Expense Claim Payers

Manager Settings > Expense Claim Payers

Setting Up Employee Expense Claims

Expense Claim Payers, as defined in this Guide, are persons who expend personal funds on behalf of the company, including directors, proprietors not using capital accounts, and all other persons. They are one of three types of Payers for whom expense claims can be entered. The others are Members created in the Capital Accounts tab and Employees.

Note

Members and Employees can also be defined as Expense Claim Payers, especially if consolidated reporting is desired. See this Guide for further information.

Members and Employees can also be defined as Expense Claim Payers, especially if consolidated reporting is desired. See this Guide for further information.

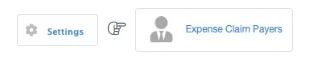

To set up an Expense Claim Payer, go to the Settings tab and click on Expense Claim Payers:

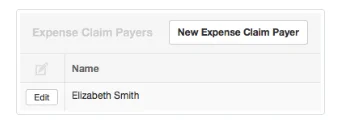

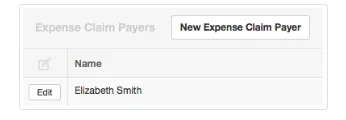

Click New Expense Claim Payer:

Complete the form:

- Name is how the expense claim payer will appear in selection list. (If the payer is also a member or employee, include a distinguishing identifier in the name so they can be told apart.)

Note:

Starting Balance is no longer entered using this form.

Click Create. The Payer will appear in the Expense Claim Payers list: