after clicking the Edit button to the left of a report in the list:

Click Update after editing to save the revised report. Saved reports can also be deleted when no longer needed by clicking Delete at the bottom of the edit screen.

Note

Manager does not save reports as documents or files. It stores definitions of reports, including necessary dates, titles, column headings, etc. When a saved report is viewed, Manager actually creates it in real time from the stored definition. Therefore, a deleted report can always be recreated, because Manager never deletes the underlying transactions, only the information needed for a particular display. And if report formats are improved as Manager is updated, all saved reports will automatically be updated, too.

Manager does not save reports as documents or files. It stores definitions of reports, including necessary dates, titles, column headings, etc. When a saved report is viewed, Manager actually creates it in real time from the stored definition. Therefore, a deleted report can always be recreated, because Manager never deletes the underlying transactions, only the information needed for a particular display. And if report formats are improved as Manager is updated, all saved reports will automatically be updated, too.

Cloning reports

Definitions of reports can be cloned. This capability is useful when nearly identical reports must be produced, especially when they are complex. For example, Profit and Loss Statements might be generated under both accrual and cash basis accounting.

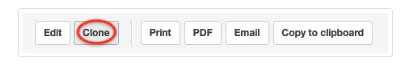

To clone a report, click View beside it in its listing. Click Clone at the top of the report window:

Modify the clone as desired and click Create.