Advances-Deposits

Manager Menu-Tabs > Cash Tabs

Advances and Deposits

Customer advances are funds received by a business from a customer before they have been earned. While the funds may be present in a bank or cash account of the business, they are actually being held in trust for the customer and represent a liability the business must eventually either repay or convert to income by completion of the economic activity for which they are intended.

Some examples include:

- Advances accompanying purchase orders for custom manufacturing

- Receipts from prepayments for services or utilities to be invoiced later to the customer

Two essential facts must be recorded for every advance:

- Customer - who is making the deposit?

- Amount - how much is the deposit?

Supplier advances are funds paid by a business to a supplier before they have been earned. While the funds may be in the supplier’s hands, they are actually being held in trust for the business that pays the deposit and represent a liability the supplier must eventually either repay or convert to income by completion of the economic activity for which they are intended.

Some examples include:

- Advances accompanying purchase orders for custom manufacturing

- Prepayments for services or utilities to be invoiced later by the supplier

Two essential facts must be recorded for every advance payment:

- Supplier - who is receiving the advance?

- Amount - how much is the advance?

If not activated, Activate the Special Account tab.

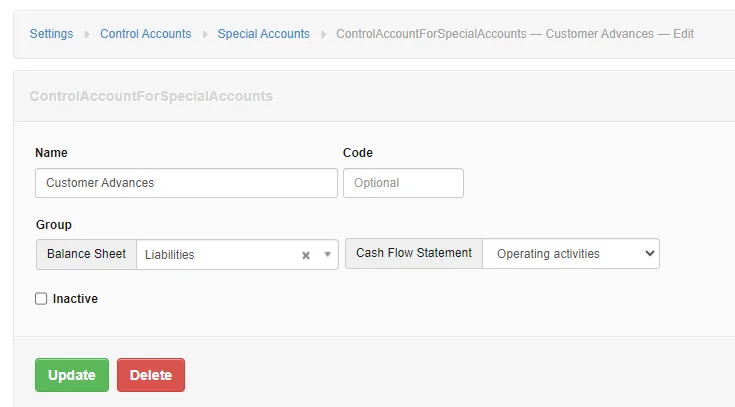

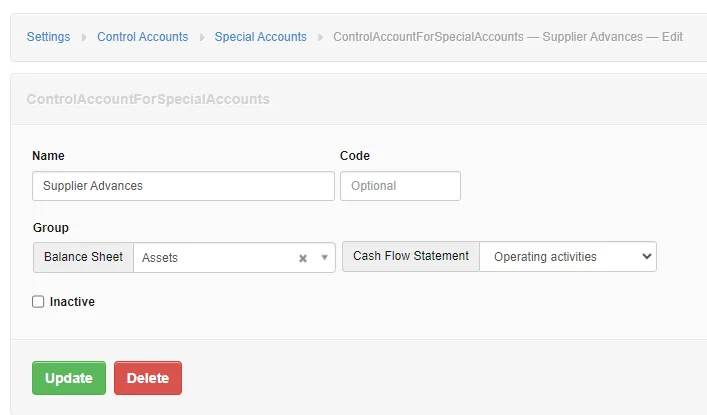

In Settings create the Special Accounts:

Customer Advances - Liabilities

Supplier Advances - Assets

Settings Control Accounts Listing now displays the entered accounts

Click on Special Accounts Tab

Enter Customers you receive advance payments from and Suppliers you send advance payments to

Assign to appropriate Control Account - Customer Advances or Supplier Advances

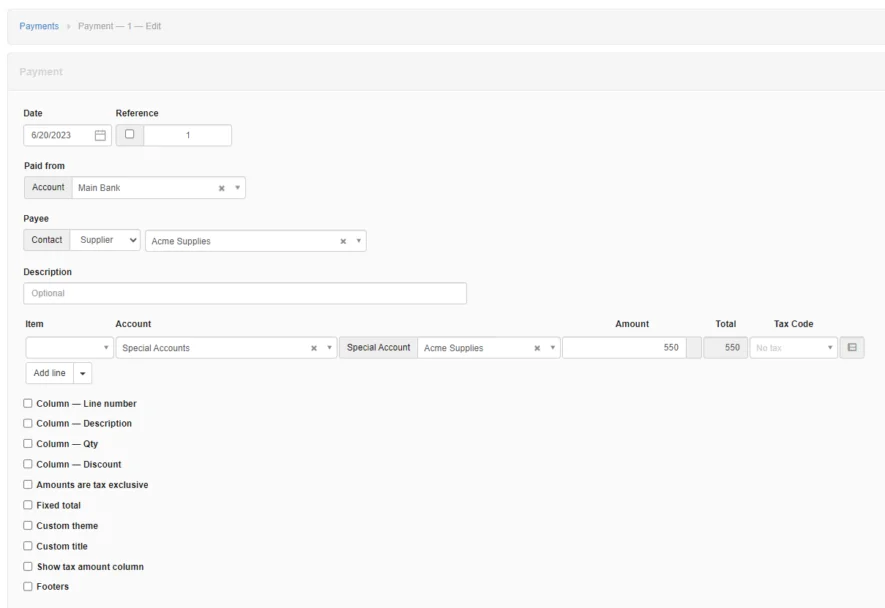

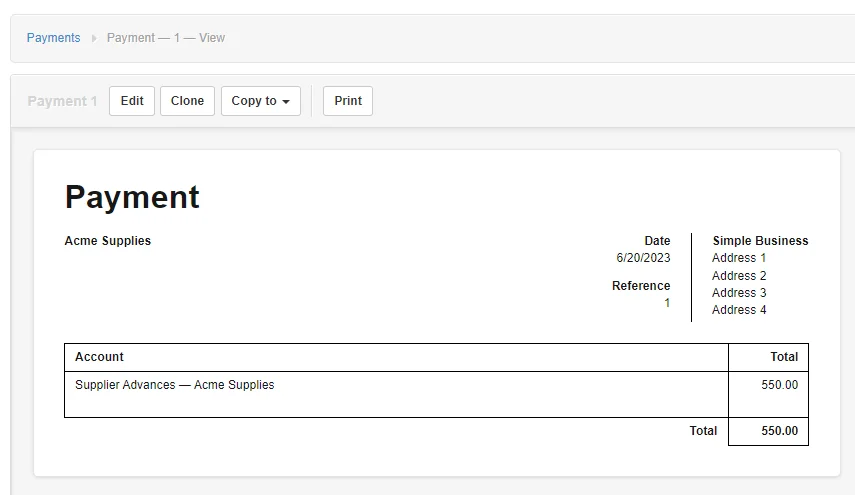

Select Payments tab

In our example we entered a Supplier Advance Payment made to Acme Supplies of 550.

Paid From: Main Bank

Payee: Supplier-Acme Supplies

Account: Special Account

Special Account: Acme Supplies

Amount: 550

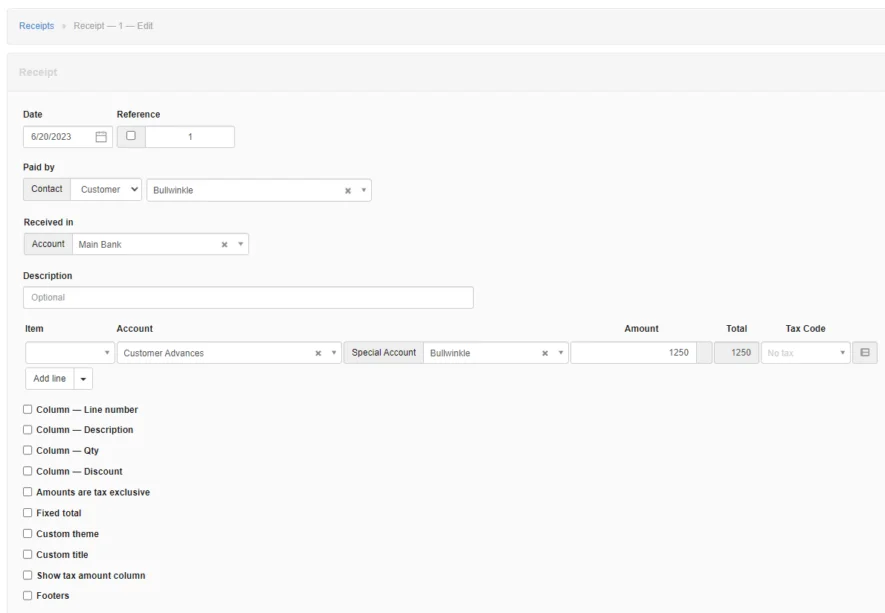

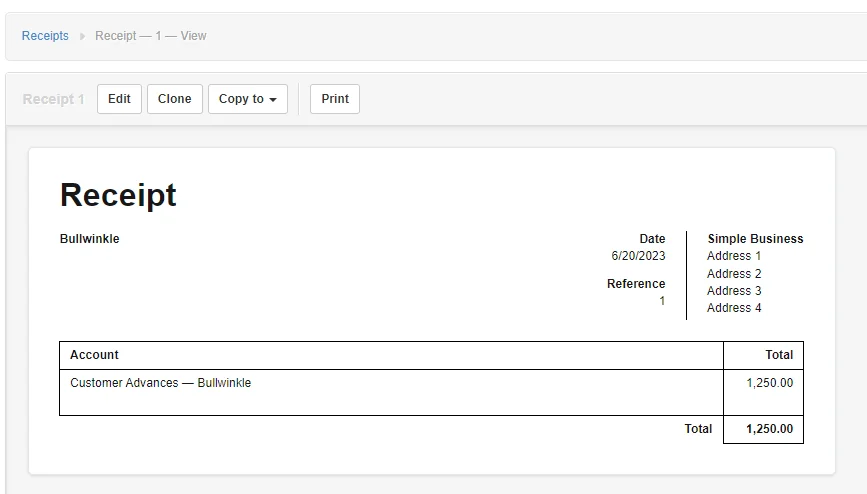

Select Receipts tab

Enter Advance Payment from Customer

In our example we entered a Customer Advance Payment made by Bullwinkle of 1250.

Paid By: Contact - Customer - Bullwinkle

Received In: Main Bank

Account: Customer Advances

Special Account: Bullwinkle

Amount: 1250

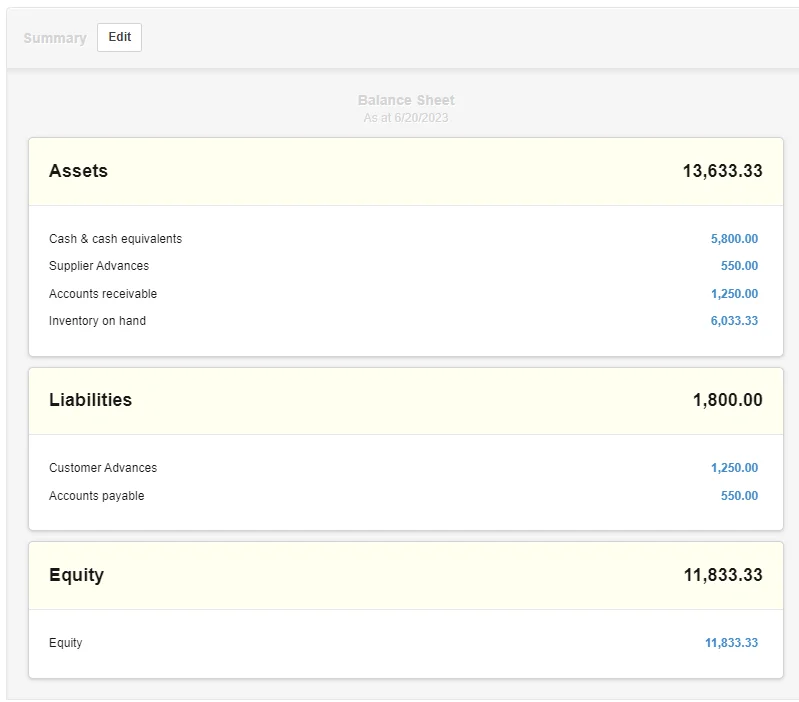

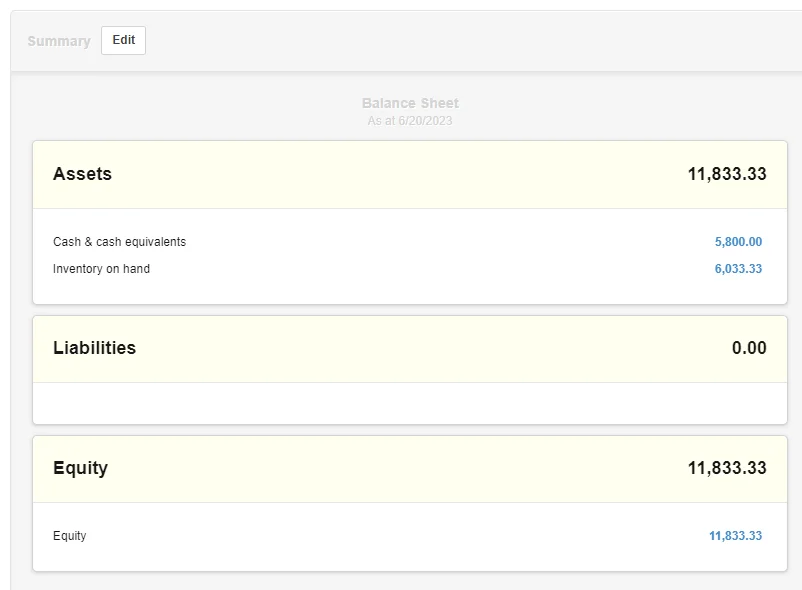

Summary Page now displays Balance Sheet showing:

Supplier Advances (Acme Supplies) - Asset - 550

Customer Advances (Bullwinkle) - Liability - 1250

Accounts Receivable (Bullwinkle) - Asset -1250

Accounts Payable (Acme Supplies) - Liability - 550

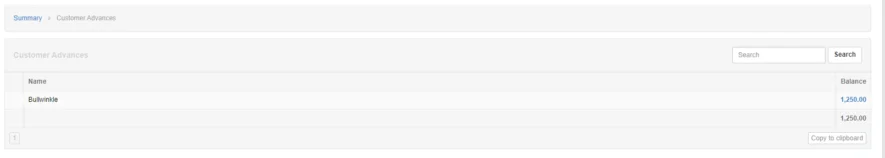

Click on the blue amounts on the Summary Page for the Supplier Advances Account - 550 and Customer Advances Account - 1250 to display the detail balances of the accounts.

The listings display a Supplier Advance of 550 to Acme Supplies and a Customer Advance from Bullwinkle of 1250.

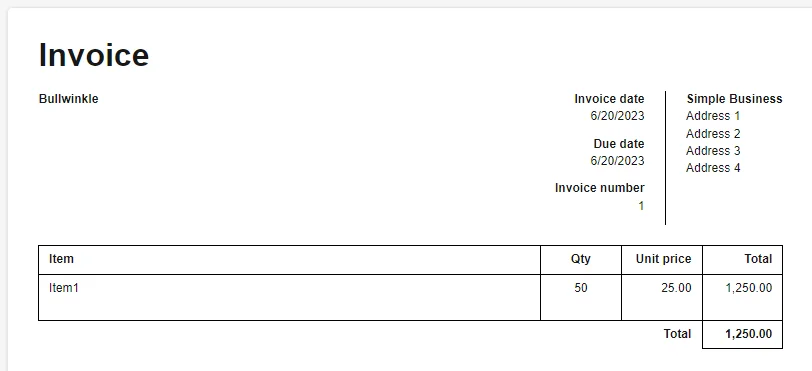

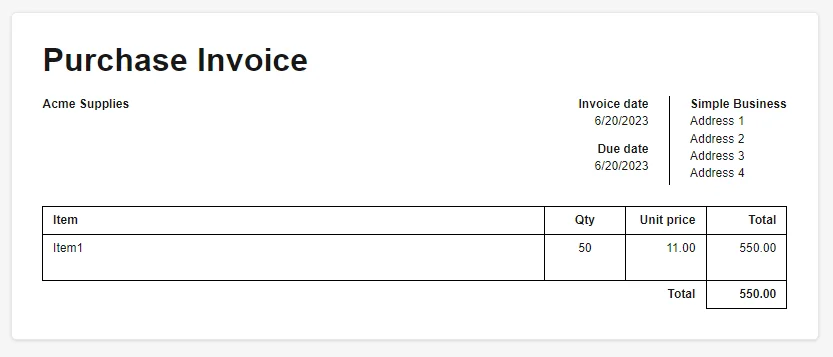

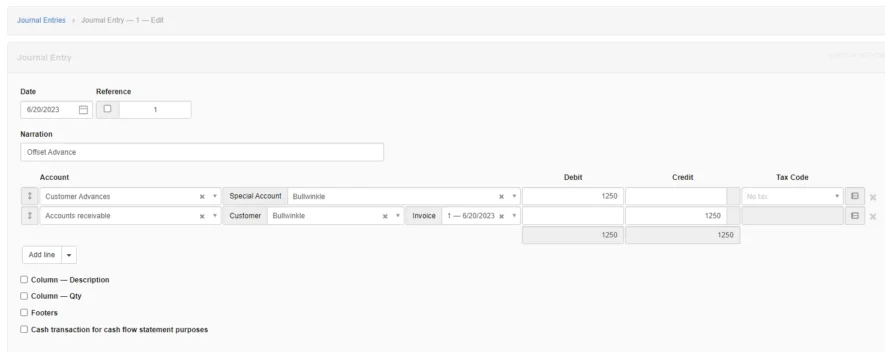

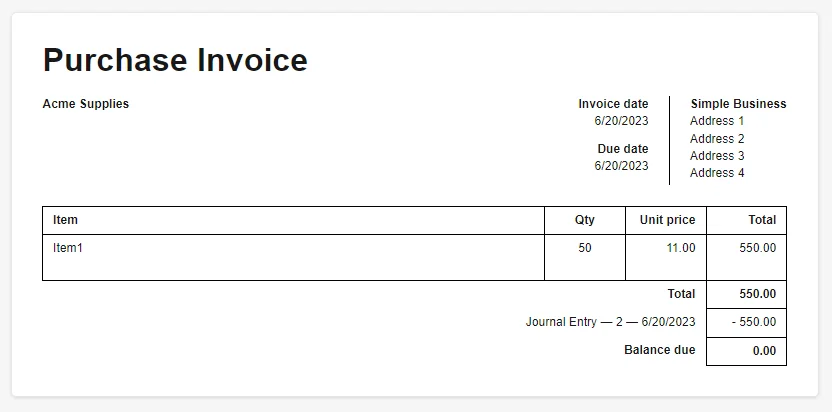

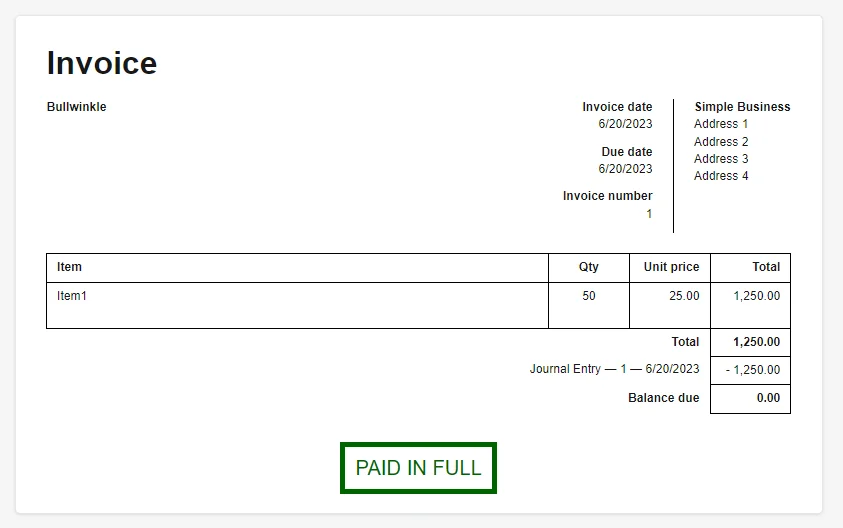

After a sales invoice or purchase invoice invoice is entered make a Journal Voucher and offset the Customer's Accounts Receivable Balance or the Supplier's Accounts Payable Balance accounts with the Customer's Advance Payments or the Supplier Advance Payments accounts.

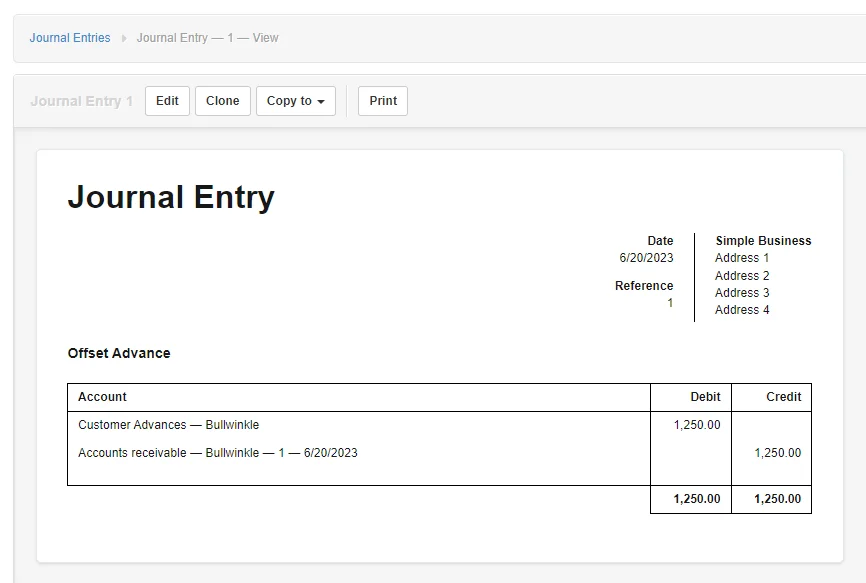

Journal Entry 1

Offsets Bullwinkle's Customer Accounts Receivable Account with Bullwinkle's Customer Advances Account balances of 1250

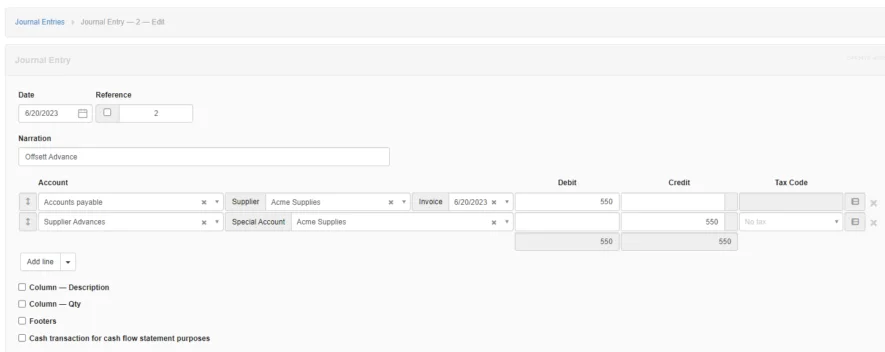

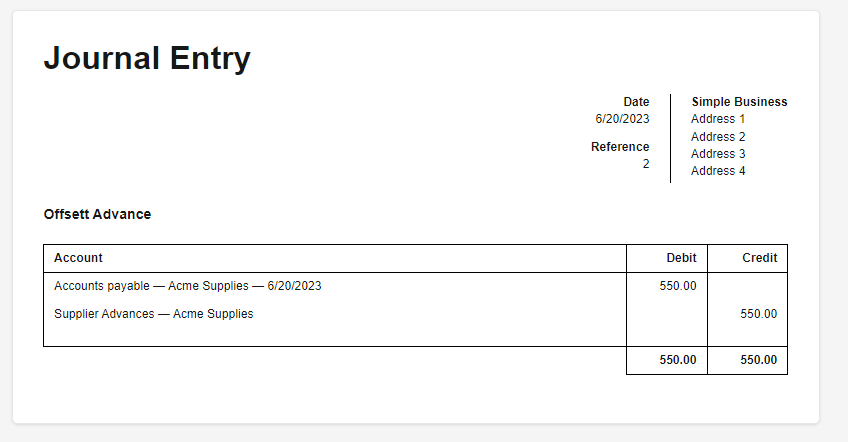

Journal Entry 2

Offsets Acme Supplies Accounts Payable Account with Acme Supplies Supplier Advances Accounts balances of 550

Click Journal Entries tab to display the Journal Entry listing that displays these two journal entries

After these Journal entries have been posted the Invoice Balances along with the Accounts Receivable, Customer Advances, Accounts Payable, and Supplier Advances balances.

After posting the Journal Entries, the Summary Screen balances for the Accounts Receivable, Customer Advances, Accounts Payable, and Supplier Advances balances are not displayed since they now have a zero balance.

Note

You can do the same for Deposits

Some examples of deposits include:

- Cleaning or damage deposits for rental property received from tenants or paid to owners

- Deposits to hotels for confirmation of reservations